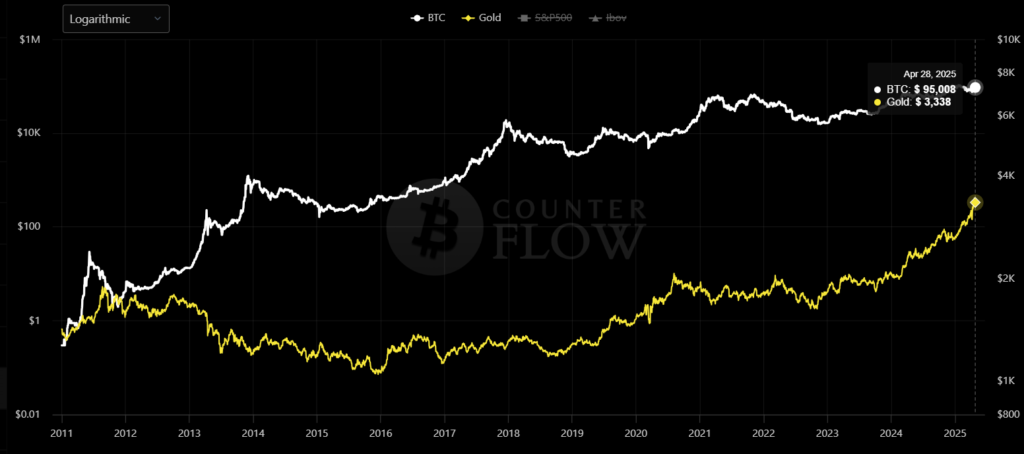

Bitcoin’s Correlation with Gold Surges After February’s Decoupling

The 30-day Pearson correlation coefficient between Bitcoin and gold has reached 0.54, nearing the annual high of 0.73. This may indicate a strengthening narrative of Bitcoin as a safe-haven asset among investors, researchers at The Block noted.

This increase in interdependence followed a notable decoupling of the leading cryptocurrency from the precious metal in February. During that time, the 30-day correlation plummeted from 0.73 to -0.67 over three weeks.

At the beginning of February, Bitcoin was trading around $102,000, while an ounce of gold was priced at $2,800. By the end of the month, the cryptocurrency had fallen to $84,000, and the precious metal had risen to $2,850.

“This divergence caused a sharp drop in correlation, with Bitcoin falling more than 17% while gold rose nearly 2%,” analysts noted.

Since then, the correlation coefficient between these assets has significantly recovered, rising from -0.67 to 0.52. The likely reason for this “re-coupling” is “liberation tariffs”, which contribute to increased macroeconomic uncertainty and a decline in the dollar index.

History Repeating?

Examining historical patterns, the “reunion” of Bitcoin with gold can be seen as a cyclical phenomenon. Experts at The Block have counted 18 instances since 2020 when the correlation coefficient between Bitcoin and gold dropped below -0.50 or approached this mark.

In 17 episodes, the indicator recovered within seven days. The sole exception was December 2022, when it took just over two weeks to return to initial values.

Historically, whenever the correlation coefficient between Bitcoin and gold falls below -0.50, the cryptocurrency tends to “strongly reattach” to the metal. This process is often accompanied by a rise in correlation to 0.8 and above, after which the cycle of “decoupling” resumes.

Back in 2020, researchers at NYDIG reported on the strengthening of Bitcoin as a safe-haven asset following U.S. President Donald Trump’s “Liberation Day.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!