Bitcoin Yet to Reach Profit-Taking Levels for Holders, Says Glassnode

Realized profits for both short-term and long-term Bitcoin holders remain below previous all-time highs ATH. According to Glassnode, under such circumstances, many investors are willing to wait for higher prices.

#Bitcoin’s rally to a new ATH is driven by strong spot demand and institutional inflows, with over 95% of supply in profit. This article explores on-chain indicators, highlighting robust spot buying momentum, rising ETF AUM, futures premiums, and the potential for sustained gains… pic.twitter.com/N8gJENt5kL

— glassnode (@glassnode) November 12, 2024

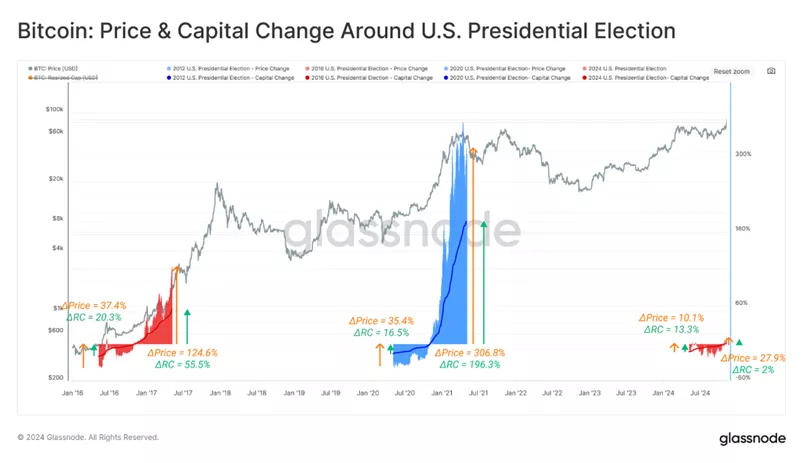

Analysts calculate that realized capitalization increased by 13.3% before the elections and by 2% after the event. In terms of price, these changes amounted to 10.1% and 27.9%. The current cycle reflects a more restrained reaction compared to past market responses.

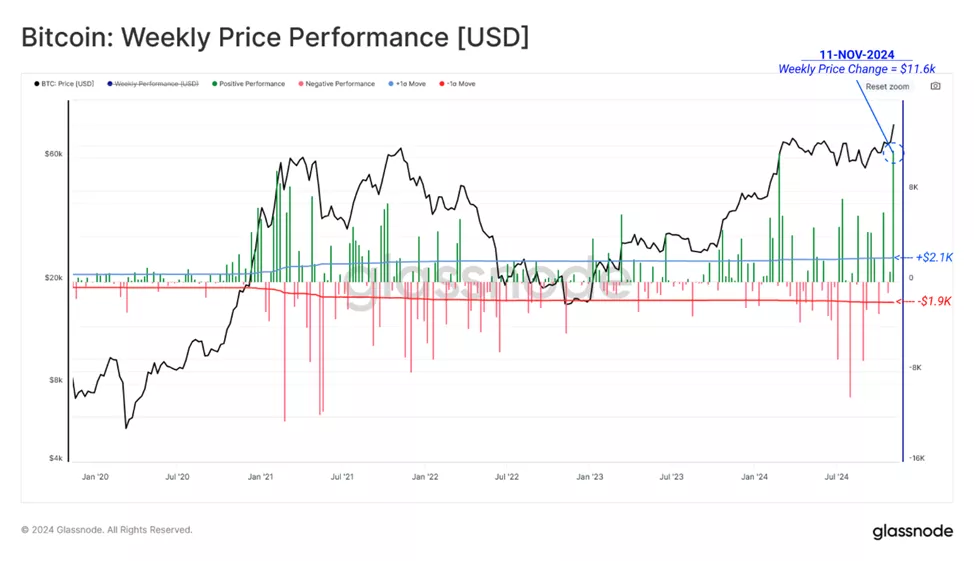

Over the past week, the price surged by $11,600 in absolute terms, exceeding the upper statistical range (one standard deviation) fivefold, “indicating unprecedented bullish strength” associated with expectations of regulatory landscape changes.

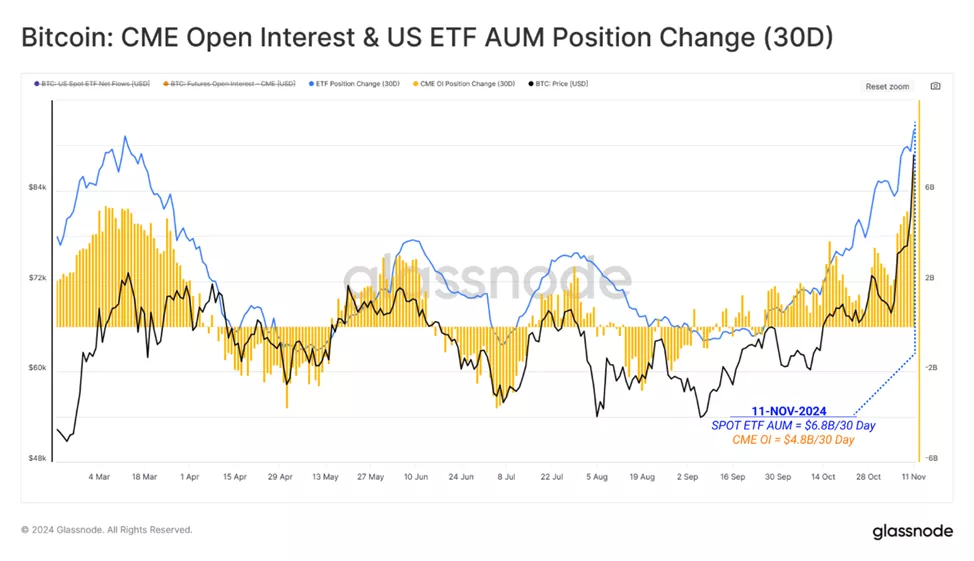

Experts noted significant buying pressure on Coinbase, as well as an inflow of $6.8 billion into BTC-ETFs over the past 30 days. The increase in open interest in Bitcoin futures on the CME by $4.8 billion over the same period indicates “a preference for spot trading through exchange-traded funds.”

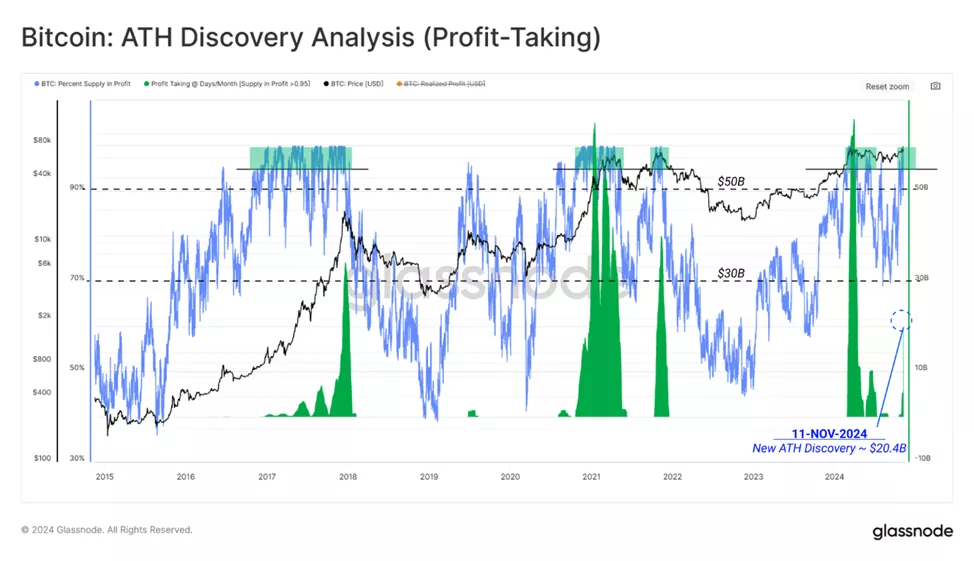

The chart below shows the cumulative realized profit after reaching new ATHs. Historically, on a monthly basis, this figure ranged from $30 billion to $50 billion before buying pressure eased. Currently, the metric has reached $20.4 billion.

“While profit-taking is significant, it remains below historical highs, suggesting additional opportunities for further growth until demand potentially wanes,” the review states.

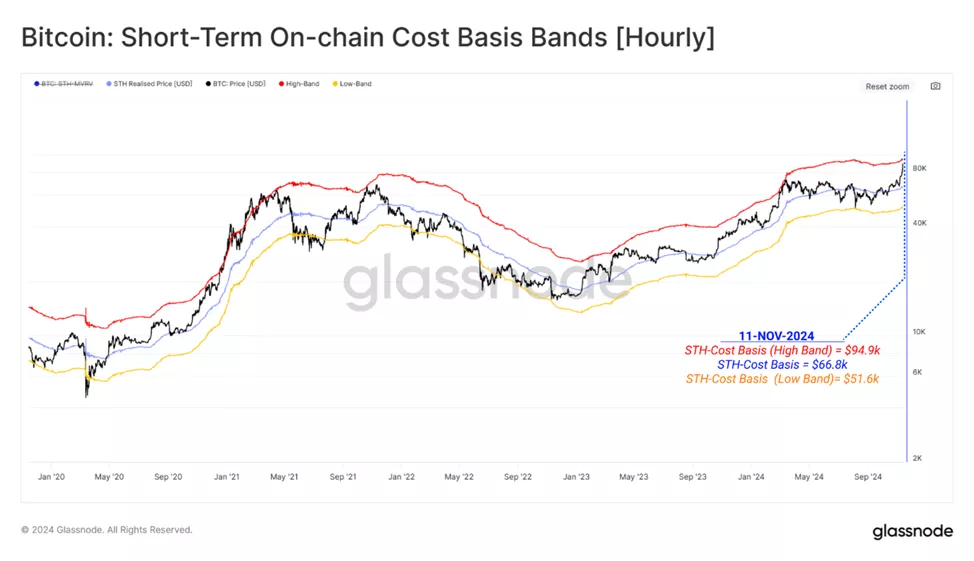

The next illustration shows the dynamics of the “cost price” of coins for “new investors” with one standard deviation in both directions. According to experts, after setting a record, quotes often approach the upper boundary of the range and test it several times.

Currently, the price stands at $87,900, with the band deferred by one standard deviation at $94,900.

The volume of realized profit on a daily basis reached ~$1.56 billion, with 46% ($720 million) attributed to hodlers. This is about half the level of previous cyclical ATHs ($3 billion, with over 50% formed by long-term investors).

“If demand persists, there will be opportunities for continued price growth. Greater selling pressure will be required before quotes reach typical levels for profit realization,” specialists concluded.

Earlier, Copper identified the timing of Bitcoin’s peak formation.

Previously, Bernstein urged to “add crypto assets to the portfolio as soon as possible.” They recommended purchasing a basket of digital assets, including BTC, ETH, SOL, OP, ARB, POL, UNI, AAVE, and LINK.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!