BitMEX under fire, Ethereum’s new roadmap, and other events of the week

As the week draws to a close, we recall U.S. authorities’ accusations against the bitcoin-derivative exchange BitMEX, the ongoing KuCoin hack investigation, Vitalik Buterin’s new Ethereum roadmap, and other key events.

Bitcoin price

Over the past seven days, the price of the first cryptocurrency edged down slightly, by about 0.5%.

The week began with two failed attempts to breach the $11,000 mark, but after the high-profile accusations against BitMEX were announced, the price plunged, breaking below $10,400 on Thursday and Friday.

Nevertheless, by the end of the period Bitcoin recovered somewhat and at the time of publication was trading around $10,600 — roughly where it stood seven days earlier. Market capitalization: $196.3 billion (57.9% of the total market cap).

Source: hourly BTC/USD chart from Bitstamp on TradingView.

Bitcoin registered the longest on-record run of days with a daily close above $10,000. The metric surpassed a three-year-old record.

Moreover, the supply of ‘free’ bitcoins is tightening — the number of coins mined has surpassed the 18.5 million mark. Less than 2.5 million BTC remain mineable, or just under 12% of the total supply.

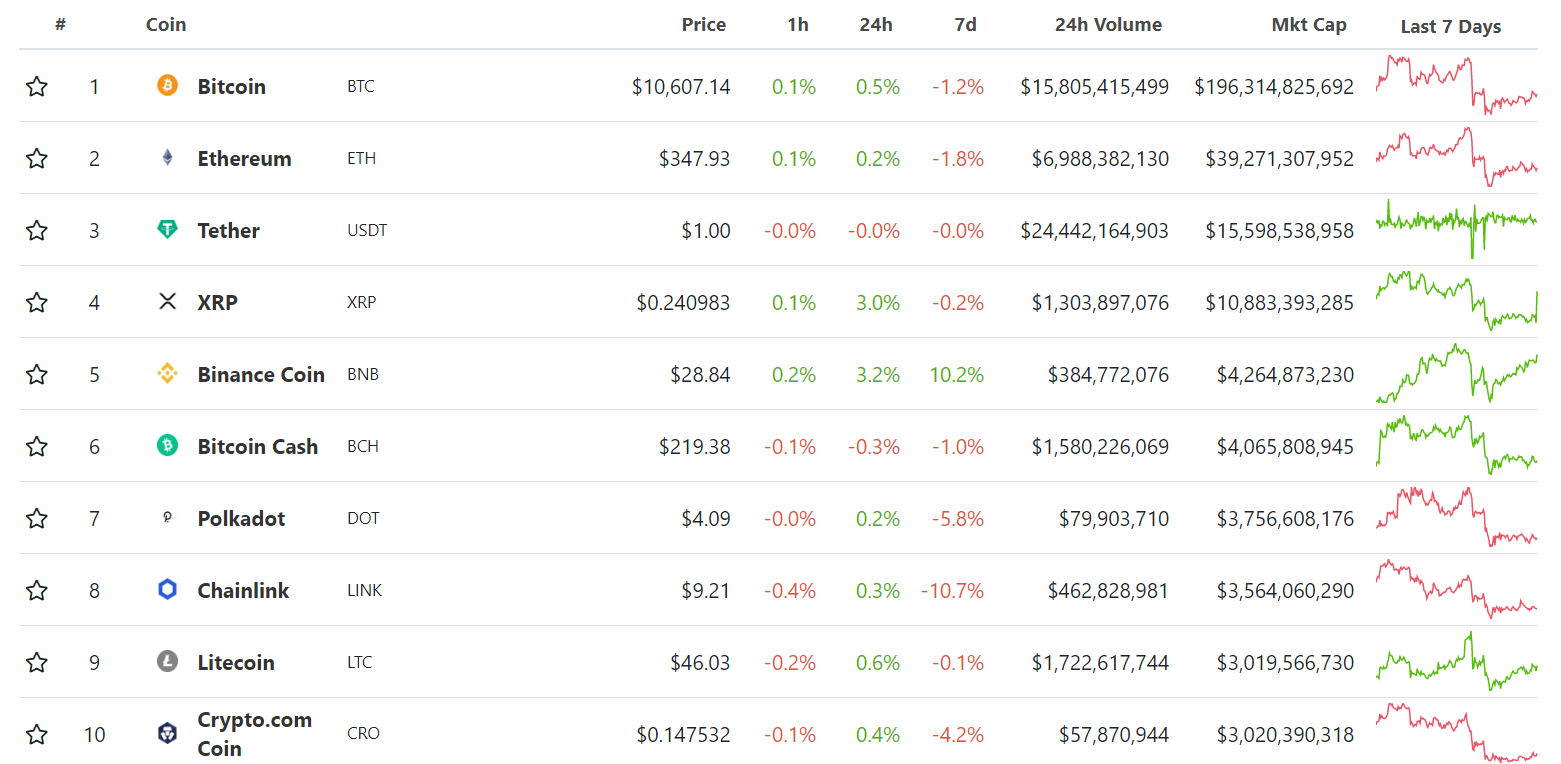

The second-largest cryptocurrency, Ethereum, also slipped slightly and was trading just below $348.

Among the top ten, the biggest gainer this week was Binance Coin (+11%) at $28.84; Litecoin rose 2.3% to $46; Ripple up 0.9% to $0.2409 and Bitcoin Cash to $219. Chainlink fell more than 10% as its price slid to $9.20, dropping to ninth place by market capitalization.

Source: Coingecko.

US authorities move against BitMEX

On Thursday, October 1, it emerged that the U.S. Commodity Futures Trading Commission (CFTC) and the Department of Justice have filed charges against the cryptocurrency derivatives exchange BitMEX and its owners, including co-founder and CEO Arthur Hayes. They are accused of operating an unregistered trading platform and violating Commission rules, including anti-money-laundering and Know Your Customer (KYC) provisions.

In addition to Hayes, the defendants include BitMEX co-founders Ben Delo and Samuel Reed, parent companies HDR Global Trading Limited and 100x Holdings Limited, as well as ABS Global Trading Limited, Shine Effort Inc Limited and HDR Global Services (Bermuda).

Additionally, the U.S. Department of Justice has charged Hayes, Delo, Reed and BitMEX’s head of business development Greg Dwyer with violations of the Bank Secrecy Act.

BitMEX CTO Samuel Reed was arrested that morning in Massachusetts, where he will appear in court. Hayes, Delo and Dwyer remain at large.

“We contend that the four defendants, through the trading platform BitMEX owned by their company, knowingly violated the Bank Secrecy Act, evading U.S. anti-money-laundering requirements,” said William Sweeney, the FBI’s deputy director, in a statement.

In BitMEX, the prosecution’s case is contested, and the exchange says it has always complied with U.S. law in line with regulator guidance.

The charges were explosive, triggering not just a drop in Bitcoin to around $10,500 but also a significant outflow of BTC from the exchange, which, despite the situation, continued to fulfill its withdrawal obligations.

According to Glassnode, as of October 1 BitMEX held about 170,000 BTC (~$1.8 billion), or about 1% of the active supply. However, in the first 24 hours after the charges were filed, roughly 40,000 BTC were withdrawn.

#Bitcoin outflows from BitMEX addresses continue – our data shows that in the past hour another 7.200 BTC were withdrawn.

The total amount pulled from the exchange over the past day is now nearly 40,000 $BTC.

Live chart: https://t.co/jlunNHscY3 pic.twitter.com/i0jtdjBtqG

— glassnode (@glassnode) October 2, 2020

Additionally, open interest (OI) plunged — according to Arcane Research, it fell to 61,869 BTC within hours, a level similar to April this year. By morning of October 2, the depth of the drop exceeded 16%.

Update:

The open interest on the BitMEX Bitcoin perp has fell further throughout the night, and reached 45,112 BTC at 07:00 (GMT+2).

The open interest (measured in BTC) is currently down 16% since the CFTC announcement. pic.twitter.com/GTnI291Enu

— Arcane Research (@ArcaneResearch) October 2, 2020

The BitMEX saga continues to be widely debated in the community, and there is little doubt it will unfold further soon.

According to EXANTE co-founder Anatoly Knyazev, the charges against the exchange signal a message from US authorities that the crypto business must operate under the rules of the existing financial system.

“US authorities have made it clear that the entire cryptocurrency sector, including its gray areas, is under their control and will henceforth operate under their rules,” said Knyazev.

He says that compared with the BitMEX case, New York prosecutors’ case against Bitfinex and Tether “looks liberal.” Yet following the BitMEX accusations, risks for Tether holders rose substantially.

The expert noted that after the BitMEX situation, participants in crypto exchanges will have to either comply with regulations or move into DeFi. However, the DeFi space is not entirely immune to potential scrutiny from American regulators.

Adam Cochran agrees, a partner at Cinneamhain Ventures. In his view, the U.S. authorities’ charges against BitMEX could be a bad omen for the DeFi sector. He also doubts that the decentralized nature of DeFi services frees participants from liability. In Cochran’s words, this myth has been fueled by a narrow understanding of the limits facing exchange regulators.

DeFi: a practical guide

29 September, ForkLog Live hosted an online conference titled “DeFi: a practical guide.” Nine speakers discussed trends and challenges in the decentralized finance market and debated the prospects for its regulatory framework.

A concise summary of the conference speakers can be found in ForkLog’s special feature ForkLog.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full feed of news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!