Bitcoin’s Peak Predicted for May 2025 Amid US Recession Forecasts

Bitcoin is expected to reach its peak in late May 2025, coinciding with recession forecasts in the United States. This perspective was presented by Copper, as reported by The Block.

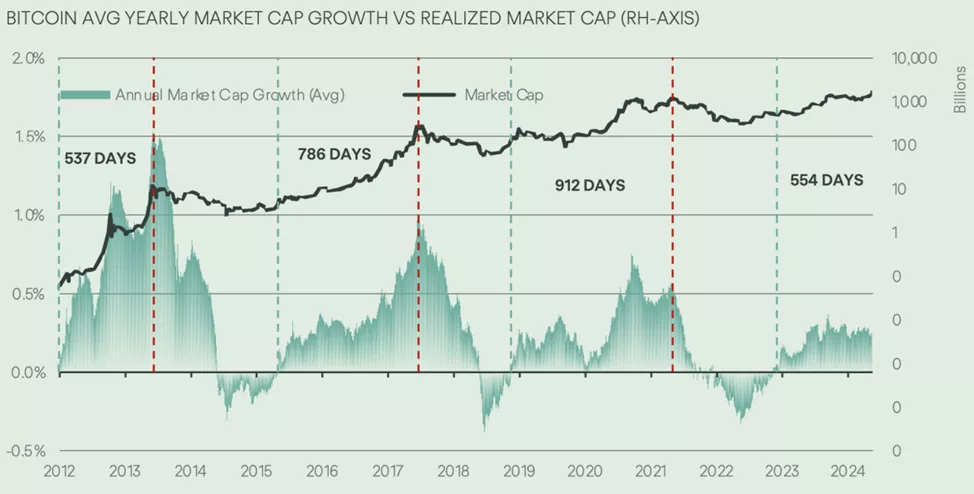

Experts explained their position using data from various bullish and bearish cycles. They found that, on average, these cycles last about 756 days. Since the formation of the bottom, 554 days have passed, leaving 202 days until the peak, assuming the analogies remain accurate.

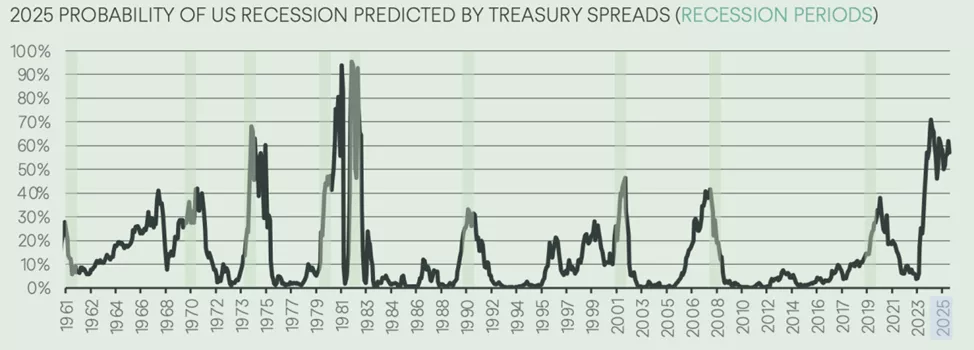

Analysts noted that JPMorgan estimates a 45% probability of a recession in the second half of 2025.

Specialists warned that while Bitcoin has historically shown resilience during economic downturns, market sentiment and investor behavior might differ this time.

In the near term, the positive trend for digital gold is expected to continue, as indicated by technical indicators like the RSI, experts noted.

Earlier, Bernstein urged investors to add crypto assets to their portfolios “as soon as possible.” They recommended acquiring a basket of digital assets, including BTC, ETH, SOL, OP, ARB, POL, UNI, AAVE, and LINK.

Back in previous reports, former BitMEX CEO Arthur Hayes reiterated his forecast of Bitcoin rising to $1 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!