Bittrex Restrictions, Bitcoin Smart Contract, Sale of a $700 Million Wallet, and Other Events

As the week comes to a close, we recall Uniswap’s liquidity loss caused by the migration of assets into its fork, the impending release of 5-nanometer mining chips, a serious bug in Bitcoin Core, and other developments.

Bitcoin price again stuck in a sideways range

During the past week, the top cryptocurrency traded in a relatively narrow range—from $9,825 to $10,576.

Hourly BTC/USD chart for Bitstamp from TradingView.

According to Whalemap, near $11,288 and $10,570 concentrated are clusters of “unspent bitcoins” stored on whale wallets.

As seen on the chart, there were no strong moves during the week until the price approached the $10,570 resistance level a few hours ago.

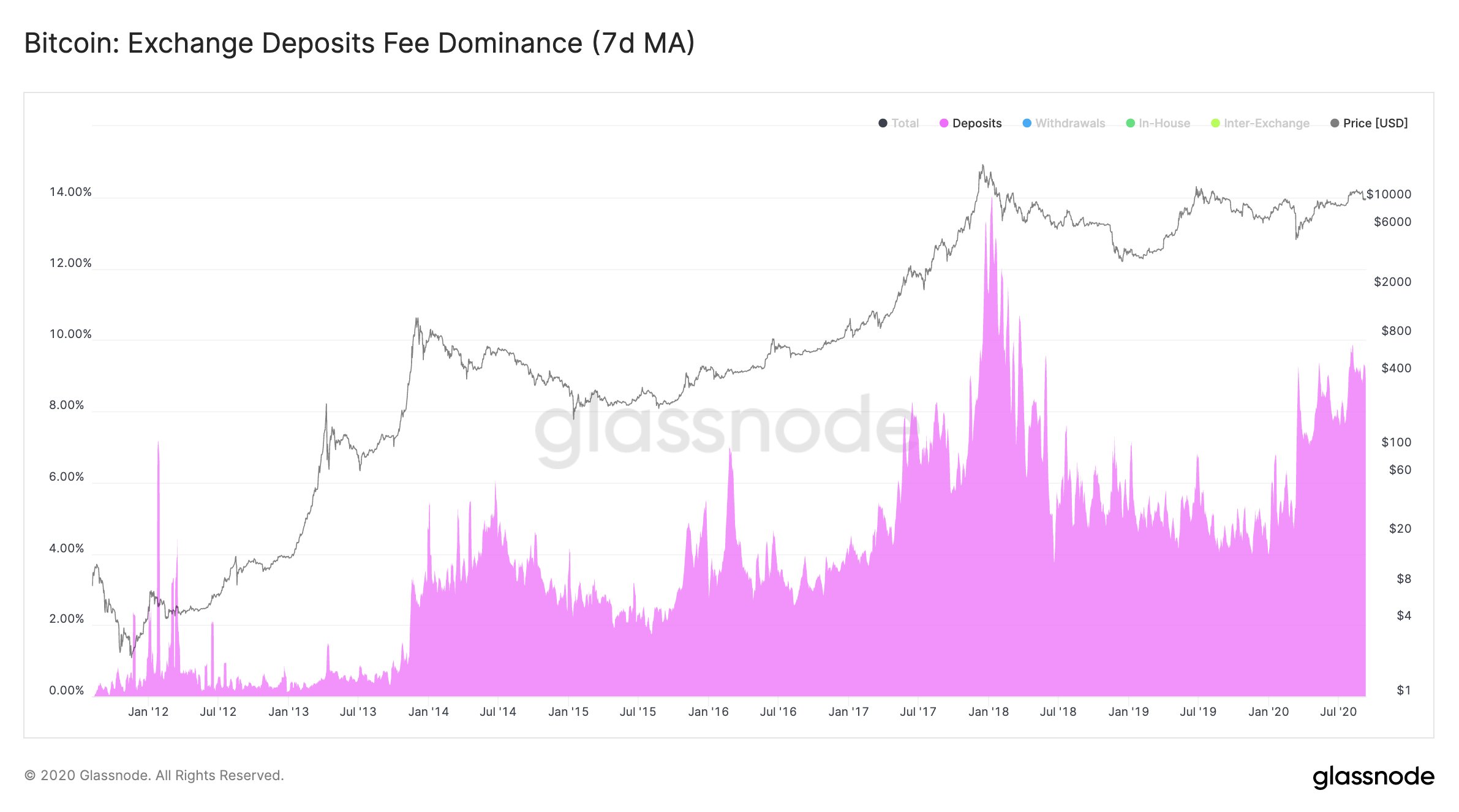

On-chain metrics also point to a high likelihood of a bearish scenario for Bitcoin. For example, the total fees paid to miners for deposits on exchanges rose to end-2017 levels, actively reducing positions among large CME players in recent times.

Data: Glassnode.

There are also positive fundamentals — for example, the Bitcoin hash rate is rising.

This may indicate market participants’ confidence in Bitcoin’s future prospects, including potential price appreciation and growing investment in mining hardware.

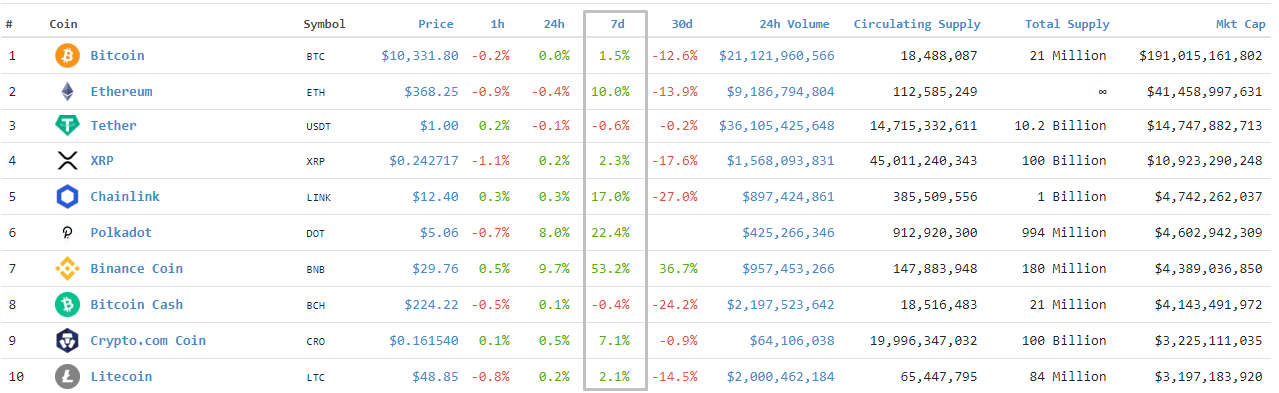

At week’s end, the top-10 crypto assets by market capitalization look like this:

Data: CoinGecko.

Over the past seven days, Binance Coin (+53.2%), Polkadot (+22.4%) and Chainlink (+17%) surged. Ethereum rose 10%, and Bitcoin 1.5%.

Ukraine and Belarus users unable to access the Bittrex exchange

Bittrex announced the cessation of services for users in Ukraine, Belarus and several other countries. The exchange explained its decision citing regulatory frameworks in certain jurisdictions.

“Bittrex Global is proud to be the safest place to trade crypto assets, but also the most tightly regulated. Given this and the regulatory frameworks that exist in some jurisdictions, our lawyers have instructed us that in the short term we will be forced to suspend services in several countries, including Ukraine, Belarus, Burundi, Mali, Myanmar, Nicaragua and Panama,” explained the exchange representatives.

The Bittrex team stressed that users must withdraw all funds by September 24.

Ukraine and Russia lead Chainalysis cryptocurrency adoption index

Chainalysis researchers highlighted in the study the widespread adoption of digital assets by ordinary users.

In calculating the index, the per capita value of remitted digital assets, coin balances on accounts, and the volume of retail and P2P transactions under $10,000, calculated at purchasing power parity, were considered. Venezuela rounds out the top three.

Data: Chainalysis.

Developer reveals serious Bitcoin Core bug discovered back in 2018

Storj decentralized storage protocol developer Braydon Fuller said of a previously unknown bug in Bitcoin Core software. The vulnerability could have allowed attackers to steal funds, delay payments and split the blockchain into competing chains.

According to Handshake protocol developer Javed Khan, the “remote nodes can fill up with invalid transactions” that cannot be purged from memory. An accumulation of stale data can lead to “uncontrolled resource consumption” and ultimately bring a node down.

The Handshake developer added that the vulnerability could have allowed attackers to steal funds from nodes with open connections to the Lightning Network.

As far as is known, no one exploited the bug.

The Bitcoin network hosts the first smart contract using Discreet Log Contracts

Developers Nicolas Dorier and Chris Stewart placed bets using Discreet Log Contracts (DLC) — the first, they say, smart contract on the Bitcoin network.

If Donald Trump wins the U.S. presidential election, the 1 BTC payout will go to Dorier. If Joe Biden takes the post, the money goes to his opponent. Under the terms of the deal, a victory by a third candidate returns the bets to the participants.

Journalist Marty Bent called the appearance of the first DLC “a very important moment in Bitcoin’s history.” He added that wallet software will soon be released that will allow anyone to create contracts based on this technology.

The idea for contracts of this type belongs to Tadge Dryja, one of the leading developers of the Lightning Network.

A wallet containing 69,370 BTC put up for sale

The cryptocurrency wallet holding 69,370 BTC ($716 million at the time of writing) appeared for sale on the hacker forum RaidForums.

The wallet ranks seventh globally by the amount of bitcoins. Hackers have been trying to crack it for years without success and have previously listed it for sale.

However, there is no guarantee that the wallet.dat file actually contains bitcoins. According to Wallet Recovery Services chief Dave Bitcoin, hackers could have forged the wallet so that it stored the address but possessed a different private key.

Other experts doubt that the wallet can be cracked at all. They speculate the wallet.dat file is encrypted with AES-256-CBC and SHA-512, which would require an enormous amount of time to crack.

French network of 15,000 restaurants starts accepting Bitcoin

The Just Eat restaurant delivery network in France began accepting Bitcoin. The option appeared among the order payment options.

The payments provider is the cryptocurrency processing service BitPay.

Uniswap loses 70% of liquidity due to $2 billion migration to SushiSwap

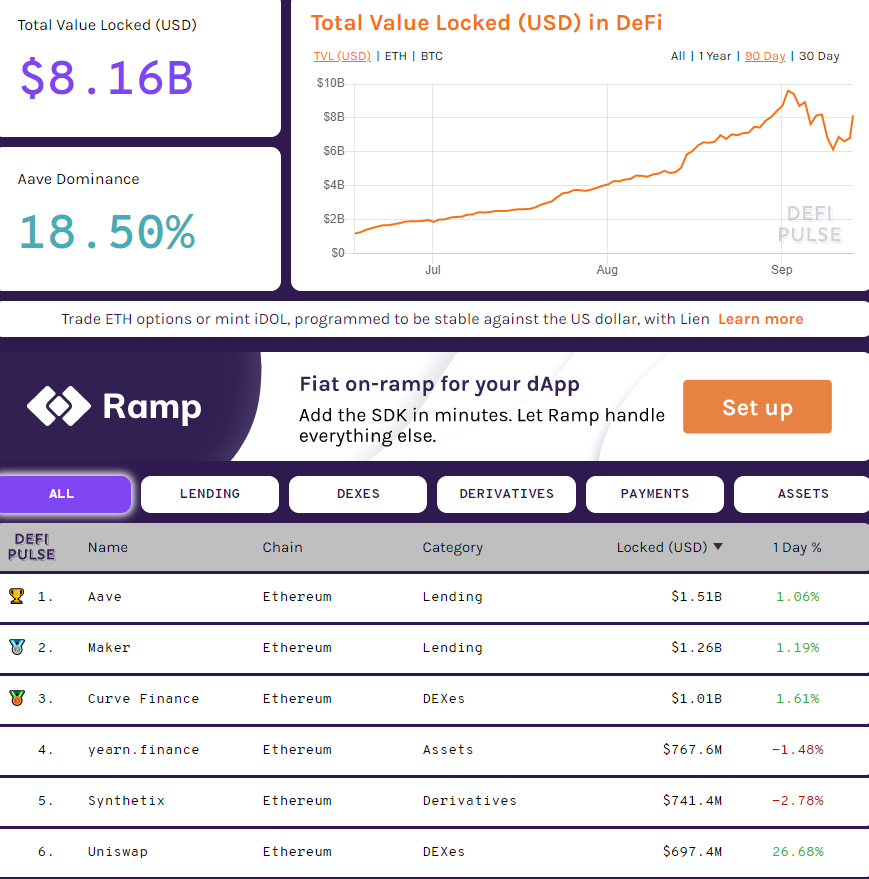

Leading decentralized exchange Uniswap lost more than 70% of its liquidity as assets migrated to its fork SushiSwap.

Within 48 hours, Uniswap’s liquidity shrank by nearly $2 billion. It now ranks sixth in the DeFi Pulse index.

Total value locked in DeFi assets amounts to $8.16 billion. Data: DeFi Pulse.

Before the migration, Uniswap led the value of Ethereum assets locked in the DeFi sector for a time.

Last weekend, an anonymous SushiSwap developer sold half the funds from the developer fund, breaking his promise. But on the other hand, “Chef Nomi” returned 38,000 ETH (about $14 million at the time of the transaction) to the fund, apologizing to the crypto community for his decision.

Micree Zhang announced sales of 5-nanometer miners

One of Bitmain’s founders, Micree Zhang announced the launch of miners based on 5-nanometer chips. The first shipment on a 100% prepaid basis is planned for January 2021.

Bitmain’s other co-founder, Jihan Wu, said that the 5nm chips are test samples, whose use may entail potential problems. In his view, Zhang is trying to fix his financial situation at the expense of users.

According to Chinese sources, leading ASIC miner manufacturers MicroBT, Canaan and Ebang have sold off their inventories this year, and Bitmain is experiencing supply difficulties due to founder disputes. A potential shortage of Bitcoin mining equipment may emerge in the market.

What else to read and watch?

This week, ForkLog published the DeFi Bulletin — a digest of the main news from the rapidly growing decentralized finance sector. The piece also includes information on the value of locked assets, DeFi token market caps, and DEX turnover.

In the “Explain the Crypto” segment, Max Bit spoke with Kuna founder Mikhail Chobanian about crypto scams, touching on DeFi and other timely topics.

Follow ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!