Bitcoin Speculators Shift to Profit-Taking, Says Researcher

Short-term holders of Bitcoin are taking profits.

Short-term holders of the leading cryptocurrency have begun locking in profits, observed CryptoQuant contributor known as IT Tech.

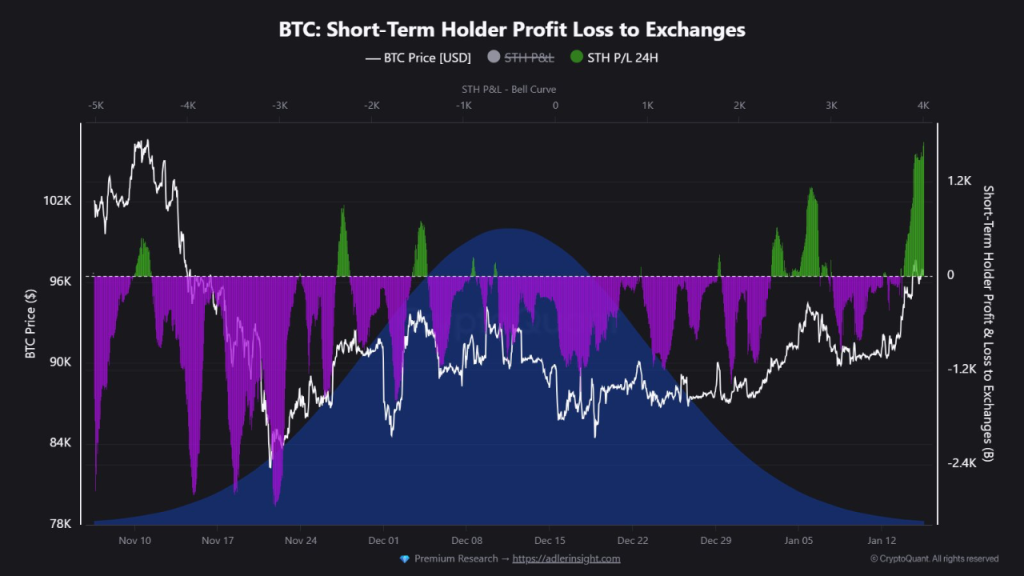

The chart below illustrates the profit and loss dynamics of short-term investors (STH) transferring assets to exchanges.

After a prolonged period of loss-making trades, a sharp spike in profit-taking occurred in the past 24 hours, coinciding with a gradual recovery in Bitcoin’s price.

At the time of writing, digital gold is trading around $95,300. Over the past seven days, the asset has appreciated by 5.4%, according to CoinGecko.

IT Tech concluded that “late” buyers used the local rebound and emerging liquidity to exit positions.

“STH profit spikes usually signal the exhaustion of the current momentum, rather than the start of a new rally,” the expert warned.

Whales Back in Profit

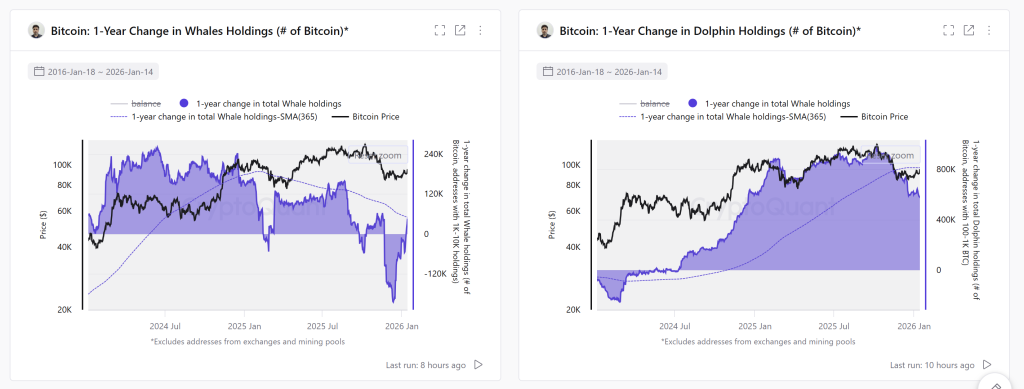

CryptoQuant analysts have noted a trend shift among major players — the annual net change in “whale” balances (1,000-10,000 BTC) has decreased by 220,000 BTC.

The decline in activity followed a cyclical peak of 400,000 BTC accumulation recorded in December 2024, marking the sharpest drop since early 2023.

However, last week the trend reversed: whales increased their holdings by 46,000 BTC (+21%). The metric returned to positive territory for the first time since November 2025, marking the end of a period of active asset distribution.

The dynamics of “dolphins” (wallets holding 100 to 1,000 BTC, including ETF) appear weaker. From an October peak of 972,000 BTC, this group’s holdings fell to 589,000 BTC. A nearly 38% correction indicates cooling interest in this segment.

Who Moves the Price?

The accumulation cycles of “whales” and “dolphins” develop at different paces. In the current market phase, large holders showed maximum activity in June 2024 — at that time, their annual balance growth reached 260,000 BTC. “Dolphin” reserves at that moment were only 11,000 BTC.

Later, the situation changed: thanks to the popularity of ETFs, “dolphin” assets showed explosive growth, reaching 970,000 BTC by October 2025. But following the peak came a sell-off. Due to significant volumes, this group of investors has recently exerted a key influence on pricing.

However, historically, global rallies are initiated by “whales,” analysts believe. Therefore, the current resumption of purchases by them should be seen as an “early fundamental signal,” rather than a short-term price growth factor.

Back in mid-January, a popular market sentiment indicator pointed to “greed” among Bitcoin investors for the first time since October indicating “greed” among Bitcoin investors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!