Bitfinex Analysts Forecast Bitcoin to Reach $125,000 in July

In July, Bitcoin could rise to the range of $120,000–125,000 if a weak US employment report prompts the Fed to ease monetary policy and lower the key rate. This is reported by The Block, citing Bitfinex experts.

Stronger-than-expected figures could lead to a drop in quotes to the $95,000 level.

Bitfinex analysts anticipate signs of a slowdown in the labor market in the fresh employment report, which will be published on June 6. They forecast that the number of new non-farm jobs will range from 125,000 to 130,000, significantly lower than the April figure of 177,000.

Unemployment is expected to remain at 4.2%, while average hourly wages are projected to increase by 0.2–0.3% compared to the previous month.

Weak labor market data could bolster the narrative of slowing inflation and hasten the Fed’s rate cuts. In turn, this would support investor interest in risky assets like Bitcoin, according to Bitfinex.

“If the leading cryptocurrency holds above $105,000, it could target $120,000-150,000 in June […]. Although the labor market is just one aspect, it could contribute to a ‘domino effect’ in a chain of factors that might prompt the Fed to ease monetary policy more swiftly,” the experts explained.

A more positive report could delay rate cuts, strengthen the dollar, and increase pressure on Bitcoin. In such a scenario, the $95,000-97,000 range would serve as a local bottom — accumulation is already noticeable there, the company noted.

“The report’s results will be important for short-term traders, but in a broader perspective, it is just part of the overall picture,” added Bitfinex.

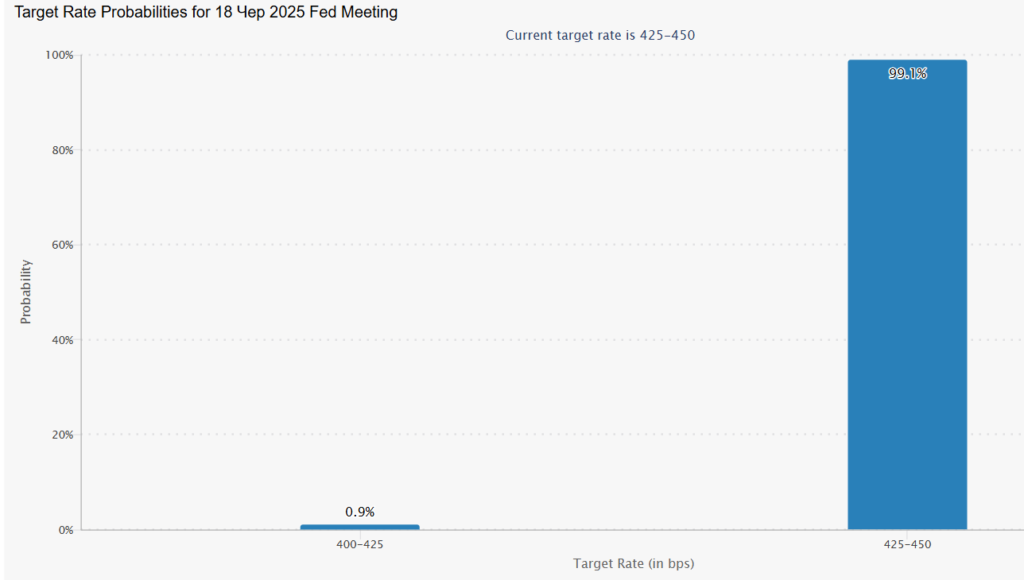

The market expects the rate to remain in the current range of 4.25–4.5% at least until the end of July. Most traders do not anticipate a reduction until September.

Bearish Signals

Leading BRN analyst Valentin Fournier has taken a more cautious stance. He urged market participants to adopt a defensive strategy amid strengthening bearish signals.

Among the concerning indicators: a decrease in inflows to ETFs, weakening market momentum, and an increase in cryptocurrency IPOs. The latter may indicate investors’ desire to lock in profits in the short term.

“Following the news of the Pump.fun token sale, Circle announced a $1 billion stock sale, which raised its valuation to $6.9 billion. Meanwhile, Kraken is reportedly planning an IPO later this year,” Fournier said during a conversation with the publication.

In his view, crypto companies see the current market situation as a window of opportunity to capitalize on high valuations. In turn, this may suggest expectations of slowing growth or price declines “among insiders.”

As reported, CryptoQuant analysts suggested a return of the leading cryptocurrency’s rate to the $96,700 level, which corresponds to the average purchase price of short-term investors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!