Bitcoin Shows Tepid Reaction to Fed’s Rate Cut

Fed cuts rate again; Bitcoin and Ethereum prices dip.

On October 29, the United States Federal Reserve (Fed) reduced the key interest rate by 25 basis points for the second consecutive time, bringing it to 3.75-4%. Read more.

“Available indicators suggest moderate growth in economic activity. Employment growth has slowed this year, and the unemployment rate has slightly increased but remained low until August; more recent data confirm this trend. Inflation has risen since the beginning of the year and remains somewhat high,” the press release states.

The meeting’s outcome aligned with investor expectations, resulting in a muted market reaction. Bitcoin’s chart shows volatility and high trading volumes, yet no drastic change in price.

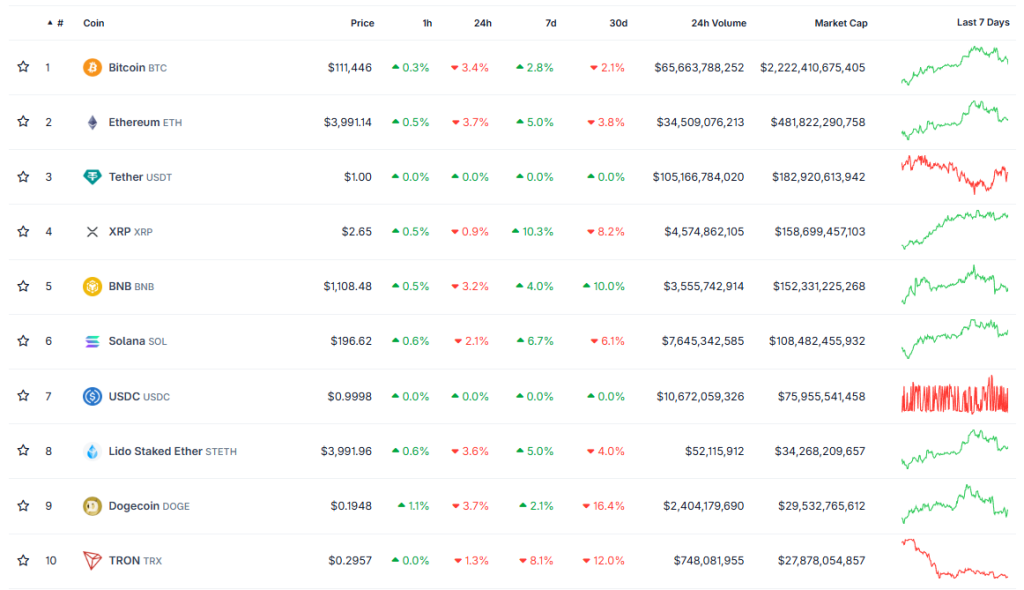

At the time of writing, the leading cryptocurrency is trading around $111,500, having lost 3% in 24 hours.

The price of Ethereum has fallen below $4,000.

Other top-10 capitalized assets also entered the “red” zone. TRX fell by 11% over 24 hours, while DOGE dropped by 3.7%.

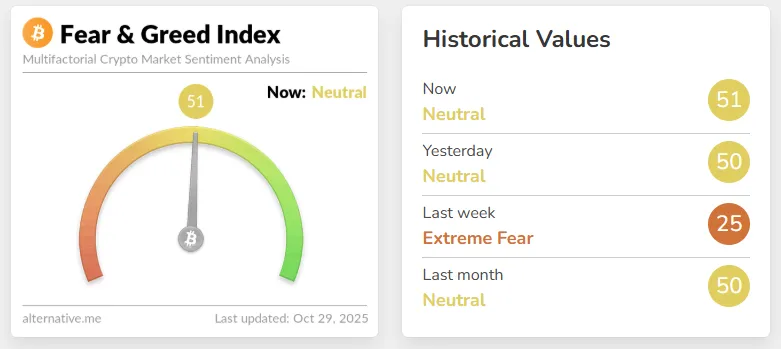

The Fear and Greed Index remains neutral at 51.

Fed’s Future Plans

In the long term, the Fed aims for an annual inflation rate of 2%.

The committee also decided to end the reduction of the total volume of securities (QT) from December 1.

“[The Fed] will be ready to adjust monetary policy as necessary if risks arise that could impede achieving its goals. Assessments consider a wide range of information, including labor market conditions, inflation pressures and expectations, as well as financial and international developments,” the regulators clarified.

During a press conference, Fed Chair Jerome Powell noted that the U.S. economy is currently significantly affected by the government shutdown. This has also delayed the release of several important indicators.

Powell added that President Donald Trump’s trade tariffs are contributing to inflation growth. Prices are rising in affected categories of goods.

Additionally, the chairman believes that the risks of a weakening labor market are increasing.

Analyst Axel Adler Jr. suggested a new Bitcoin rally might occur following the Fed meeting.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!