Bitcoin Surpasses Canada’s GDP and Amazon’s Market Capitalization

The market capitalization of Bitcoin has reached $2.4 trillion, surpassing the GDP of countries such as Canada ($2.2 trillion) and Brazil ($2.1 trillion). The total value of the entire cryptocurrency market is estimated at $3.8 trillion, comparable to the GDP of the United Kingdom.

This growth has allowed the leading cryptocurrency to surpass the market capitalization of tech giant Amazon ($2.3 trillion) and silver ($2.2 trillion).

The event has sparked reactions within the financial community. Gold advocate Peter Schiff urged investors on his X account to seize the opportunity:

“Today, as Bitcoin reaches new highs (in dollars), is a great time to sell it and buy silver. Even if the leading cryptocurrency continues to rise, the metal should increase much more. And while Bitcoin can easily crash, the downside potential for silver seems very limited.”

Kirill Khomyakov, head of regional markets for Binance in the CIS, Central and Eastern Europe, and Africa, told ForkLog that the high capitalization of cryptocurrencies reflects their growing economic value rather than speculative interest.

According to him, Schiff’s criticism of Bitcoin contradicts market data, which indicates a stable interest in the leading cryptocurrency.

Khomyakov added that institutional investors are showing interest in the asset, confirming the perception of Bitcoin as a strategic and long-term asset.

The Binance representative emphasized that the capitalization of the cryptocurrency market is not an abstract figure. It reflects the value of a new financial ecosystem used by hundreds of millions of people.

Khomyakov cited the company’s services as examples that confirm the real use of cryptocurrencies.

“More than $230 billion has been processed through Binance Pay in 300 million transactions. Binance Earn users have earned over $50 billion. This proves that cryptocurrencies are used for real tasks: paying for goods, cross-border transfers, and participating in DeFi,” he explained.

The fact that a digital asset has surpassed the economy of a developed country in terms of capitalization indicates a global transformation in the approach to finance, Khomyakov believes. The speaker called the leading cryptocurrency a unique combination of technology and financial instrument that can scale globally without intermediaries.

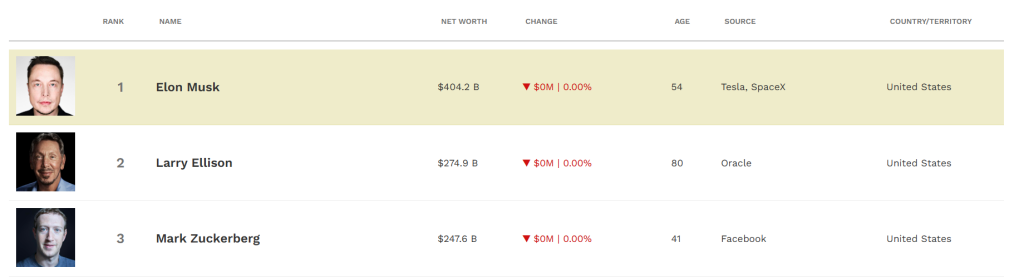

Among the world’s billionaires, Bitcoin’s market capitalization exceeds the combined wealth of Elon Musk ($404 billion), Larry Ellison ($274 billion), and Mark Zuckerberg ($247 billion).

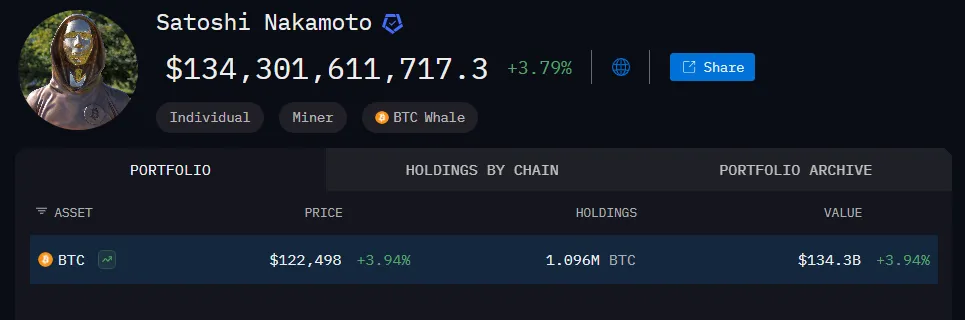

The largest holder of Bitcoin remains its creator, Satoshi Nakamoto, with 1.096 million BTC worth $134.3 billion. This makes him one of the wealthiest individuals on the planet.

The leading cryptocurrency is gradually becoming a global asset on par with gold and shares of tech giants. To surpass gold in market capitalization ($22 trillion), Bitcoin would need to exceed $1 million per coin.

Since the beginning of 2025, the precious metal and the leading cryptocurrency have become the most profitable assets, with returns of 28% and 26% respectively.

Gold (+28%) and Bitcoin (+26%) are now the top performing major assets so far in 2025. We’ve never seen these two in the #1/#2 spots for any calendar year. $GLD $BTC

Video: https://t.co/8pPyZehrH9 pic.twitter.com/XiQzuqf7q6

— Charlie Bilello (@charliebilello) July 13, 2025

Previously, gold and Bitcoin have never occupied the top two spots in terms of returns within a single calendar year. This is the first such occurrence in recorded history.

Earlier, senior cryptocurrency research analyst at Bitwise, Juan Leon, believes that global GDP will increase by $20 trillion due to digital asset and artificial intelligence industries by 2030.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!