Bitcoin’s Record Highs Enhance Liquidity, Reports Kaiko

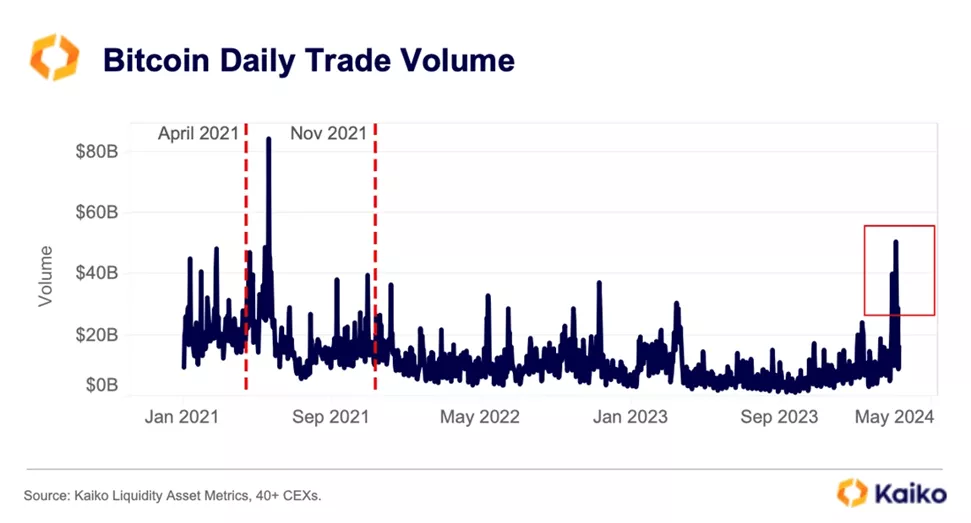

- Bitcoin’s new all-time high has led to record liquidity depth and a return of trading volumes to 2021 levels.

- Tether’s market capitalization has reached a historic high of $100 billion.

- Funding rates remain near peaks, indicating sustained high demand.

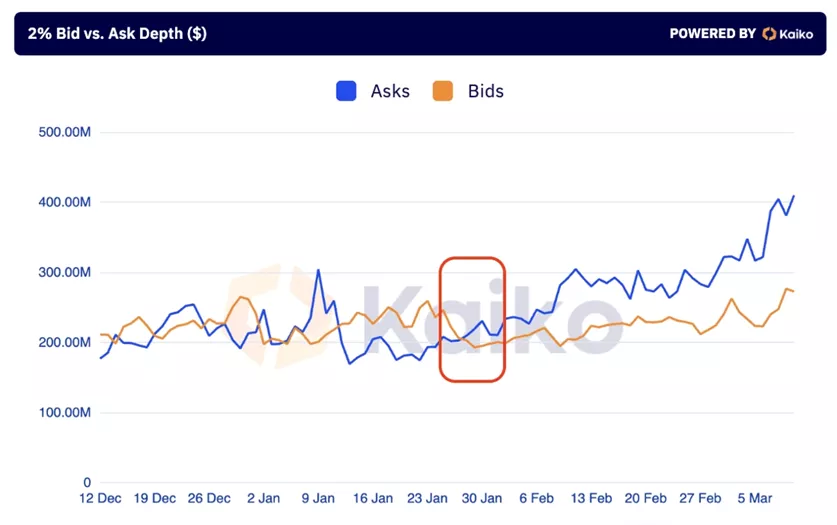

The market depth of Bitcoin, in terms of the value of orders within 2% of the order book, reached a record $600 million. This growth coincided with the new ATH, according to Kaiko.

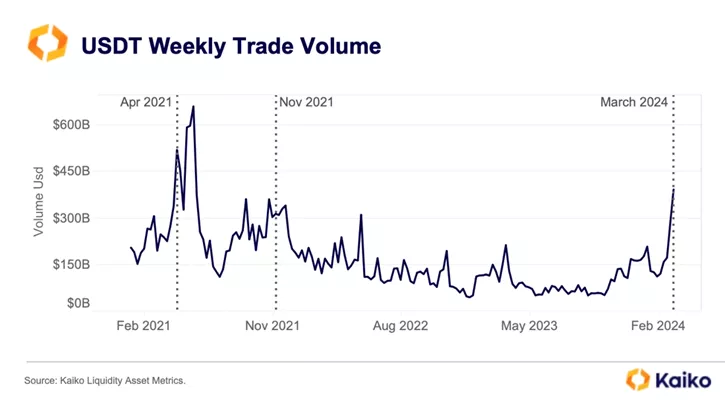

#USDT trade volume on CEXs has increased in line with crypto prices.

However, volumes remain well below their peak of $661bn reached in May 2021, and are about equal to volumes hit during the last bull market.

So why is market cap at all time highs? pic.twitter.com/L5hKBU7y46

— Kaiko (@KaikoData) March 12, 2024

Analysts noted that the number of asks significantly exceeded the number of bids. This divergence is the strongest since early 2021.

This situation indicates traders are taking profits as the all-time high is reached, specialists added.

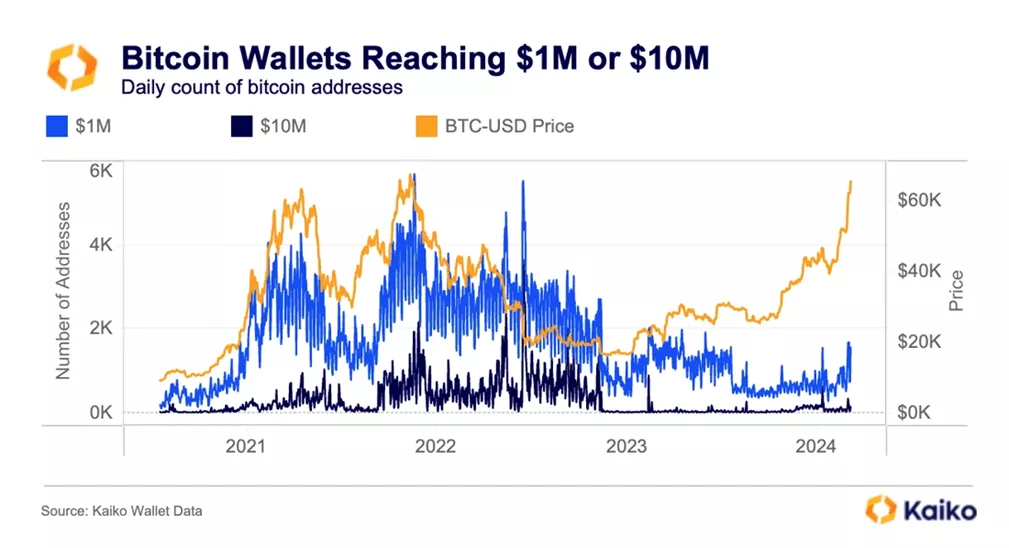

How Many Bitcoin Millionaires Are There?

On-chain analysis revealed a relatively slow increase in the number of new Bitcoin millionaires. During the current rally, the daily increase in holders of seven-figure dollar amounts remained below 2,000. In comparison, in 2021, these rates reached 4,000 wallets; for eight-figure amounts, it was 2,000 addresses.

Experts highlighted three reasons:

- New capital has yet to fully manifest.

- Whales are taking profits.

- Large players store coins on centralized platforms rather than in non-custodial wallets.

Tether’s Records

Kaiko noted that USDT reached a record $100 billion in market capitalization. These peak values did not lead to increased trading activity—turnover remained significantly below the $661 billion peak in May 2021, and its share in the total volume decreased. Analysts found no explanation for this.

On March 5, Bitcoin trading volume on spot platforms reached $51 billion, surpassing the levels of the 2021 bull market.

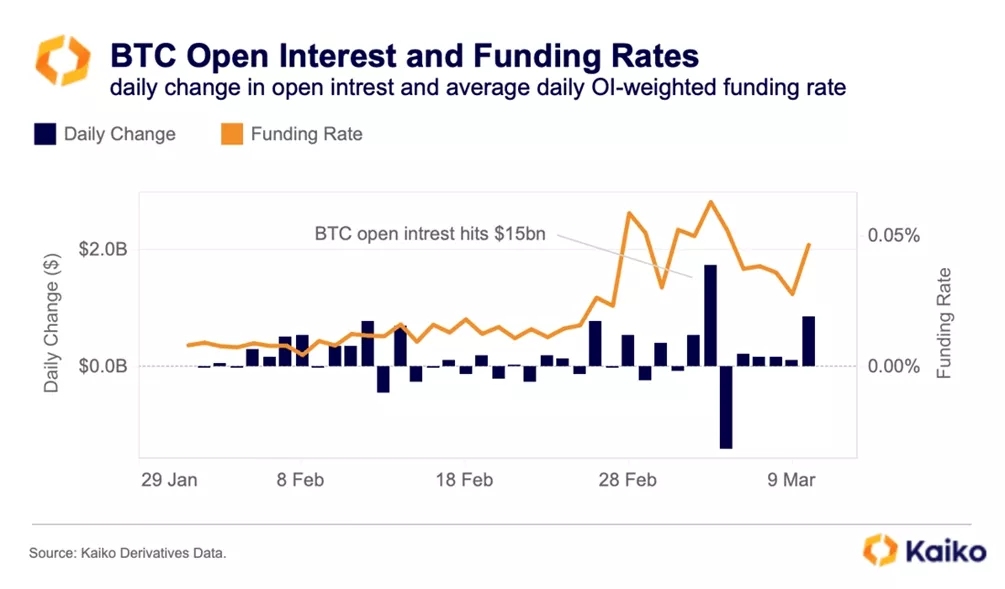

Bulls Hold Firm

On March 4, open interest in perpetual contracts for digital gold surged by nearly $2 billion to a multi-year high of $15 billion, before dropping by $1.4 billion the next day. The persistence of funding rates near peaks indicates sustained demand for the asset, specialists concluded.

Weekly inflows into crypto products reached a record $2.69 billion, according to CoinShares.

Earlier, IntoTheBlock identified five factors that could push Bitcoin’s price above $70,000 in the coming months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!