Bitcoin slips below $96,000 amid fears of persistent inflation

After a rapid climb toward $100,000, the largest cryptocurrency just as quickly fell below $96,000, losing 6% in 24 hours.

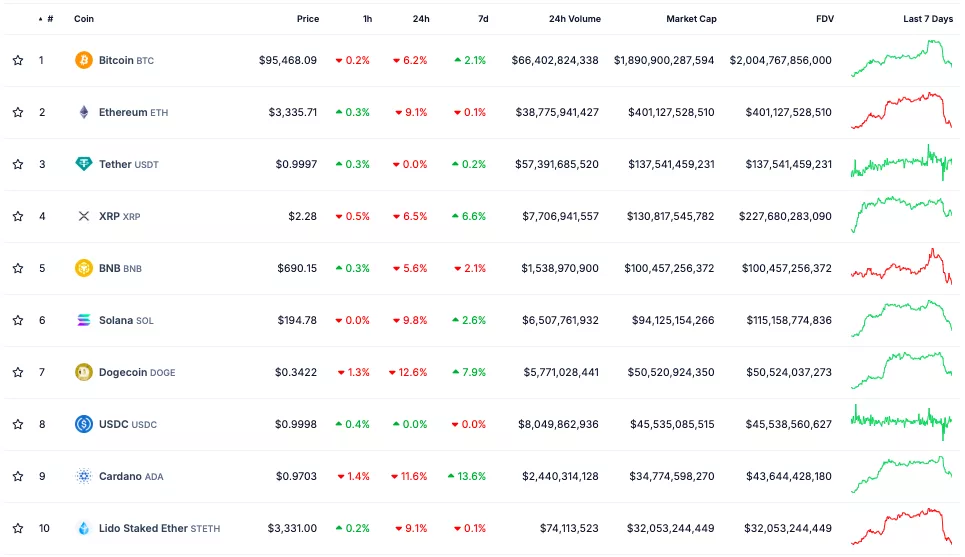

At the time of writing, digital gold is trading at $95,500 with a market capitalisation of $1.89 trillion.

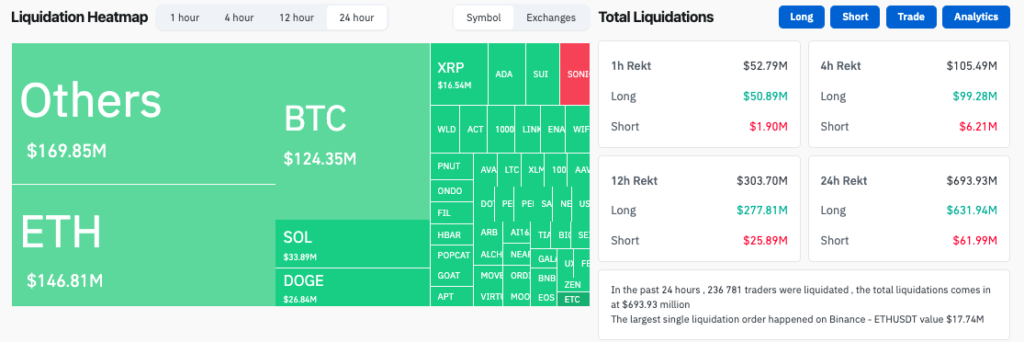

According to Coinglass, liquidations over the past 24 hours exceeded $690 million. The bulk ($631 million) came from long positions.

Bitcoin dragged all top-10 crypto assets into the red. Ethereum fell harder, dropping 9% to $3,330.

Solana (SOL) fell 9.8% to below $200. Dogecoin (DOGE) retreated 12.5%, while Cardano (ADA) lost 11.6%.

Presto Research analyst Min Chong told The Block that broader markets, including equities, are declining amid macroeconomic concerns about persistent inflation.

“Not only cryptocurrency, but also the Nasdaq and S&P 500 fell by more than 1%. This was caused by inflation concerns after ISM showed faster-than-expected growth in the U.S. economy. This intensified fears of persistent inflation, [led] to higher bond yields, and 10-year Treasury securities reached their highest level since April,” he noted.

Chong added that the inauguration of U.S. President-elect Donald Trump on 20 January will add to market volatility.

The crypto trader under the pseudonym Daan Crypto Trades wrote that it “will be interesting” to see how bitcoin behaves in the short term.

$BTC About $1.6B in Open Interest wiped out since the local high yesterday.$ETH also saw about $1B in Open Interest get rinsed out on this move.

Going to be interesting seeing how this plays out in the short term. Overall market still remains choppy which is usually the case… pic.twitter.com/hk7g04UEcB

— Daan Crypto Trades (@DaanCrypto) January 7, 2025

“Overall, the market still remains choppy; this usually happens at the end and beginning of the year,” he added.

Glassnode analyst James Check wrote in a report that demand for bitcoin is falling despite a slowdown in selling. By his observation, spot trading volume has also been dropping rapidly since November—down 54% in a month and a half.

Earlier, technical analyst Ali Martinez called $104,700–105,770 an important resistance zone, a break of which would secure new highs for bitcoin.

Earlier, experts at Galaxy Research forecast bitcoin at $150,000 in the first half and $185,000 in the fourth quarter of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!