Bitcoin Whales Slow Accumulation Amid Market Uncertainty

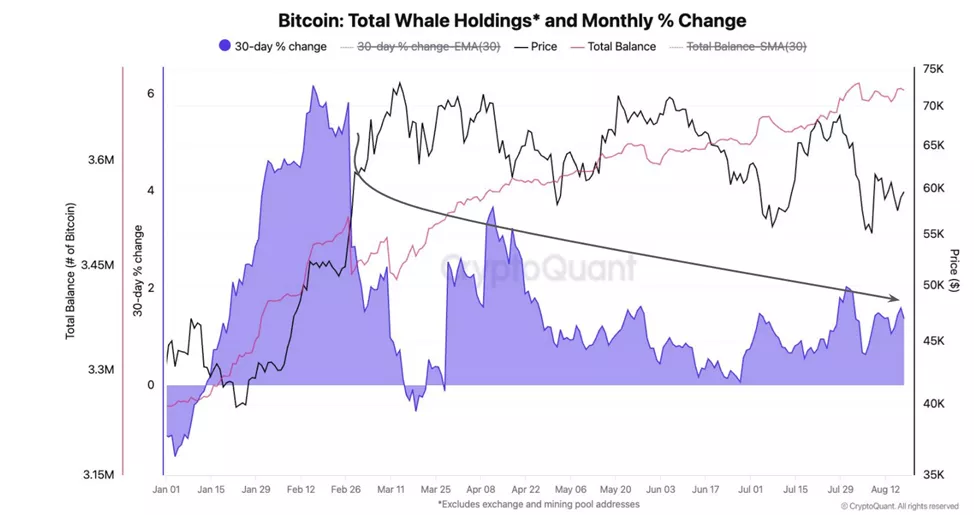

Large bitcoin investors have reduced their monthly accumulation rate to 1%, down from the typical 3% seen in bullish markets, according to CryptoQuant, as reported by Cointelegraph.

In February 2019, this figure reached 6%.

Analysts indicate that most demand metrics currently show weakness, insufficient to reach a new all-time high.

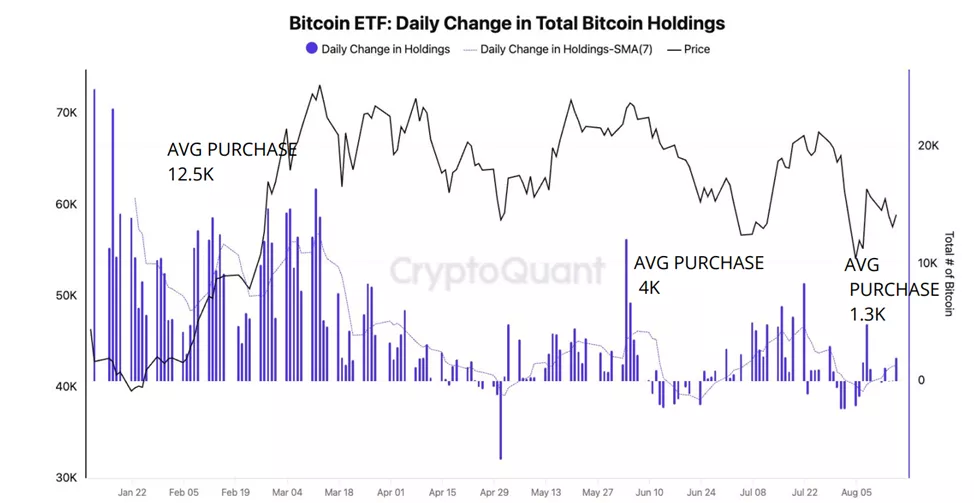

Experts have deemed the alternative of spot bitcoin ETFs as “unreliable.” The daily net inflow into these instruments is only a fraction of March’s values. Over the past week, the daily figure has dropped to 1300 BTC.

“A recovery in BTC-ETF inflows is necessary to boost overall demand for bitcoin, potentially leading to a rally,” experts noted.

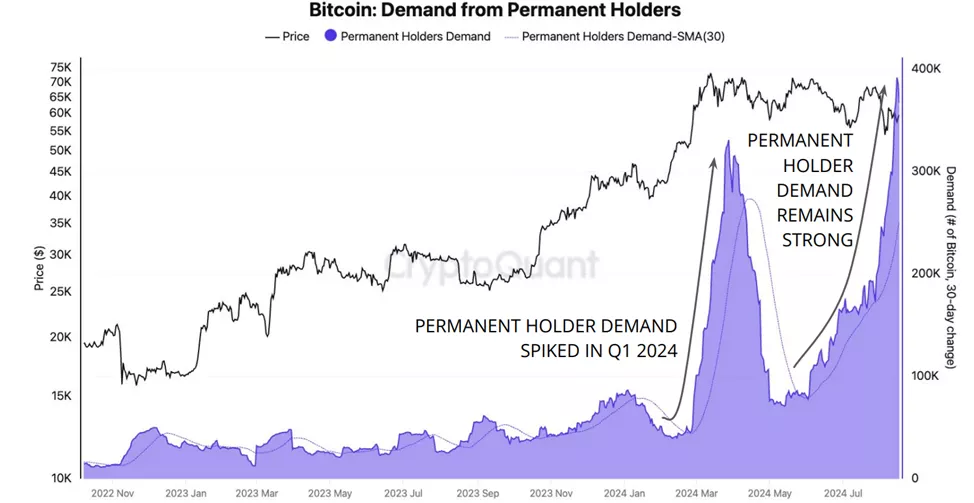

According to analysts, hodlers continue to accumulate coins.

“The total balance of these holders is growing at a record pace — 391,000 BTC per month. Demand from long-term investors is increasing even faster than in the first quarter, when the price exceeded $70,000,” the report states.

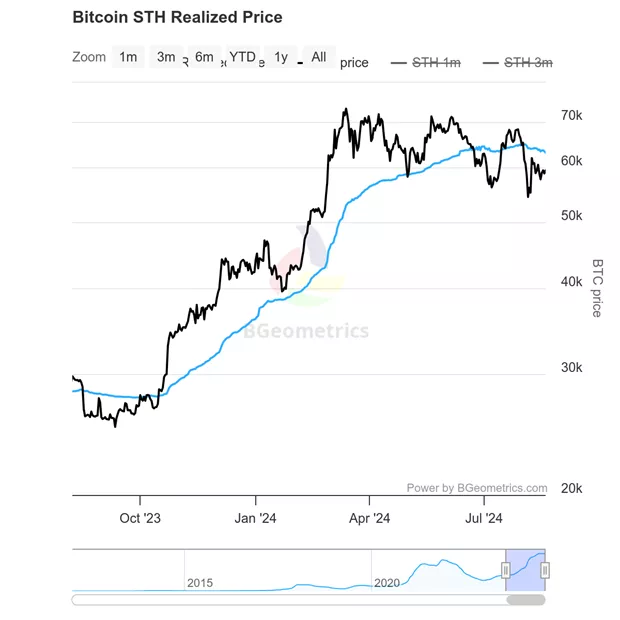

Another market participant category — short-term investors — has faced unrealized losses. According to BGeometrics, their average purchase cost is $63,000, higher than the current $59,650.

Analysis of bitcoin options indicated trader optimism following the US elections, according to Wintermute.

Previously, Bitwise’s Chief Investment Officer Matt Hougan concluded that the industry’s fate is indifferent to politicians’ attitudes. A similar opinion was expressed by former BitMEX CEO Arthur Hayes.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!