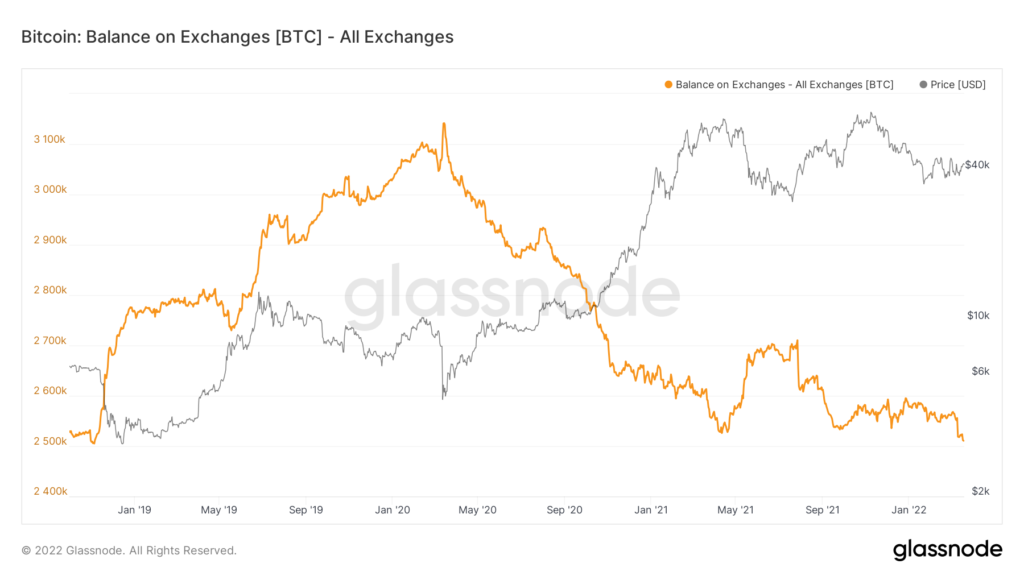

Bitcoin supply on centralized exchanges hits its lowest since 2018

Bitcoin supply on centralized exchanges fell to 2.51 million coins, a fresh low not seen since November 2018. Data from Glassnode show.

The outflow of BTC from centralized trading platforms to more secure non-custodial wallets may indicate that market participants favour long-term investment strategies.

Another possible reason is the sanctions against Russia, under which several crypto exchanges blocked accounts of users in the region. With a view to safeguarding their assets, the latter prefer to control private keys themselves.

Major platforms such as Binance and Kraken said they would not block customers from Russia unilaterally, but would comply with requirements from global regulators.

Earlier, Binance ceased processing cards issued by Russian sanctioned banks. The company also blocked transactions with Visa and Mastercard cards issued in Russia.

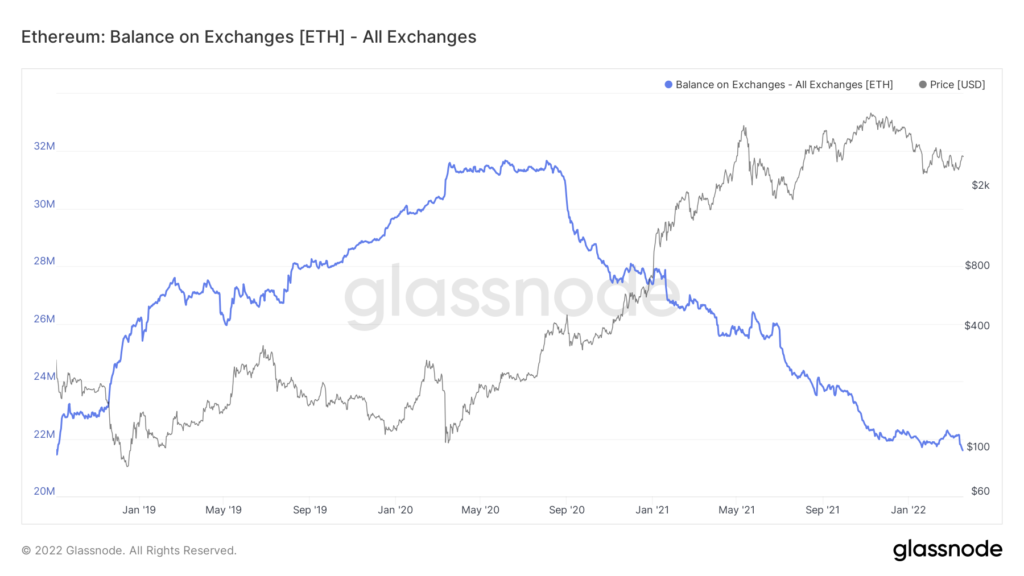

A similar trend is observed for the second-largest cryptocurrency. Ethereum supply on centralized platforms fell to 21.6 million ETH, a fresh low since September 2018.

Meanwhile, the share of ETH locked in DeFi protocols remains fairly high. In October 2021 the figure topped above 28% — now it stands at 27.55%.

According to CoinGecko, Bitcoin rose 7.7% and Ethereum 13.5% over the past seven days. At the time of writing, the first asset trades near $41,860, the second near $2,925.

In March 2022, Elon Musk stated that, in anticipation of rising inflation did not plan to sell the Bitcoin, Ethereum and Dogecoin he owns.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!