Bitcoin’s Potential Local Bottoms Ahead of US Elections

- The options market anticipates a new all-time high for Bitcoin by the end of November and increased volatility post-US elections.

- Traders have noted the possibility of Bitcoin’s price retreating to $65,000 before a rebound.

The price of Bitcoin is expected to hit $66,200 before a rebound ahead of the US presidential elections, according to trader Titan of Crypto.

#Bitcoin Local Bottom at $66,200 Before a Bounce? ?#BTC couldn’t close above Tenkan ?, signaling a possible more profound pullback.

If the breakout is confirmed, we might see a retest of Kijun ? around $66,200, which could mark a local bottom. pic.twitter.com/a3M1YBh7vA

— Titan of Crypto (@Washigorira) November 3, 2024

“The price didn’t close above Tenkan [in the Ichimoku Kinko Hyo indicator]. This signals a possible deeper pullback. If the breakout is confirmed, expect a retest of Kijun near $66,200, which could indicate a local bottom,” the expert wrote.

Trader Credible Crypto identified the area between $65,000 and $69,000 as a “must-bounce zone in the near term.”

A quick look at some of our back-end data on $BTC here:

The good:

OI has nearly completed reset from the most recent rise as we are seeing some de-leveraging into support (65-69k) on this drop. This is a good sign for bulls.

In addition, the perp premium that had spiked at our… https://t.co/1uDt2cL7EZ pic.twitter.com/omjV5T9f4n

— CrediBULL Crypto (@CredibleCrypto) November 2, 2024

“Considering the high timeframe picture, a breakout of ATH is possible before a larger correction. Let’s see if we can get this bounce, and then we can move forward,” the expert clarified.

The pullback began after an unsuccessful attempt to return to the all-time high. In anticipation of the conclusion of the US presidential race, many traders opted to reduce positions.

Signals from the Options Market

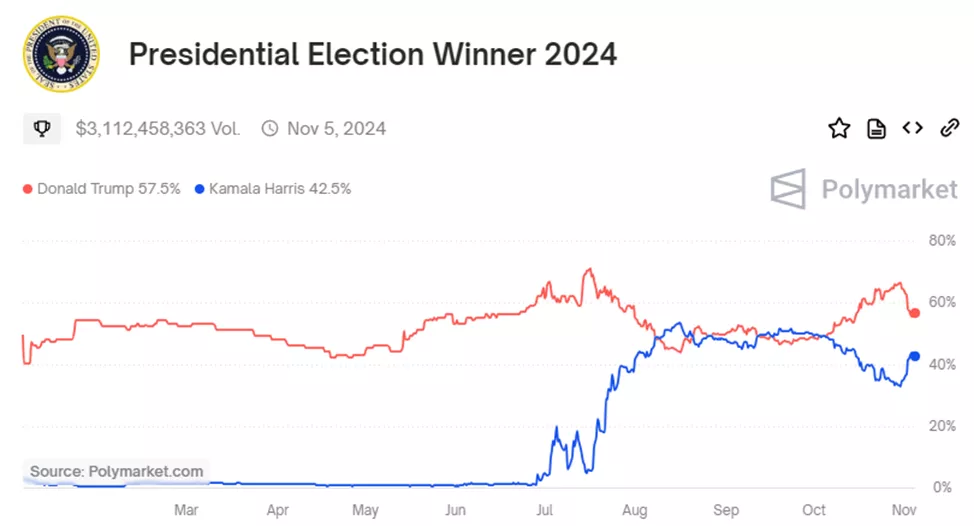

QCP Capital noted a significant decrease in the lead of Republican candidate Donald Trump over Democratic rival Kamala Harris. The probability of Trump’s victory is estimated at 55%, down from 66% a week ago.

Analysts forecast fluctuations in Bitcoin prices until the election outcome is clear, with a subsequent recovery if Trump wins and a deeper pullback if he loses.

2/ Options markets, however, suggest an appetite for upside, with increased buying of Nov-end 75k Calls and election-date volatilities rising.

— QCP (@QCPgroup) November 4, 2024

Experts noted optimism among options market participants for the medium-term outlook.

“We are seeing increased positioning with substantial purchases of calls with strikes at $75,000 by the end of November,” they commented.

Nick Forster, founder of DeFi Derive.xyz, explained to The Block that the observed rise in volatility in the derivatives market suggests a two-in-three chance of seeing Bitcoin and Ethereum price swings of ~10% after the November 5 elections.

For Ethereum, this range is from -8.97% to +9.85% (from $2222 to $2700), for digital gold — from -9.25% to +10.19% (from $62,500 to $75,400).

“The total open interest in Bitcoin calls is 1179 contracts, while puts stand at 885, indicating a bullish market sentiment despite potential volatility,” Forster noted.

Previously, Tyr Capital and Bitget Research also warned of increased price fluctuations post-US elections. A similar view was presented by Standard Chartered.

Bitwise identified Trump’s victory, further rate cuts by the Fed, and new stimulus measures for China’s economy as conditions for Bitcoin reaching over $80,000 by year-end.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!