Bitcoin Plummets to $104,000 as Analysts Outline Future Trajectory

On June 17, the leading cryptocurrency rapidly lost ground, plunging from $108,000 to $103,500. Analysts anticipate a “big move” soon.

On the hourly chart, the coin recorded 13 consecutive red candles. At the time of writing, Bitcoin is trading around $103,900, having lost 3.8% in a day.

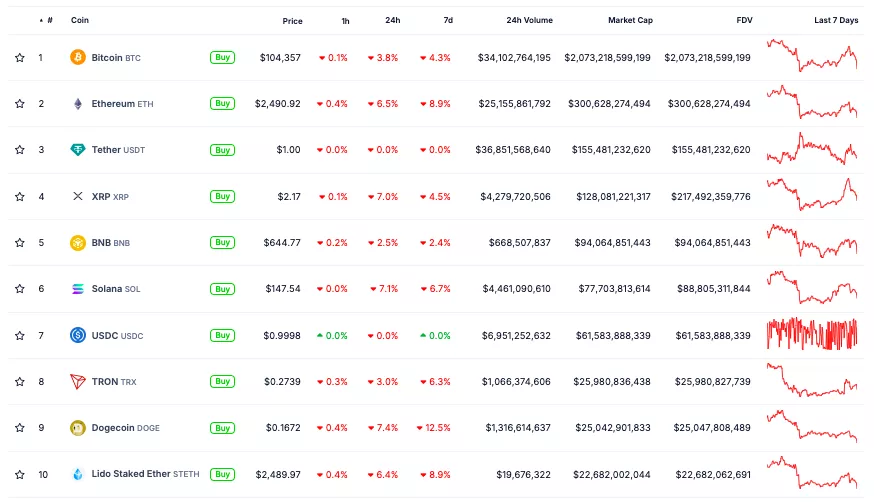

The rest of the crypto market is also showing a decline. Ethereum fell from $2650 to $2480 — approximately 5%. Solana dropped below $150 (-6.6%), and XRP tumbled to $2.2 (6%).

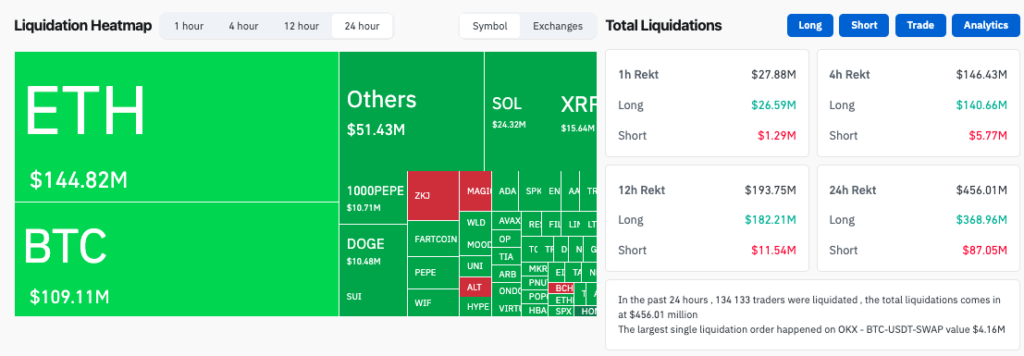

According to Coinglass, the total volume of liquidations in the market reached $452 million in a day. The majority, amounting to $365 million, was in short positions.

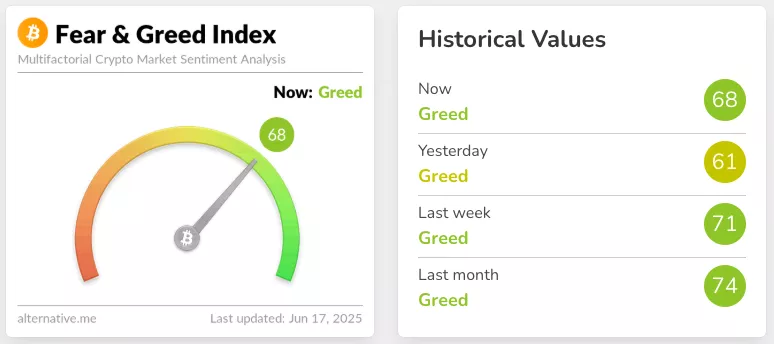

Despite the correction, the cryptocurrency fear and greed index rose from 61 to 68 points in a day.

Expert Observations

According to trader and analyst known as Skew, the market is “handling” the downturn well.

$BTC

So far this has been pretty well managed by the market

— no uptick in market vol yet

— avg volume

— no panic positioning yetFor a 3% or so pullback so far market isn’t panicked yet, although on LTF there’s clear hedge bias

Previous dips were 5% or so but had aggressive… pic.twitter.com/TD3f7E5wdO

— Skew Δ (@52kskew) June 17, 2025

He noted that there is currently no increase in volatility, trading volume remains moderate, and there are no panic sales.

“Previous declines were around 5% [the current one, by his calculations, reached 3%], but were accompanied by aggressive short positions, spot sales, and a rise in volatility with momentum in volumes. This means that the big move has not yet occurred and is brewing,” the expert explained.

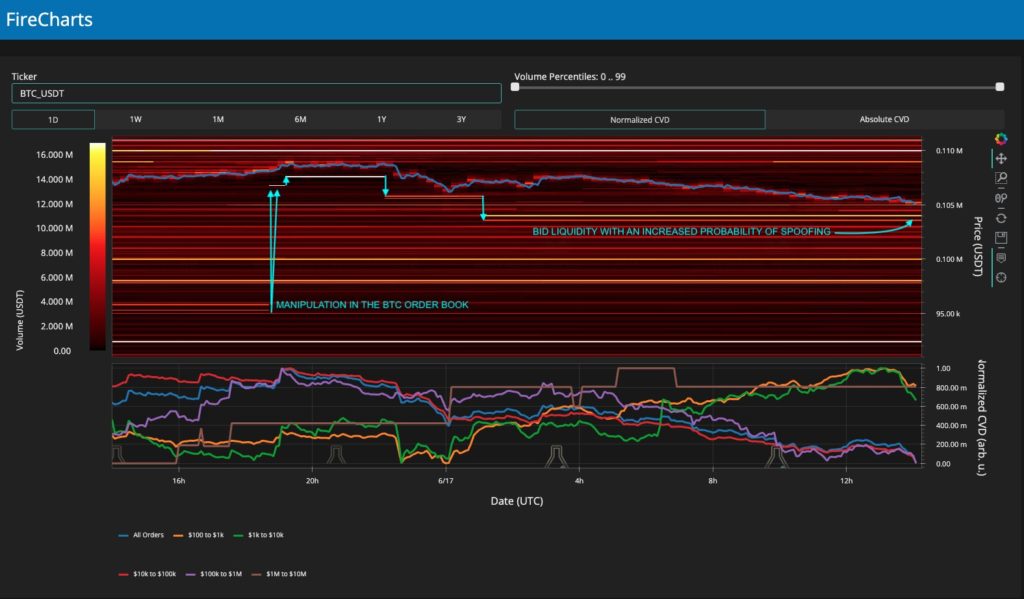

Trading resource Material Indicators highlighted “manipulations” in Bitcoin’s order book and the increased likelihood of spoofing.

“If the price falls below $105,000, prepare for a rug pull to $104,000,” the authors warned.

Analyst and MN Trading founder Michaël van de Poppe suggested the downward momentum might continue. Losing $105,000 would trigger a “liquidation game,” leading to a further market drop, he believes.

#Bitcoin starts to lose the level, so there is a very likely case that we’re going to accelerate with the downwards momentum.

Sub $105,000 would push the liquidation game into play and then we’ll likely start falling deeper (and end the correction).

People might suggest its… pic.twitter.com/Ih5YnjL3lg

— Michaël van de Poppe (@CryptoMichNL) June 17, 2025

“People might suggest the cause is [the conflict] in the Middle East, but ultimately it looks like a fairly standard correction ahead of the Fed meeting on the key rate,” he clarified.

Back in QCP, highlighted the benefits of global uncertainty for the leading cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!