BitGo Debuts on NYSE with $2 Billion Valuation and Investment from Changpeng Zhao’s Fund

Custodian backed by Changpeng Zhao's investment firm YZi Lab.

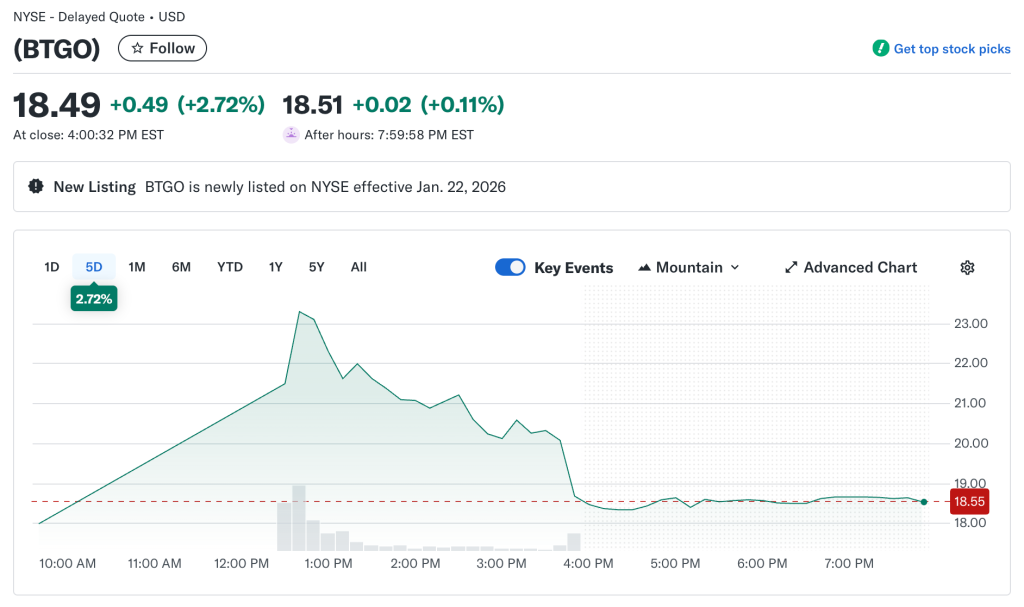

On January 22, crypto custodian BitGo made its debut on the New York Stock Exchange (NYSE) under the ticker BTGO.

It’s official! pic.twitter.com/RLKYqyNRfV

— BitGo (@BitGo) January 22, 2026

In its IPO, the company issued 11,821,595 Class A shares. Of this amount, BitGo sold over 11 million shares, while the remaining 795,000 were sold by existing shareholders. Goldman Sachs and Citigroup were the lead underwriters.

BitGo also granted underwriters a 30-day option to purchase an additional 1.77 million shares.

The opening price was $18. After trading began, the price quickly surged by 36% to reach an intraday high of $24.5.

However, the gains could not be sustained, and the stock gradually declined by the end of the session. The trading day closed at $18.49, marking a daily increase of only 2.7% from the offering price.

Through the offering, BitGo raised approximately $212.8 million with a valuation of $2 billion.

The company filed with the SEC for an IPO in September. At that time, the custodian reported holding assets worth approximately $90.3 billion.

The custodian’s client base includes about 4,600 organizations and high-net-worth individuals, as well as over 1.1 million end users.

Support

Alongside its market debut, BitGo struck a deal with investment firm YZi Lab, affiliated with former Binance chief Changpeng Zhao. The amount invested by the new strategic investor remains undisclosed.

— YZi Labs (@yzilabs) January 23, 2026

Representatives from YZi Labs explained their decision, expressing confidence that regulated crypto infrastructure in the U.S. will play a “key role” amid the growing influx of institutional capital into digital assets.

“BitGo’s impeccable reputation in security, maintained for over a decade without a single breach, is direct evidence of the strong technical foundation laid by its founder and CEO Mike Belshe,” noted YZi Labs head Ella Zhang.

Belshe described the fund’s support as “more than just money.” According to him, the strategic investment reflects a shared belief in the industry’s future.

Ledger’s IPO Plans

According to the Financial Times, Ledger plans an IPO on the NYSE, which could value the company at $4 billion.

Informed sources revealed that the firm is working on a deal with Goldman Sachs, Jefferies, and Barclays. The initial offering could occur by the end of 2026.

Investor interest in the sector has notably increased following Donald Trump’s return to the U.S. presidency in 2024. The new administration has taken a proactive stance, supporting the digital asset industry and including cryptocurrency development among national strategic priorities.

In 2025, exchanges Gemini and Bullish, as well as issuer Circle, went public. The trading platform Kraken is considering an IPO in the first quarter of 2026.

Back in November, Ripple President Monica Long denied plans for a fintech company’s initial public offering.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!