Bitcoin’s Return to All-Time High Predicted for March

The active formation of positions in call options with strike prices ranging from $60,000 to $80,000, coupled with frenzied demand for ETFs, could propel Bitcoin to its ATH as early as March, according to a report by QCP Capital.

?Options Vol-cast – 15 Feb 24

1/ #BTC has broken above the 50k level again after more than 2 years. This has been on the back of impressive inflows from the BTC spot #ETFs of about $500-650m a day, which works out to 10-13k BTC bought daily.

— QCP Capital (@QCPCapital) February 15, 2024

“This week alone, market participants spent around $10 million on premiums,” the review states.

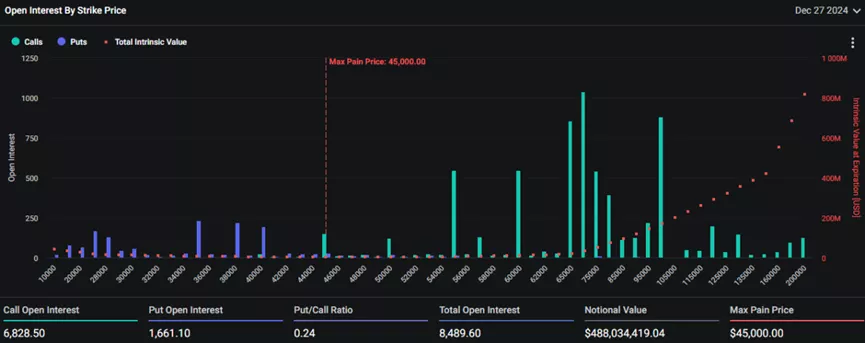

The diagram presented below from The Block highlights a $100,000 strike for December Bitcoin options.

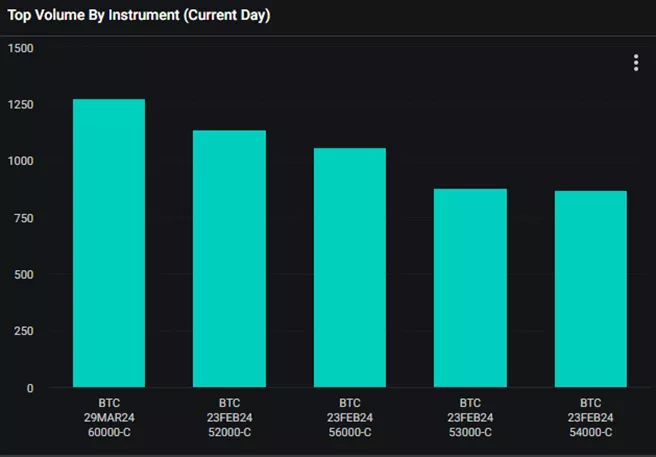

Among upcoming expirations, the largest open interest volume is in calls with a strike price of $60,000 maturing at the end of March, noted the publication. According to Deribit, this figure is equivalent to 1,273 contracts (~$67 million).

QCP Capital explained the options market dynamics and the breakthrough above $50,000 by increased demand for spot ETFs.

“We expect the trend to continue due to the flow of global liquidity into instruments. With companies like Fidelity allocating 1-3% of a universal conservative ETF to digital gold, this class of crypto assets will now be in the spotlight for investors,” the experts wrote.

Analysts suggested Bitcoin’s price could rise to its all-time high next month.

Their colleagues at CryptoQuant share this optimistic view, albeit in the medium term. They pointed to a target of $150,000, suggesting the market will choose between two possible scenarios.

$BTC has two Paths. Both Lead to $150k

“I spent over 100 hours diving through on-chain data to find out. Here’s what I found…” – By @onchain_edge

Full post ?https://t.co/MZZS2f0iQD pic.twitter.com/UZBXneAtIt

— CryptoQuant.com (@cryptoquant_com) February 15, 2024

- Scenario A suggests a repeat of the 2019 situation, where the “loss-making” supply reaches a bottom at 16% and then rises again. This would lead to a drop to the realized price ($23,000) over the next six months, followed by a transition to Scenario B.

- Scenario B involves reducing the share of unrealized losses to 3%, achievable with a rally to $150,000.

Experts believe the second scenario is more likely, citing the potential influx of “new money” and the absence of a peak in open interest in derivatives.

They advised patience, cautioning against opening shorts or using leverage.

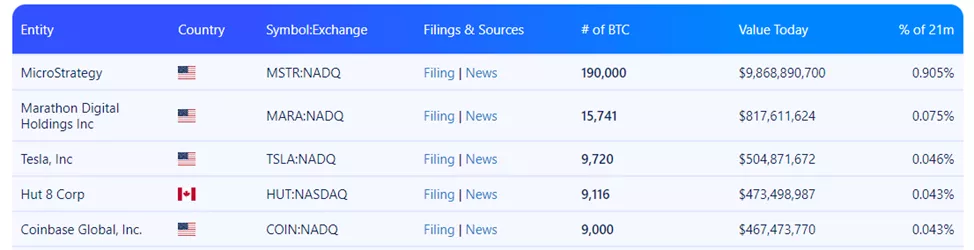

This advice aligns with MicroStrategy’s Bitcoin strategy. The company’s 190,000 BTC holdings are nearing a valuation of $10 billion.

Michael Saylor, founder of MicroStrategy, has highlighted the unmet investor demand for digital gold.

On February 12, early Bitcoin adopter Tuur Demeester suggested that the first cryptocurrency could reach $600,000 by 2026.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!