Bitcoin’s Dip Below $60,000 May Trigger Panic Selling, Warns Expert

A drop in the price of the leading cryptocurrency below $60,000 could trigger panic selling, according to FxPro trader Alex Kuptsikevich, reports CoinDesk.

The expert believes that a breakthrough above $65,000 would signal a revival of bullish sentiment. If this prediction comes true, it would lead to the price stabilizing above the 50DMA and the reversal area in May.

According to the expert, the current price dynamics are characterized by a sequence of lower lows and highs. This indicates that investors are offloading strong positions during price rallies.

“The pressure is likely due to asset sales by miners and fears of tighter cryptocurrency regulation,” said Kuptsikevich.

The trader referred to the decline in mining difficulty following the halving in April.

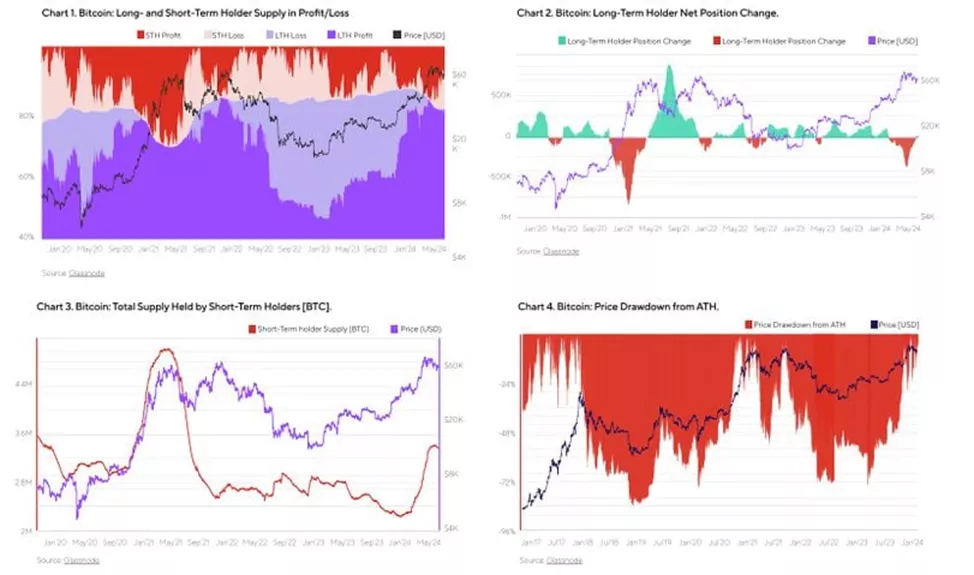

Analysts at Ryze Labs warned that the behavior of speculators—those holding tokens for less than 155 days—could significantly impact markets in the coming months.

According to experts, there have been three instances when a total of 94% of held coins became “profitable”:

- from mid-November 2017 to mid-April 2017;

- from mid-February to mid-April 2021;

- from late February 2024 to early April.

The peak value of digital gold held by short-term investors reached $117.8 billion in 2017 and $289.9 billion in 2021.

During these periods, long-term holders and miners offloaded the leading cryptocurrency to speculators.

According to experts, after reaching extremes, losses for short-term investors began to rise rapidly. This led to an inversion, where the latter started selling coins to hodlers.

Analysts emphasized that this shift historically led to a significant drop in bitcoin’s price in the following four to six months. In the most recent such period, it reached 6% of the ATH after a month, they calculated.

“The current cycle may differ from previous ones due to institutional demand amid improving macroeconomic conditions. However, if these supporting factors weaken, a drop similar to past episodes could occur,” the specialists warned.

In May, Bitfinex predicted a sideways movement for bitcoin and further asset growth.

Earlier, Standard Chartered stated that the leading cryptocurrency had already formed a bottom at $56,500, confirming a target of $150,000 by the end of the year and $200,000 by the end of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!