Bitwise and Grayscale Predict Bitcoin’s New ATH in 2026

Bitwise and Grayscale predict bitcoin's new peak by 2026.

Bitwise and Grayscale have released forecasts suggesting that the leading cryptocurrency will reach a new price record in 2026. Analysts agree that the traditional bitcoin cycle model is outdated.

Bitwise Forecast

Matt Hougan, Chief Investment Officer at the asset management firm, emphasized that three key drivers of bitcoin have lost their relevance:

- Halving: the impact of each subsequent block reward halving is weaker than the last;

- Interest rates: from 2018 to 2022, they rose and restrained the market, but a decline is expected in 2026;

- Leverage: after record liquidations in October, leverage decreased, and improved regulatory conditions minimize the risk of large-scale crises.

New growth factors for digital gold have emerged, the main one being institutional capital. Bitwise anticipates that inflows into spot bitcoin-ETFs will strengthen next year as major players like Morgan Stanley, Wells Fargo, and Merrill Lynch join the sector.

“Simultaneously, the crypto industry will begin to reap the benefits of digital asset-friendly regulatory shifts following the [U.S. presidential] elections in 2024, and Wall Street and fintech companies will seriously engage in blockchain adoption,” the expert added.

According to him, all this will lead bitcoin to new historical highs, marking the end of the era of four-year cycles.

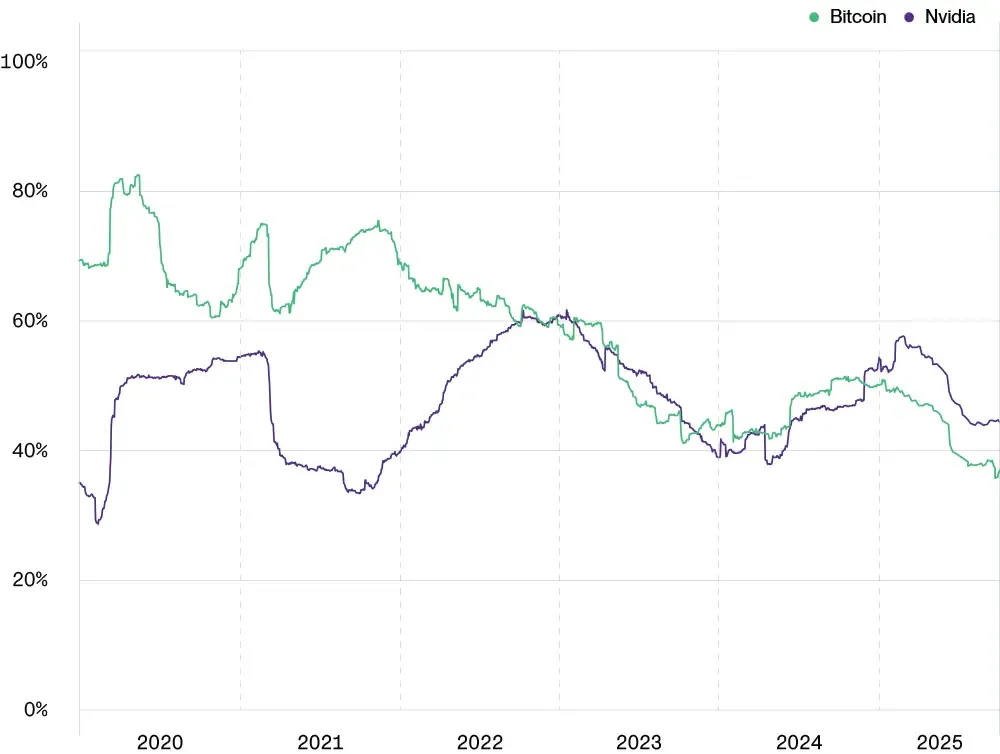

Hougan also noted that in 2025, digital gold was less volatile than Nvidia stocks. Bitwise expects this trend to continue.

Another forecast touched on the asset’s correlation with the stock market, which experts believe will be even lower in 2026.

“We believe that the crypto market will be driven by factors specific to it: regulatory progress and institutional adoption, while the stock market may struggle with concerns over inflated valuations and short-term economic growth rates,” Bitwise stated.

Grayscale Forecast

Experts at the company believe that bitcoin will reach a new all-time high in the first half of next year. They cited the following main reasons:

- Increasing global demand for alternative stores of value. The flagship of the crypto market and Ethereum serve as digital scarce commodities—safe-haven assets in an era of rising sovereign debts and inflationary risks threatening traditional currencies. As these macro threats intensify, interest in crypto assets in investment portfolios will only grow.

- Improvement in the regulatory environment in the U.S. This process will culminate in bipartisan legislation on market structure (CLARITY Act), expected in 2026. It will firmly establish cryptocurrencies within the U.S. legal framework and open the floodgates for institutional capital.

Grayscale emphasized that their forecast coincides with the end of bitcoin’s four-year cycle.

Experts also highlighted ten major investment themes for the next year. Among them: the expansion of the stablecoin market thanks to the GENIUS Act, reaching a tipping point in tokenization, and the growth of DeFi led by lending markets.

“In 2026, we expect to see practical results from the adoption of ‘stablecoins’: from integration into cross-border payments and use as collateral on derivatives exchanges to appearing on corporate balance sheets and as an alternative to credit cards in online shopping,” the analysts wrote.

They expressed doubt about the significant impact of quantum computing and crypto treasuries (DAT).

“Research and preparation in the field of post-quantum cryptography will continue, but this issue is unlikely to affect valuations next year. […] Despite media attention, we believe that DAT will not become a major factor in market fluctuations,” the report states.

Earlier, experts from the cryptocurrency division of a16z crypto identified 17 key theses that will shape the near future of cryptocurrencies and related technologies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!