Bitcoin’s Resilience Amid GBTC Sell-Off Highlighted by Experts

Net capital flows into spot Bitcoin ETFs have strengthened, despite the supply overhang caused by exits from the GBTC by Grayscale. This conclusion was reached by Glassnode.

The Bitcoin market continues to show resilience, recovering from the initial sell-the-news drawdown following ETF approvals.

In particular, the market is working through the significant supply overhead created by investors rebalancing capital out of the GBTC product since its… pic.twitter.com/e9Lfwc2zbN

— glassnode (@glassnode) January 30, 2024

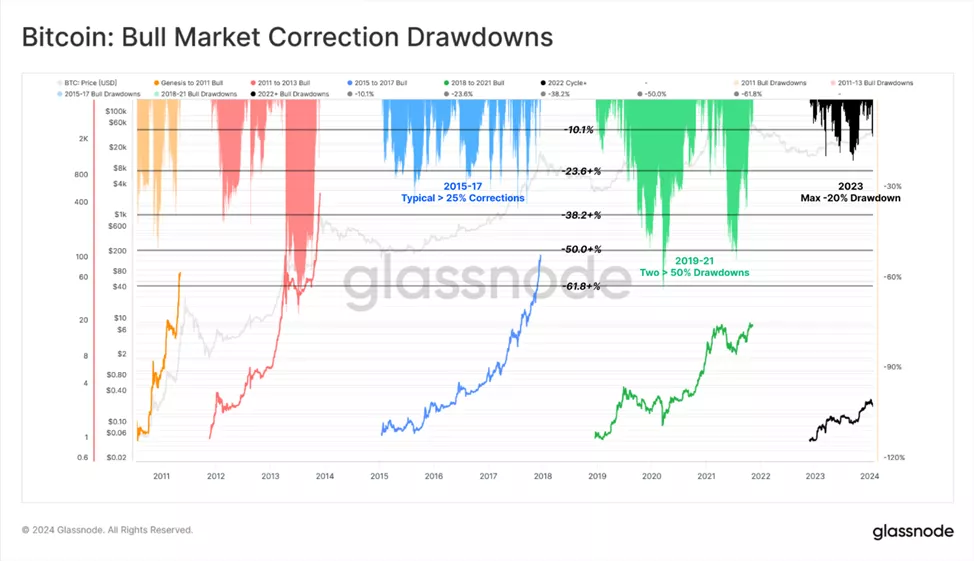

Experts noted similarities between the current bull market and its predecessors in 2016–17 and 2019–20 in the context of dynamics relative to the previous ATH.

The difference lies in the smaller amplitude of the pullback (20.1%) compared to 23.6% in 2016–17, as well as 50% and 61.8% in 2019–20.

As potential support, analysts suggested the “cost price” of short-term investors ($38,400) and the True Market Mean Price indicator developed jointly with ARK Invest ($33,300) — a cost basis model for active players.

According to experts, the latter metric serves as a “center of gravity,” often distinguishing bull markets from bear markets.

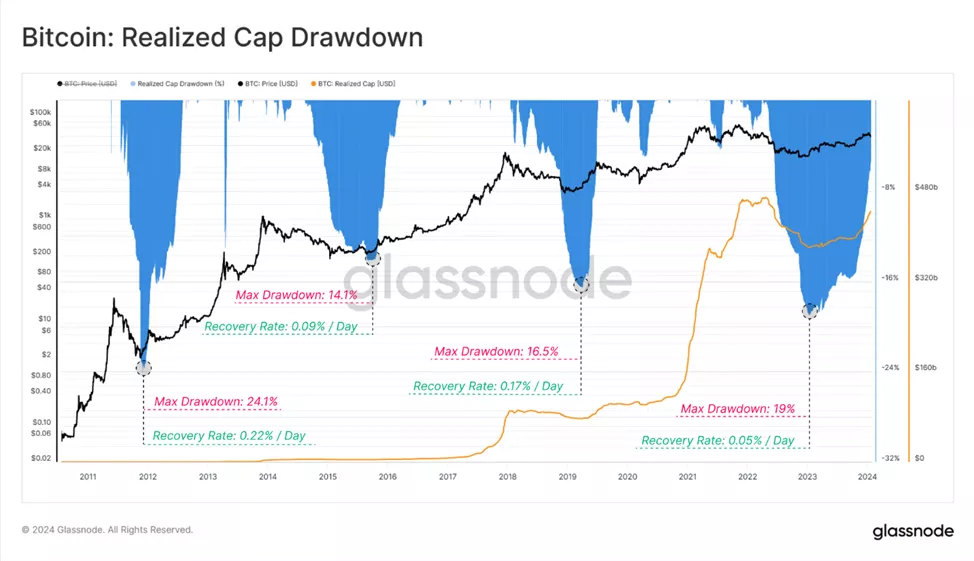

To assess the strength of capital outflows and the duration of recovery, specialists used the realized capitalization indicator.

At the time of writing, the indicator remained just 5.4% below its previous ATH of $467 billion, experiencing a strong capital inflow. The duration of the current recovery acceleration was noticeably slower than in previous cycles — 0.05% compared to 0.09–0.22%. Analysts linked this to the supply surplus due to complex transactions such as GBTC arbitrage.

The decline in AUM in GBTC was estimated at 115,600 BTC. At its peak in early 2021, the product attracted 661,700 BTC.

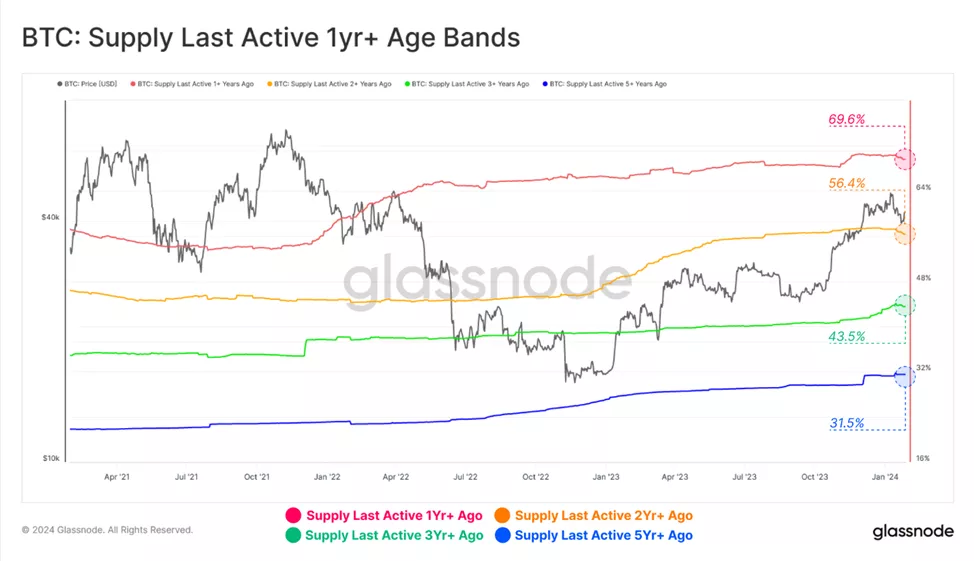

The ETF-induced turbulence did not prompt hodlers to take active measures. Coin sales intensified among holders of coins aged one and two years, while metrics for “older” bitcoins only slightly retreated from ATH.

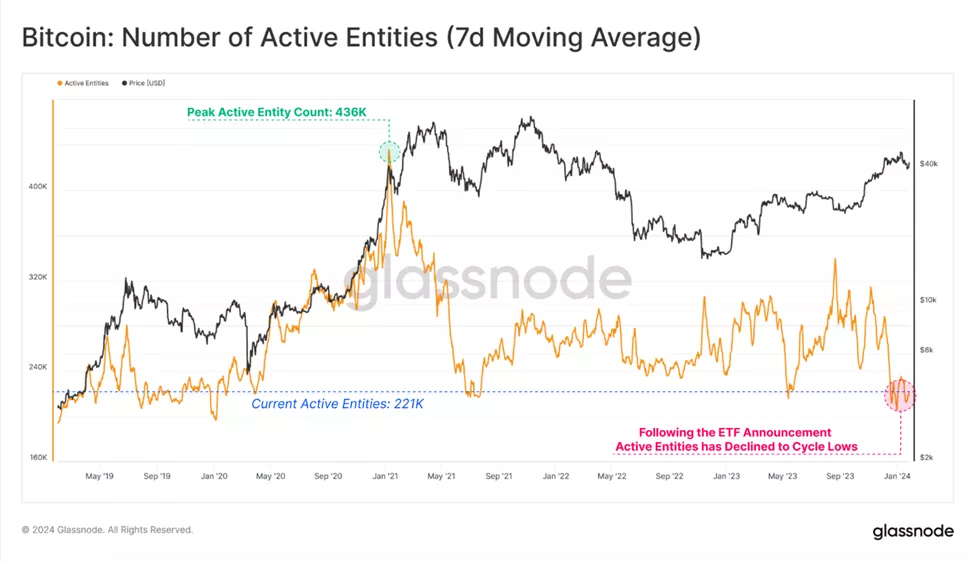

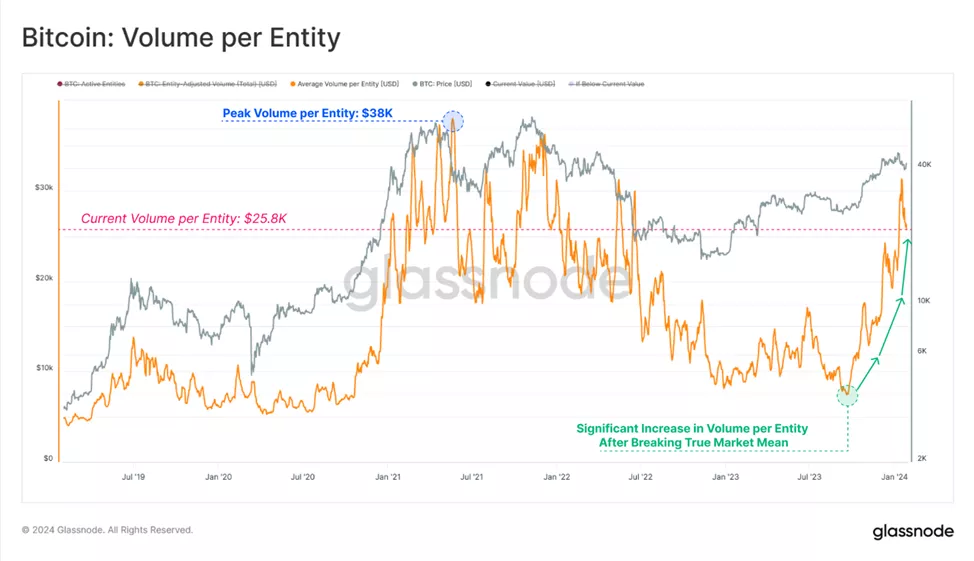

Despite increased volatility, on-chain activity has declined. The daily number of active addresses related to economic entities fell to cyclical lows of 221,000.

“This is largely the result of a surge in activity related to Ordinals and ‘inscriptions’, where many participants are reusing Bitcoin addresses,” explained the specialists.

Daily on-chain transfer volumes remain “extremely high” at $7.7 billion. According to specialists, the discrepancy with “active entities” underscores the increased presence of large organizations in the market. The average transaction volume rose to $26,300 per transaction.

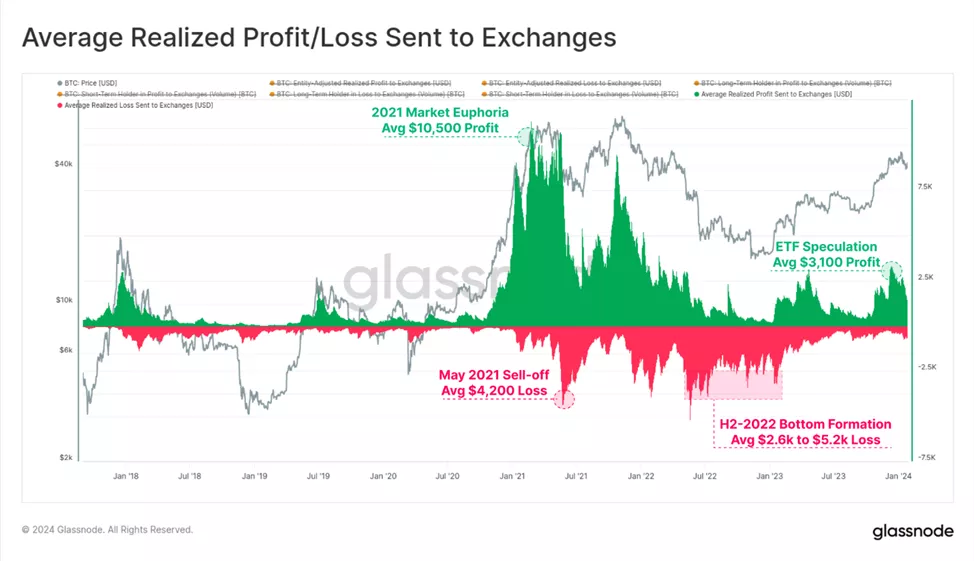

Amid ETF-driven speculation, the metric for coins sent to CEX for profit-taking increased to $3,100 per transaction. This value corresponds to the levels of the peak April rally in 2023, but still falls short of $10,500 during the euphoria of the 2021 bull market.

JPMorgan has suggested Bitcoin may stabilize after the exhaustion of GBTC sales.

Previously, a technical analyst known as Ali illustrated the price patterns of the first cryptocurrency’s last two cycles and suggested a further decline in the coin’s rate. He does not rule out a drop to $32,700.

Before this, former BitMEX CEO Arthur Hayes also stated that in the short term, Bitcoin could fall to $35,000 amid “excessive” inflation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!