Bitcoin Price Predicted to Reach $200,000, Researchers Say

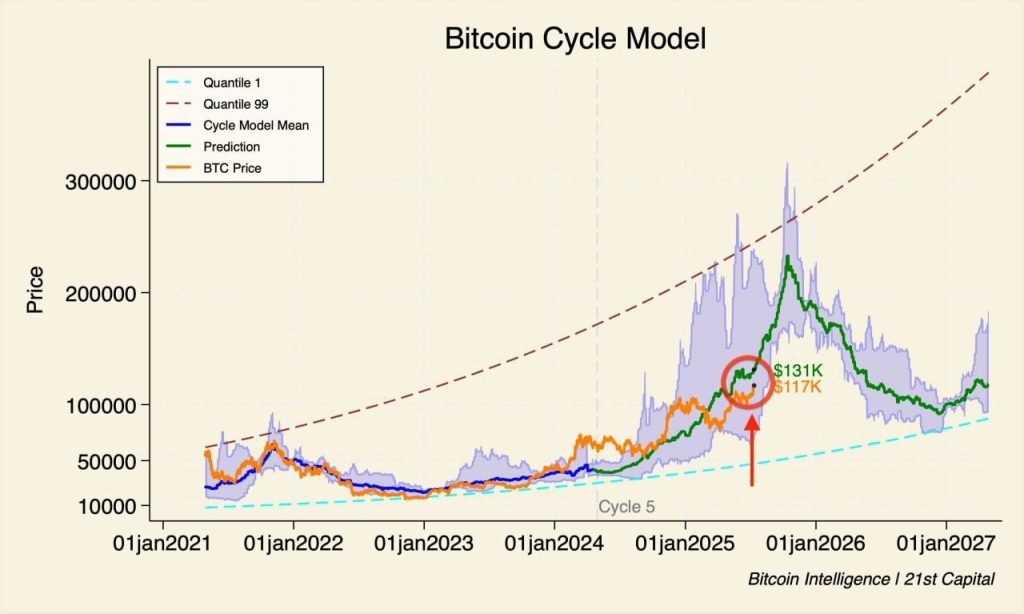

The target price level for the leading cryptocurrency is around $200,000, with the nearest key resistance slightly above $130,000, according to a report by 21st Capital.

The forecast is based on a combination of the power law and quantile regression analysis, used to assess the historical dynamics of the asset.

According to the model, the baseline trend passes through the $120,000 mark. Considering the bullish phase of the cycle, the price of Bitcoin could rise to $150,000–200,000 by the end of the year.

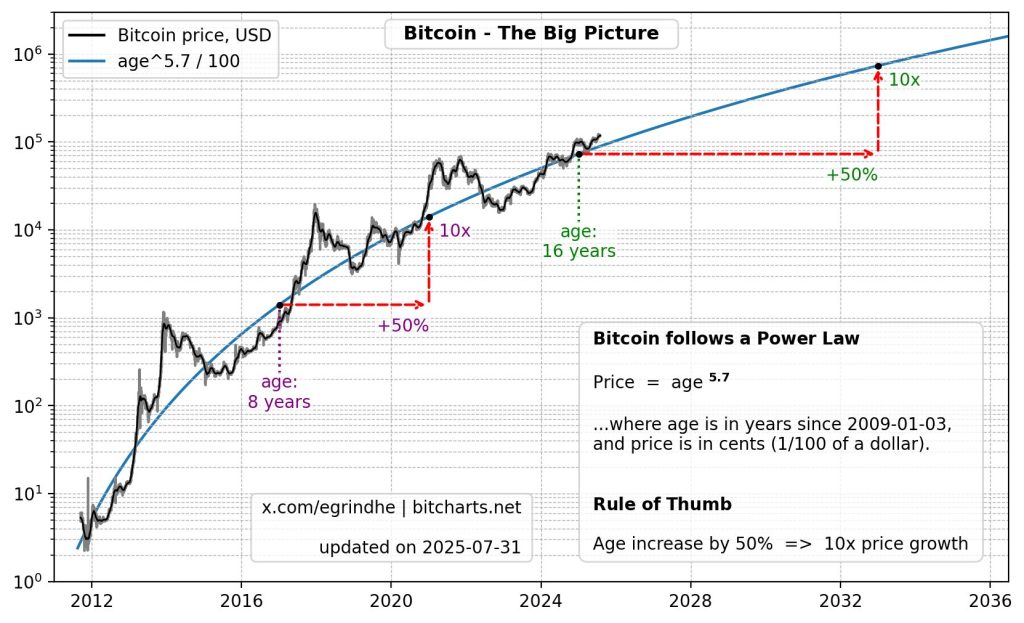

The forecast indicates a long-term target of $1.2–1.5 million by 2035, based on the exponential growth of on-chain metrics rather than speculative demand.

Each 50% increase in Bitcoin’s “age” in the past has been accompanied by approximately a tenfold increase in its price. The model captures this pattern with high accuracy (R² > 0.95).

Combined with stable on-chain metrics and favorable macroeconomic conditions, including the anticipated rate cut by the Fed in September, this suggests that the asset’s positive outlook will persist into 2025.

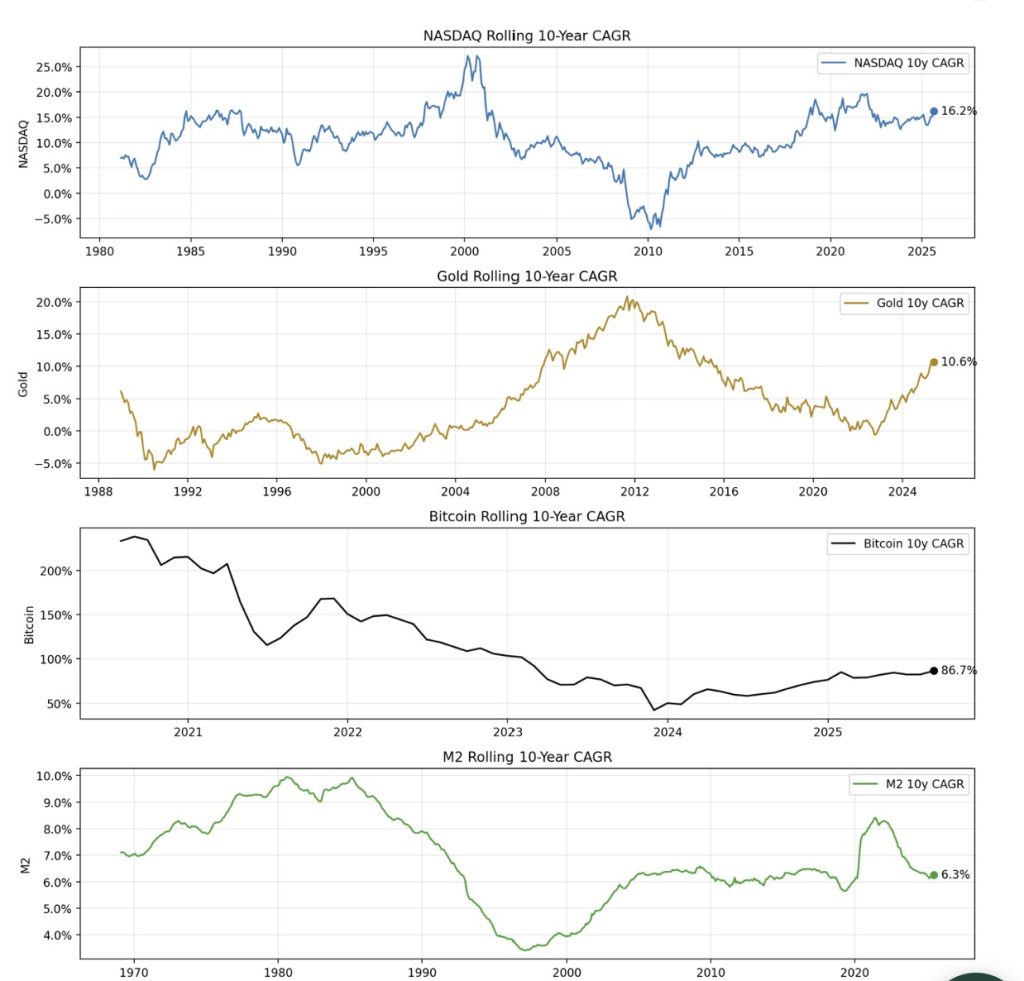

Faster Than Gold and Nasdaq

Researchers compared the 10-year average annual growth rate of Nasdaq, which typically ranges from 5–12%, with the result of the last decade — 16%. During the same period, gold appreciated by an average of 10.65%, and with a 2% annual supply increase — 12.88%.

During the same period, the money supply M2 in the US increased by about 6% per year. Against this backdrop, Bitcoin’s calculated average annual growth rate of 42.5% highlights its leading dynamics.

According to researchers, the power law model has been accurately predicting Bitcoin’s price movement for 16 years. It suggests a gradual slowdown in growth rates as the asset’s adoption expands — to 30% by 2030. This is still three times higher than the supply-adjusted rate for gold.

“Bitcoin remains the most accurate indicator of global liquidity,” experts noted in the report.

They explained this by the small market volume and the cryptocurrency’s role as a “liquidity sponge” in a “cheap money” policy environment.

The report also highlights the significance of the $114,000-117,000 accumulation zone. The resilience of the latter led to a price rise above $120,000.

No More Roller Coasters?

CryptoQuant contributor Yonsei_dent suggested that under institutional influence, bull markets will last longer, and the likelihood of “sharp short-term rallies” will decrease.

The researcher refers to the dynamics of NUPL — historically, market cycle peaks coincided with extremes of the indicator.

“In 2017, the metric formed a peak; during the 2021 cycle, a second one,” the expert exemplified.

The analyst believes that in the current cycle, NUPL is forming a third peak. Unlike previous periods, the market is moving in “gradual waves,” which may be related to the influx of institutional capital, including through American spot ETFs.

“Although the size, liquidity, and resilience of the market have grown, the percentage yield in each rally is gradually decreasing,” the expert concluded.

At the time of writing, Bitcoin is trading around $118,400. Over the past day, the price has fallen by 1.8%, according to CoinGecko.

Recently, the leading cryptocurrency reached a new all-time high above $124,000. Following the market leader, some altcoins, including BNB, also set price records.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!