Bitfinex Analysts Anticipate Bitcoin Price Consolidation Phase

Analysts at Bitfinex have suggested that the bitcoin market has entered a consolidation phase, characterized by gradual sales from long-term holders (LTH).

Last week, we saw a sharp turn in #Bitcoin‘s fortunes with significant net outflows from Spot Bitcoin ETFs, ending a 20-day inflow streak.

This is reminiscent of the outflows we saw at the end of April.

What’s driving this shift? ?https://t.co/NUj3OAKsrl pic.twitter.com/D1x9R5HnEP— Bitfinex (@bitfinex) June 17, 2024

According to experts, this group, along with whales, has exerted the most pressure on the price of the leading cryptocurrency. Collectively, they remain the largest holders of bitcoin, exerting more influence on prices than ETF outflows, specialists noted.

“Historically, LTH tend to gradually sell their assets during bull markets, especially when a consolidation phase occurs, as we are witnessing now,” they wrote.

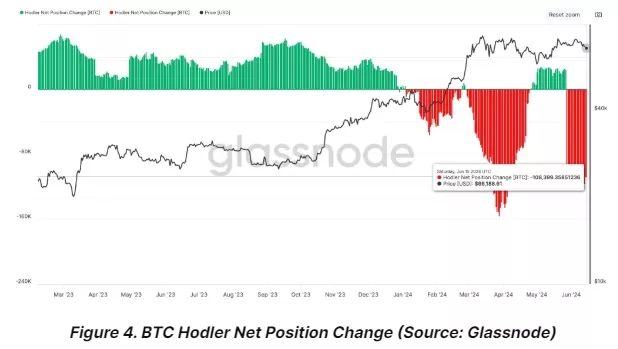

Analysts pointed out that there has been a consistently negative change in the positions of long-term holders over the past nine days. However, the metric values have not yet reached those of March, when another peak was achieved, they added.

Experts also noted the inflow of cryptocurrency to exchanges from whale wallets, which typically precedes sales.

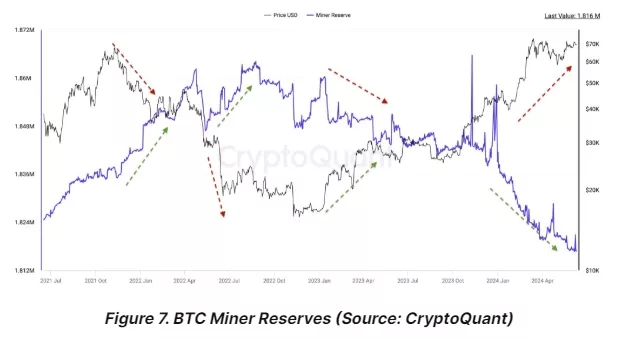

Additional pressure on digital gold is exerted by miners, whose bitcoin reserves have been declining since March. Analysts at Bitfinex suggested that before the April halving, amid rising prices, this was driven by the need for investments in upgrading equipment.

However, the continuation of this trend after the block reward reduction and its sharp acceleration last week suggest that cryptocurrency miners are compelled to sell reserves to maintain operational efficiency.

Meanwhile, analysts noted that miners’ reserves have reached a four-year low, and their market influence is diminishing.

Earlier, on-chain analyst Ali Martinez expressed confidence that the halving triggered a “wave of capitulations” among miners.

Charles Edwards, founder of Capriole Investments, also believes that the “Difficulty Ribbon” indicator points to this.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!