Bitcoin Tests $66,000 Amid Anticipation of Chinese Stimulus

On the morning of October 14, the price of the leading cryptocurrency surpassed $64,000. This was prompted by positive trends in Asian stock markets, driven by expectations of expanded stimulus measures from Chinese authorities.

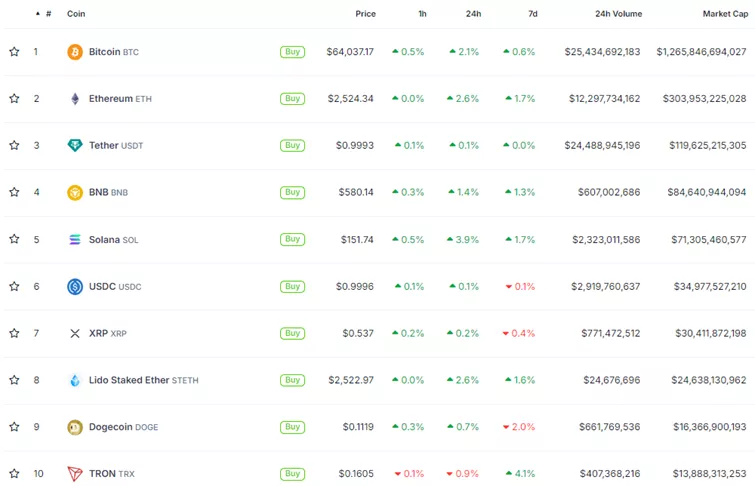

At the time of writing, Bitcoin is trading at $64,100, having gained 2.1% over the past 24 hours. Ethereum’s daily growth rate ($2520) stands at 2.6%.

Among the top 10 cryptocurrencies by market capitalization, TRON was the only one to decline (-0.9%). Other assets rose between 0.2% (XRP) and 3.9% (Solana), according to CoinGecko.

As the opening of the US stock market approached, the daily growth rate of digital gold increased to 3.7%. The price tested the psychological level of $65,000.

Around 17:45 (Kyiv/MSK), digital gold tested the $66,000 level, momentarily reaching $66,200. The coin is currently trading around $66,020.

During a weekend briefing, China’s Finance Minister Lan Fo’an promised new steps to support the real estate sector and hinted at increased government borrowing. The official did not provide specific figures regarding fiscal support.

“Chinese stocks rebounded after weekend disappointments, so risk sentiment is likely to remain in ‘buy everything’ mode until further notice,” commented SOFA.org’s Head of Analytics, Augustin Fan.

The expert noted a reassessment of US inflation data. In his view, the initial negative reaction has shifted to a renewed confidence in the downward trend of the indicator.

Min Zhu from Presto Research highlighted risks to the positive trend, including the situation in the Middle East and the progress of the US presidential race.

CryptoQuant has estimated that whales have accumulated 1.5 million BTC over the past six months.

Previously, QCP Capital suggested that rising geopolitical tensions in the Middle East could push the price down to $55,000.

CEO of Lekker Capital, Quinn Thompson, urged investors to seize the opportunity to buy digital gold during dips.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!