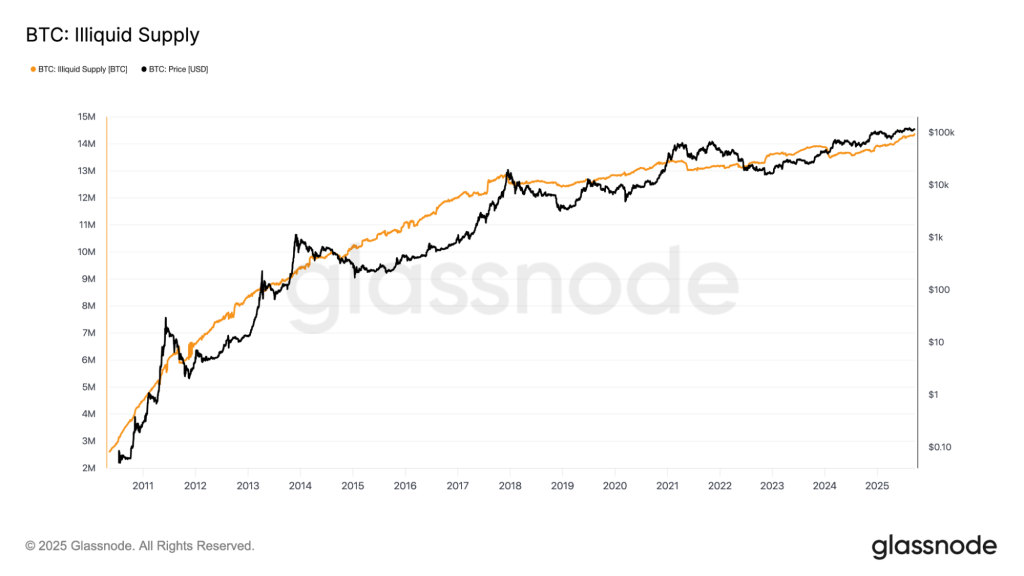

Bitcoin Whale Holdings Reach Record 14.3 Million BTC

Bitcoin's long-term holders reach a record 14.3 million BTC.

The proportion of the first cryptocurrency’s supply held by those who have hodled for more than seven years has reached a record 14.3 million BTC, according to Glassnode.

Since the beginning of the year, this figure has increased by 422,430 BTC.

This metric considers the assets of investors who prefer to hold Bitcoin long-term rather than trade, thus reducing the liquid supply on exchanges. The persistent accumulation trend by such players (LTH) reflects growing confidence in the prospects of the first cryptocurrency.

Growing Shortage

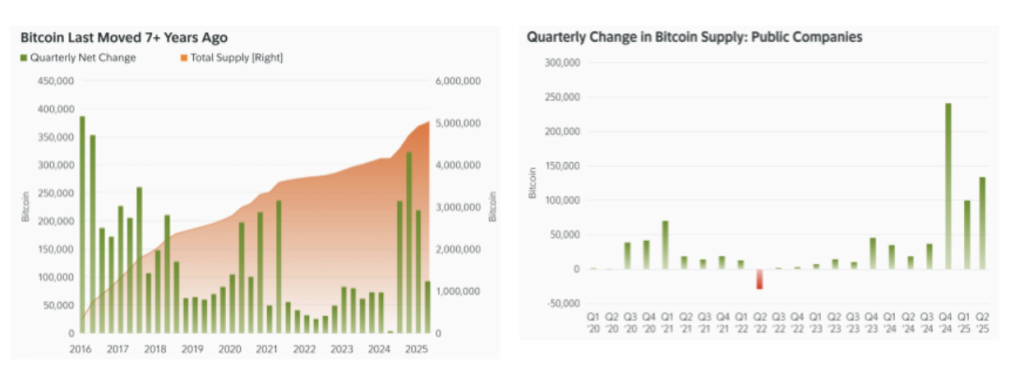

According to Fidelity, by 2025, LTH and corporate treasuries could remove more than 6 million BTC from circulation, exacerbating the shortage and potentially supporting the price of digital gold.

The company notes that the share of Bitcoin held by hodlers has been gradually increasing since 2016. The volume of coins on the balance sheets of public companies with portfolios of at least 1,000 BTC has also been steadily rising since 2020.

“We predict that this combined group will hold more than 6 million BTC by the end of 2025 — or over 28% of the 21 million BTC that will ever exist,” analysts emphasized.

The combined reserves of the first cryptocurrency on the balance sheets of corporations and in ETFs have grown by 30% since the beginning of the year — from 2.24 million BTC to the current 2.88 million BTC.

This growth reflects the ongoing concentration of digital gold supply among institutional and other large players.

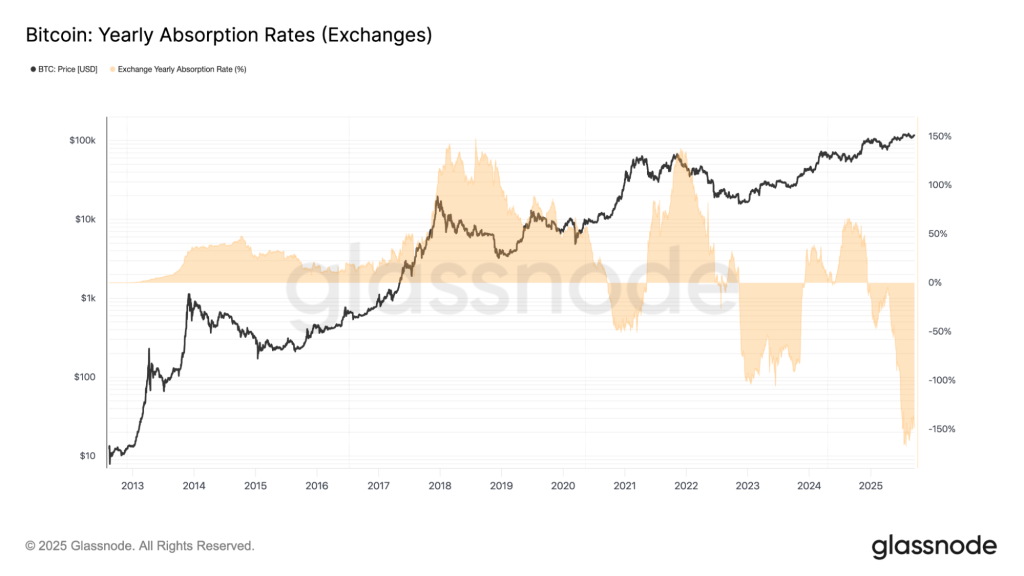

Whales and “sharks” are accumulating coins at record rates — about 300% of the annual issuance volume. Meanwhile, the reserves of the first cryptocurrency on exchanges are rapidly declining — the figure has reached -150%.

The current situation reflects a growing interest in self-custody of crypto assets and long-term investment strategies.

Earlier, researcher Axel Adler Jr. estimated a 70% probability of Bitcoin reaching an all-time high in the next two weeks.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!