Bitcoin price rally returns miners’ revenues to pre-halving levels

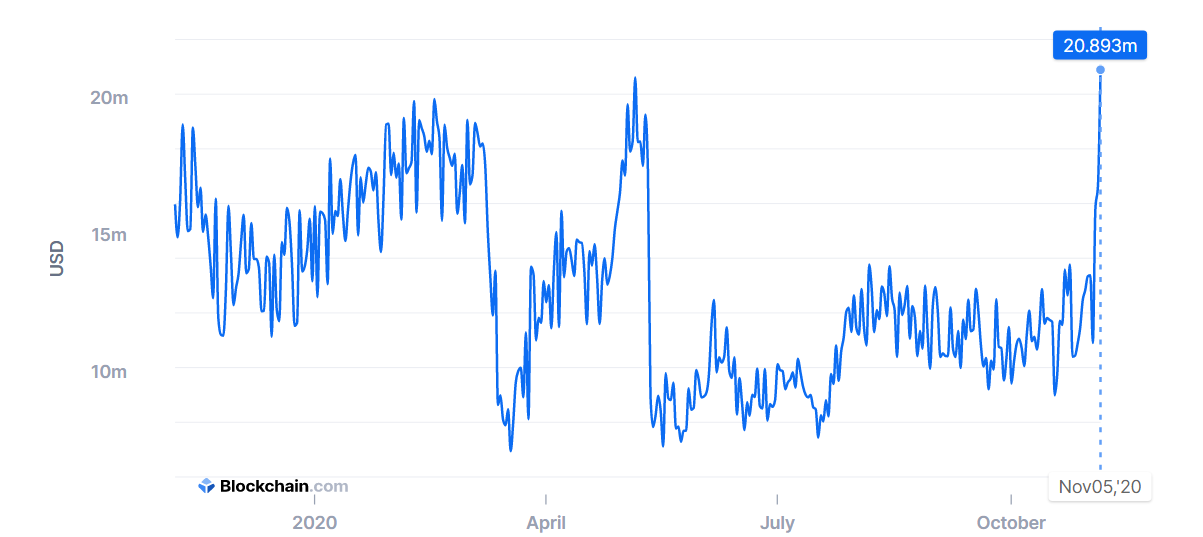

On November 5, the aggregate income of Bitcoin miners stood at $20.89 million. Such high figures were last observed in May, shortly before the third halving reduced the block reward from 12.5 BTC to 6.25 BTC.

On the Blockchain.com chart, a sharp uptick in the indicator is visible at the start of November.

Dynamics of Bitcoin miners’ revenues. Source: Blockchain.com.

On November 4, Bitcoin’s price began pressing the $14,000 mark. On November 5 they rose to above $15,200. On the next day Bitcoin neared the $16,000 level. The last time the cryptocurrency traded at such high levels was in early January 2018.

From this year’s low of $3,850, reached after the March 12-13 crash, Bitcoin has risen more than fourfold. Since the third halving, prices have risen by almost 80%.

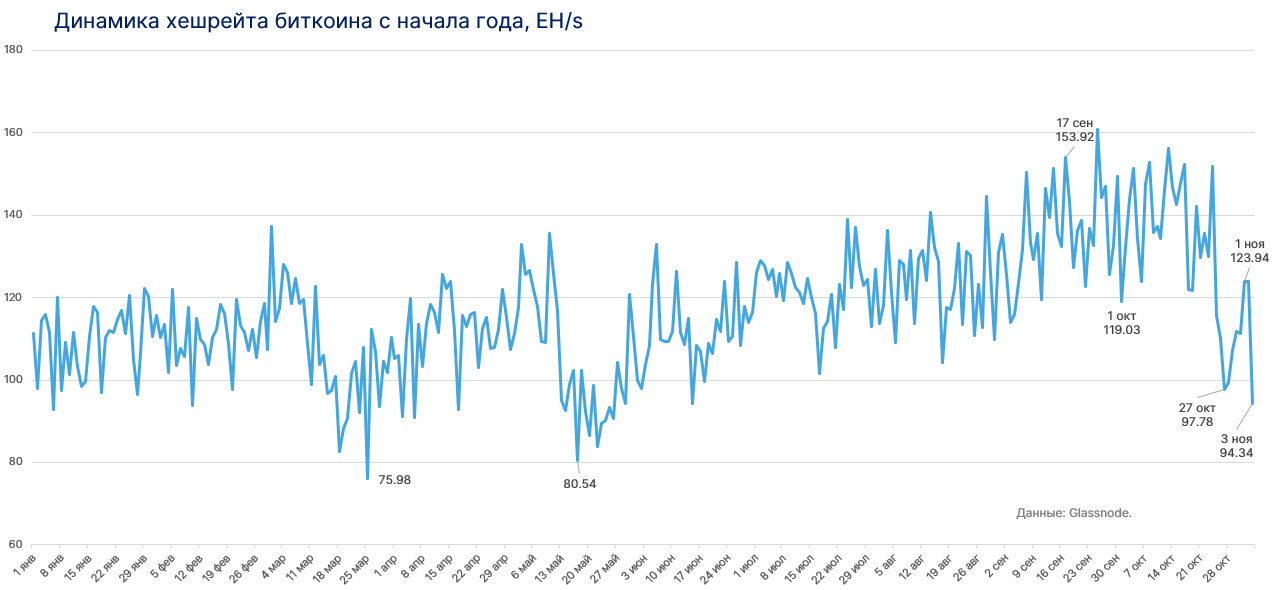

The rise in the indicator played a role, aided by the largest drop in difficulty since 2011 by 16.05%. The apparent cause was the recent drop in hash rate of 27% amid the end of the rainy season in Sichuan and the associated migration of miners.

Source: Glassnode.

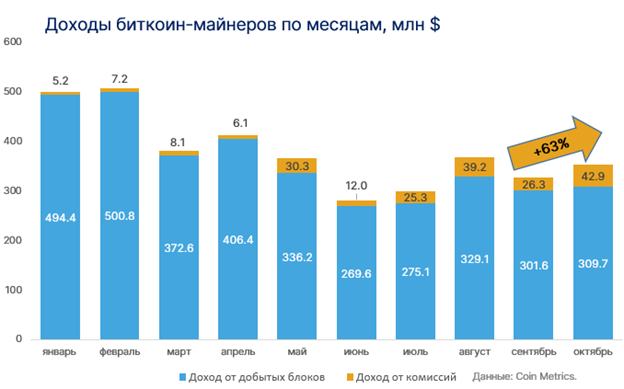

The share of fees in Bitcoin miners’ revenues rose. For October, proceeds from transaction fees amounted to $42.9 million. Compared with September, this figure rose by 63%.

Source: Coin Metrics.

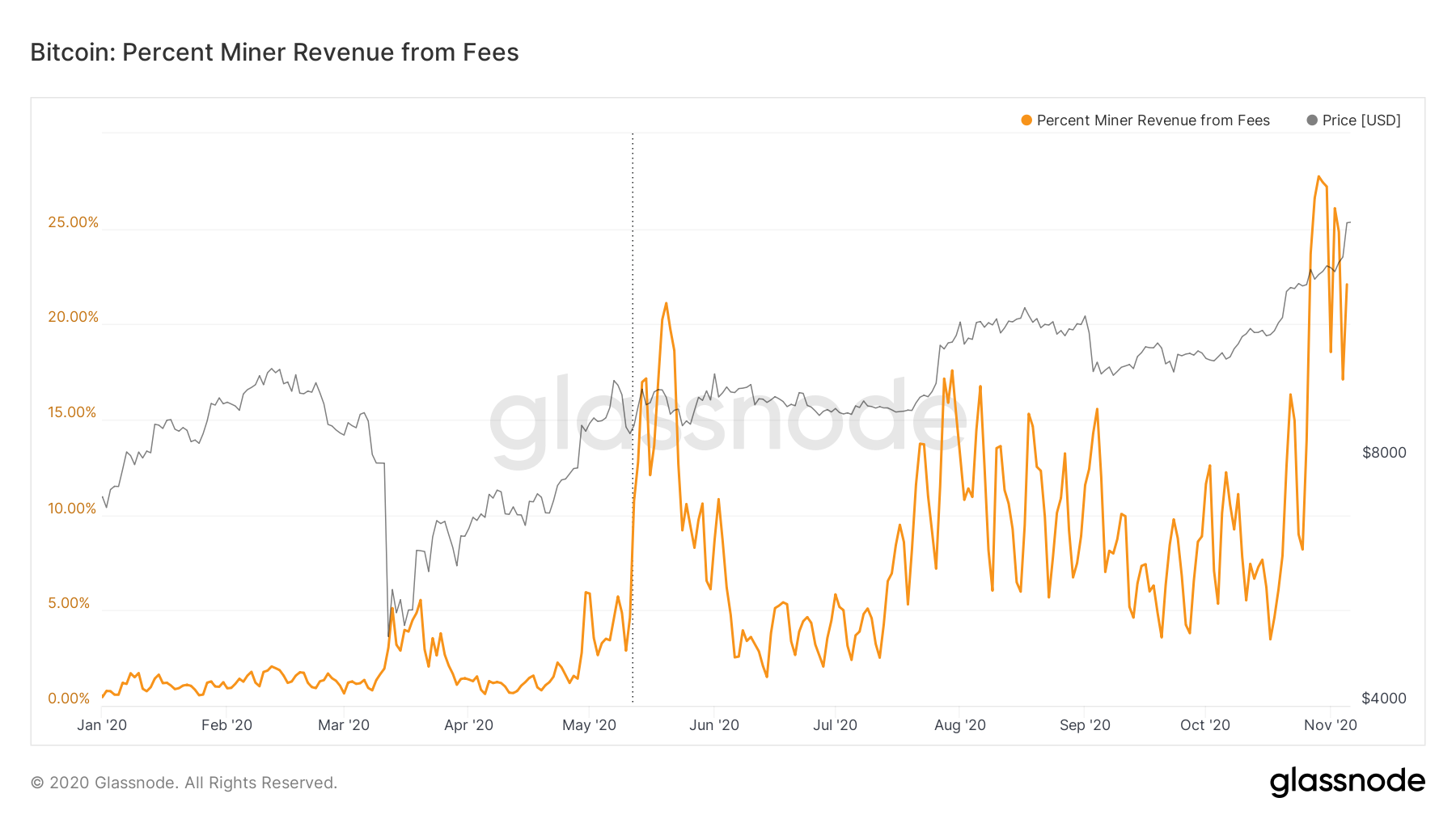

On October 29, the share of transaction fees stood at 27.75%, a peak since January 2018, and since then has remained above 17%.

Source: Glassnode.

New Bitcoin records this year have catalyzed miners’ selling inclination. CryptoQuant analysts observed a shift in their behaviour and signalled the build‑up of conditions for strengthening this trend.

It seems miners started to sell some $BTC.

You might want to set an alert for «Miner to Exchange Transactions Count Flow.» $BTC price drops when this hourly value goes above 120. The great sell-off in March this year, for example.

Set alert👇https://t.co/ZOxePE7aFm pic.twitter.com/3lFrJicvV0

— CryptoQuant.com (@cryptoquant_com) November 5, 2020

CryptoQuant founder Ki Young Ju drew attention to inflows of coins to exchange wallets from Bitcoin whale addresses. One of the metrics of this activity approached the critical zone.

$BTC whales are active on exchanges.

All Exchange Inflow Mean for spot exchanges started touching the danger zone. Above 2 BTC indicates that whales are depositing on exchanges.

I’d recommend to keep on eyes on this chart to time when to sell BTC.https://t.co/J8b3MMFjMc https://t.co/krW9akc41d pic.twitter.com/D5U7WldndB

— Ki Young Ju 주기영 (@ki_young_ju) November 6, 2020

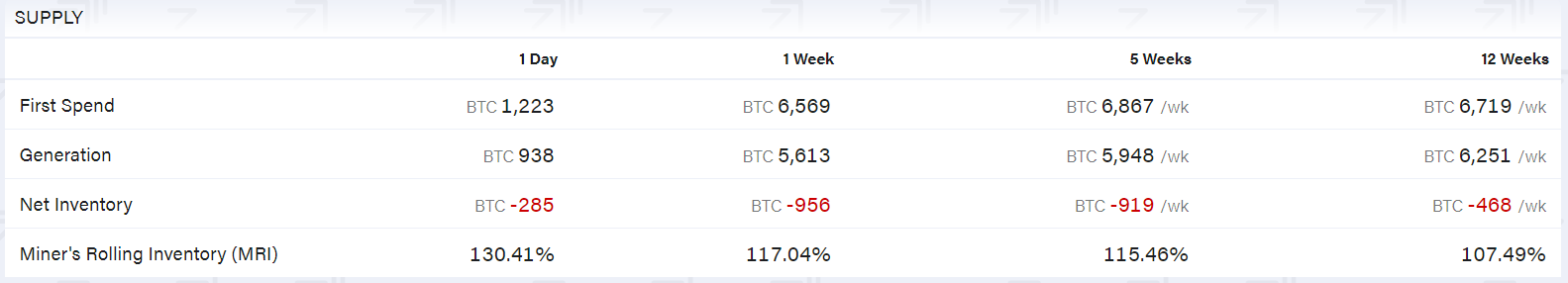

According to ByteTree, miner accumulations have declined across all tracked timeframes. Over the last day they spent 285 BTC more than they mined, and over the week – 956 BTC.

Source: ByteTree.

Earlier Bloomberg analyst Mike McGlone predicted a ‘parabolic’ rise in Bitcoin in 2021.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!