Bitcoin Volatility and On-Chain Activity Plummet to October 2023 Levels

- The volatility of the leading cryptocurrency has decreased to levels recorded nearly two years ago.

- On-chain activity continues to decline, raising concerns among analysts about the exit of retail participants.

- Despite the decline in key metrics, “whale” demand for bitcoin continues to grow.

Despite the approach of the price to its historical high and sustained interest from institutional investors, on-chain activity in the network of the leading cryptocurrency has fallen to its lowest levels in the past 20 months.

The cumulative transaction volume for June fell by 15% compared to May’s figure — a level corresponding to October 2023, when bitcoin traded in the $28,000-35,000 range.

Implied volatility has also noticeably decreased, reaching levels recorded nearly two years ago.

Empty Mempool

According to Blockchain, on July 5, there were only about 5,000 unprocessed transactions in the mempool. Later, their number increased to 15,000.

However, this is still significantly less than the end of 2024, when about 150,000 transactions were waiting for confirmation. It was then that the price of bitcoin first surpassed the $100,000 mark.

“Bitcoin’s mempool (a queue of pending transactions) is almost completely empty. The share of fee (non-inflationary) income for miners has dropped to fractions of a percent,” noted Dash’s Director of Marketing and Business Development, Joel Valenzuela.

According to him, almost all real bitcoin users have left the network, and this happened amid price peaks. Valenzuela described the situation as a serious crisis, where bitcoin risks either “going bankrupt” or becoming a fully custodial asset under the control of states and institutions.

The founder of the analytical platform Alphractal, Joao Wedson, believes that an empty mempool indicates the absence of retail participants in the market.

“When the number of transactions in the mempool starts to grow, it’s a clear sign of retail returning — as the increasing queue reflects heightened demand for network use,” the specialist noted.

Institutional Demand Grows

Despite the decline in key metrics, interest from Wall Street in digital gold continues to grow.

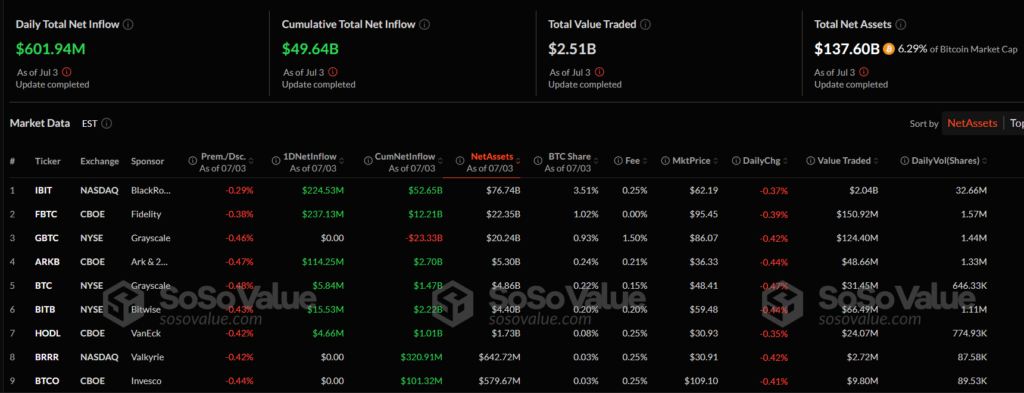

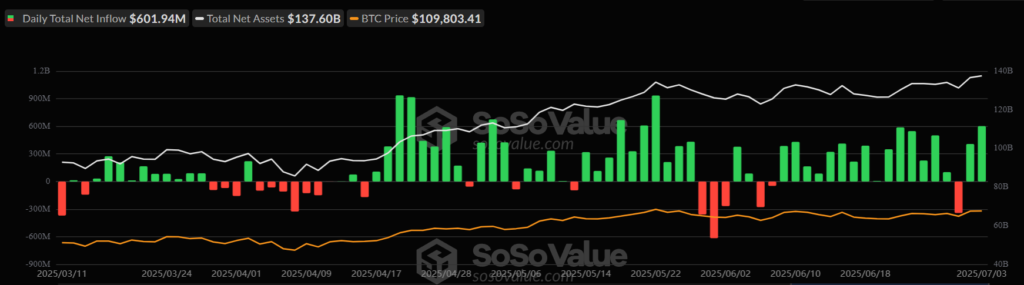

In particular, the cumulative net inflow into US spot bitcoin ETFs has approached $50 billion, and the volume of assets under management of these structures has reached $137 billion — this is 6.29% of the market capitalization of digital gold.

On July 4 alone, the net inflow into exchange-traded funds amounted to $601.9 million.

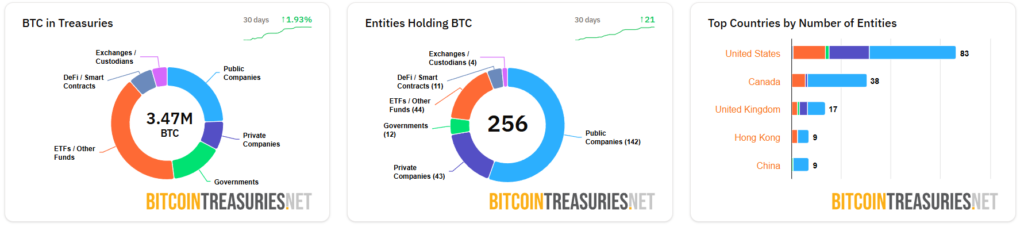

In June, public companies added approximately 65,000 BTC worth about $7 billion to their reserves, according to BitcoinTreasuries.

Corporations hold about 3.47 million BTC. This is approximately 16.5% of the total issuance of digital gold.

As reported, analyst known as Rekt Capital warned of a possible end to the bull market in two to three months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!