Bitcoin Price Dips Below $57,000

On the morning of Wednesday, May 1, the price of the leading cryptocurrency fell below $60,000.

At one point, digital gold plunged below the $57,000 mark.

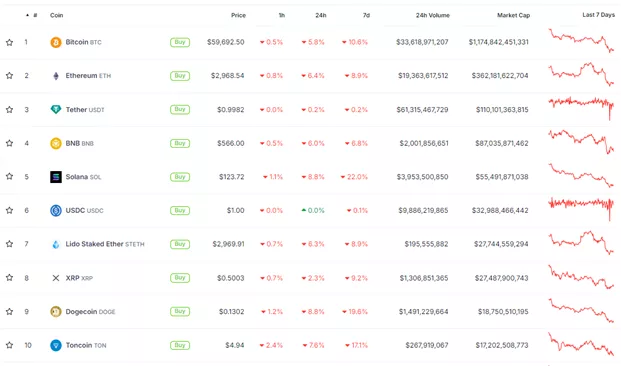

At the time of writing, the price had dropped to $59,700. Over the past 24 hours, the asset fell by 5.8%, according to CoinGecko.

Other major cryptocurrencies also experienced a downturn. Leading the decline in the top 10 are DOGE (-8.8%) and SOL (-8.8%). XRP showed a smaller decrease of 2.3%. Ethereum fell by 6.4%.

The total cryptocurrency market capitalization stands at $2.32 trillion. BTC’s dominance index is 50.7%.

The downturn in the cryptocurrency market aligns with a broader risk-off sentiment in global markets ahead of the Fed meeting.

Today at 21:00 (Kyiv/Moscow time), the Federal Reserve will announce its decision on the base rate, followed by a speech from Fed Chair Jerome Powell at 21:30.

The S&P 500 index fell by 1.6%, its largest drop since January. The yield on two-year U.S. government bonds, sensitive to Fed policy, returned to its November peak of 5%.

Recently released U.S. labor cost data showed a 1.2% increase in the first quarter, exceeding the forecast of 1% and the 0.9% rise in October-December.

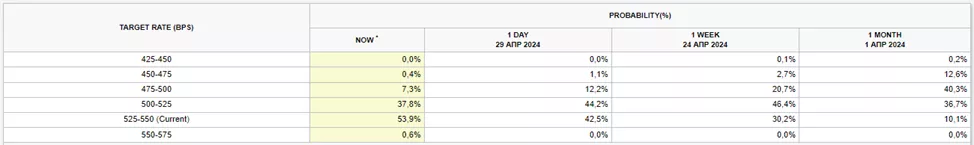

The macroeconomic statistics dampened sentiment ahead of the Fed meeting, shifting expectations for the first rate cut to November. According to futures, the probability of a policy easing in September fell from 57.5% to 45.5%. A month ago, the market was 89.8% confident in this scenario.

“Both stocks and bonds, as well as the dollar, are anticipating the likelihood that Powell will frown upon the rate decision. This morning’s data justifies the committee’s increasingly hawkish stance,” commented Jose Torres of Interactive Brokers.

Amidst this backdrop, MicroStrategy shares stood out with a 17.6% drop in capitalization. Coinbase shares fell by 6.5%, while Marathon Digital and Riot Platforms declined by 10.9% and 8.8%, respectively.

According to Santiment, the recent U.S. data sparked a surge in discussions around the hashtag #buythedip and mentions of BTC. Analysts believe this rise in sentiment indicates a renewed polarization among traders, with some advocating for buying opportunities while others remain cautious.

?? #Bitcoin fell to $60K for the first time since April 18th as #inflation fears in the US are creeping in once again. We are seeing mentions of $BTC and #buythedip calls spiking, which is signaling polarization between traders is back on the menu. https://t.co/oNOUuPkDvE pic.twitter.com/4uaWGDF0iU

— Santiment (@santimentfeed) April 30, 2024

Glassnode has concluded that Bitcoin is currently forming a floor in the $60,000–66,700 range. A sustained break below this could trigger a cascade of panic, prompting a search for a new equilibrium, they warned.

Earlier, experts explained the post-halving dynamics and predicted further developments in a commentary for ForkLog.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!