Bitcoin Unfazed by Diminished Prospects of Fed Policy Easing

Weaker-than-expected inflation deceleration shifted expectations for a Federal Reserve rate cut from May to June, yet had limited impact on Bitcoin.

In January, the annual inflation index in the US stood at 3.1%. This figure surpassed the forecast of 2.9% but was an improvement from the previous month’s 3.4%.

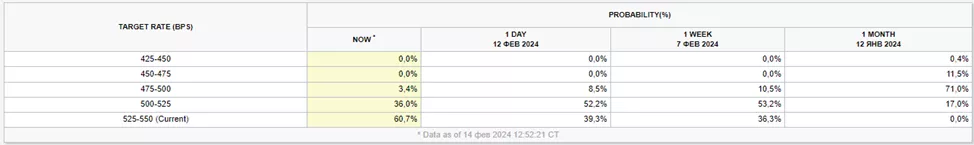

The likelihood of a Fed rate cut at the May meeting fell to 39.4% from 60.7% prior to the data release. In June, such chances are estimated at 75.5%.

Following an initial drop to $48,500 on the news, the price of the leading cryptocurrency began to recover losses by the end of the US session and by the morning of February 14 was attempting to regain control over $50,000.

Analysts at Truflation explained this behavior to CoinDesk as maintaining hopes for Fed policy easing in March.

“Until we see a weakening in economic data, the issue of rate cuts is unlikely to be discussed until May or June. Markets may have simply come to terms with the fact that higher interest rates will persist longer and have learned to live with this new reality,” they wrote.

MN Trading founder Michaël van de Poppe saw this trend as a sign of resilience in Bitcoin inflows. The expert explained that the trend will remain intact as long as the cryptocurrency’s price stays above $46,000.

#Bitcoin correcting slightly after CPI came out (higher than projected).

Inflow is great, but it’s not a guarantee that it will go up endlessly.

As long as #Bitcoin stays above $46K, trend remains up.

Good sidenote: ETH/BTC bouncing upwards. pic.twitter.com/gK3j54iGPi

— Michaël van de Poppe (@CryptoMichNL) February 13, 2024

Earlier, early Bitcoin adopter Tuur Demeester suggested that Bitcoin could reach $600,000 by 2026.

Previously, options traders placed bets on a digital gold rally to the $65,000 level in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!