Bitcoin Surpasses $70,000 as Ethereum Nears $3,800

During the night of May 20-21, the cryptocurrency market resumed its vigorous recovery. Digital gold increased by more than 6% in a day, while Ether surged by 17%.

At the time of writing, Bitcoin is trading around $71,320, and Ethereum is near $3,650.

The price of Ethereum has closely approached $3,800, with a growth exceeding 22% over the past 24 hours.

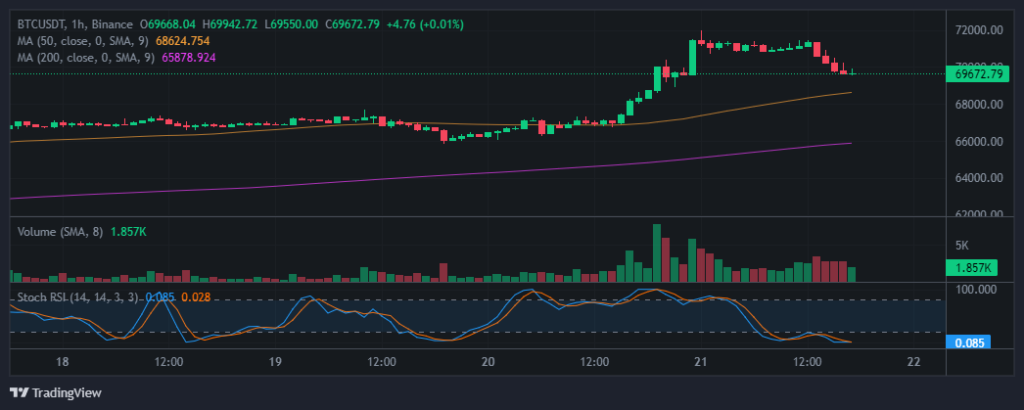

Bitcoin has corrected below the $70,000 level.

According to IntoTheBlock, 90% of holders of the second-largest cryptocurrency by market capitalization are “in profit.”

Ether’s explosive move to $3600+ puts 90% of $ETH holders in profit. pic.twitter.com/ExkqY89OD1

— IntoTheBlock (@intotheblock) May 21, 2024

A possible reason for the surge in Ether’s volatility is the increased likelihood of spot ETH-ETF approval by Bloomberg analysts Eric Balchunas and James Seyffart, from 25% to 75%.

Update: @JSeyff and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they’d be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024

Analyst and MN Trading founder Michaël van de Poppe expressed the view that Ethereum has already reached a local bottom and the price correction is complete.

The low is likely in on #Ethereum. pic.twitter.com/4FQCJuElv8

— Michaël van de Poppe (@CryptoMichNL) May 21, 2024

He also expressed satisfaction with his recent shift into altcoins.

According to SoSoValue, inflows into spot Bitcoin ETFs have been observed for six consecutive days.

Over the past day, the total net inflows into exchange-traded funds amounted to $241.12 million. The total figure for the past six days is $1.2 billion.

Leaders in net inflows over the past day:

- ARKB by Ark Invest — $68 million;

- IBIT by BlackRock — $66 million;

- FBTC by Fidelity — $64 million.

On the other hand, there is a continuous outflow of digital gold from centralized exchanges:

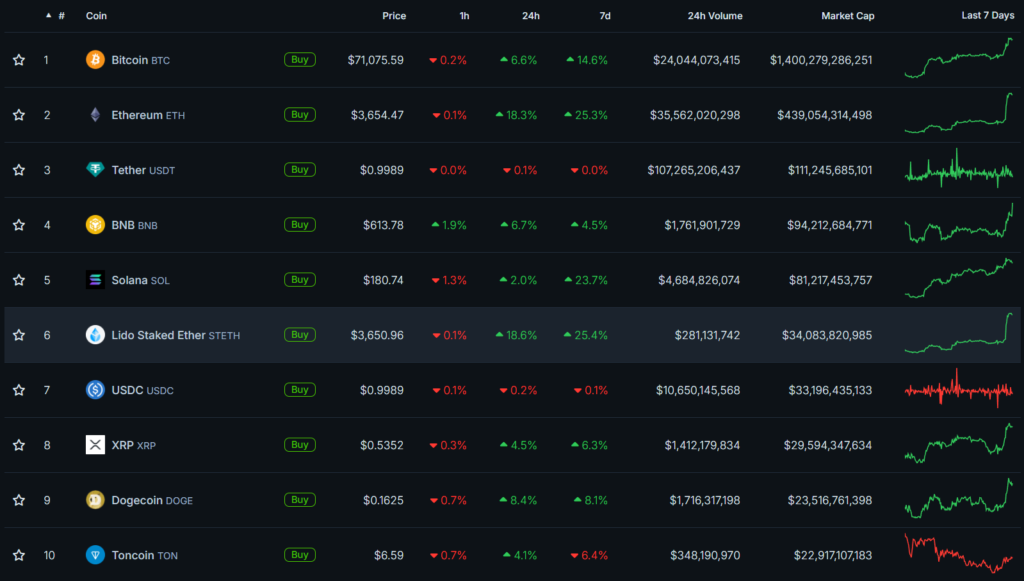

The rise of flagship cryptocurrencies — Bitcoin and Ethereum — has pushed the broader market upwards. Here is the top 10 ranking from CoinGecko:

According to Rekt Capital, the market is on the verge of an altcoin rally, with its peak expected in July.

The total market capitalization stands at $2.74 trillion, with BTC’s dominance index at 51.1%.

Welcome to the Q2 Altcoin Hype Cycle

Things are only just getting started#BTC #Crypto #Bitcoin pic.twitter.com/GPdgrV63T7

— Rekt Capital (@rektcapital) May 20, 2024

Previously, analysts at QCP Capital suggested that the post-halving effect, in the form of stabilization and Bitcoin’s transition to growth, will manifest at least two months later.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!