Bitwise CIO says the ‘full‑blown crypto winter’ is nearing its end

Bitwise CIO Matt Hougan says crypto winter is nearing its end.

The digital-asset sector is weathering a full-blown “crypto winter in the Leonardo DiCaprio from “The Revenant” style”, not a brief correction. But the current phase is closer to its end than its start, said Bitwise CIO Matt Hougan.

— Matt Hougan (@Matt_Hougan) February 3, 2026

By his estimate, the protracted downturn began in January 2025. But hefty inflows into ETFs and the activity of crypto treasuries, which bought 744,000 BTC (about $75bn) over the year, masked it and cushioned bitcoin’s decline. Without such support, the price of the first cryptocurrency could have fallen by 60%, he said.

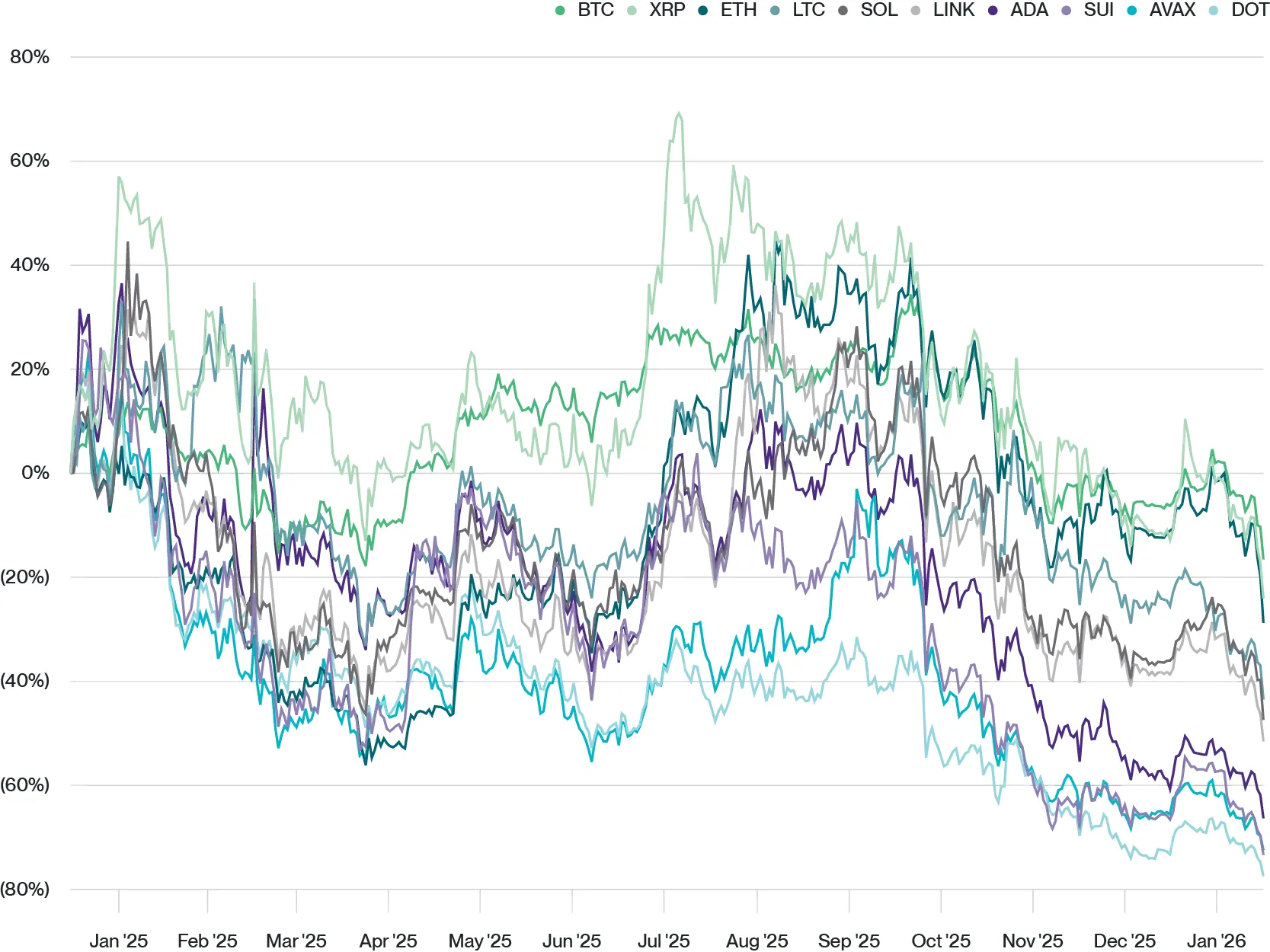

Digital gold has dropped roughly 39% from its October record above $126,000. Ethereum is down 53% from its peak, and many other coins have fallen even further.

Hougan likened the current spell to the winters of 2018 and 2022, when upbeat headlines about adoption and regulation could not overcome bearish investor sentiment.

“Why is the fear and greed index hovering near record fear levels when the new head of the the Fed is a bitcoin fan? Because we are in a crypto winter,” the expert wrote.

Signs the cycle is ending

Hougan noted that crypto winters have historically lasted about 13 months from peak to trough and ended not with a burst of enthusiasm but with seller exhaustion.

In his view, today’s mix of apathy and disappointment resembles prior market bottoms. Despite the broader weakness, the industry continues to advance in key areas: regulation, stablecoins and tokenisation.

“Good news is ignored in bear markets, but it does not disappear. It accumulates as potential energy. And when the clouds lift and sentiment normalises, that stored energy can return with double force,” he noted.

The Bitwise CIO argues the market is closer to recovery than to another plunge. He points to resilient economic growth, progress on the Clarity Act in the US and signs of sovereign bitcoin adoption.

Positive signals

According to Santiment, a mood of FUD has taken over social media after bitcoin fell 16% since late January.

😠 FUD has taken over social media following Bitcoin’s -16% since January 28th. After falling as low as $74.6K, $BTC has rebounded back up to $78.3K as a result of retail selling their bags. This is more proof that markets move the opposite direction of the crowd’s narratives.… pic.twitter.com/NDffU98ZWM

— Santiment (@santimentfeed) February 2, 2026

The flow of negative posts keeps growing; retail pessimism is at its highest since the November correction. Analysts see this as a signal of a near-term recovery:

“In most cases, such periods of strong negativity are followed by a recovery bounce. So far, the current move looks encouragingly similar to the two previous instances after waves of FUD.”

Experts at Swissblock pointed to network-growth and liquidity metrics for the leading cryptocurrency at their lowest since 2021. Back then, similar readings preceded bitcoin’s rally to an all-time high.

The last time Network Growth & Liquidity hit these extreme levels was in 2021, right before BTC’s final push to a new ATH. We are starting to see a recovery in these metrics, signaling a potential final bullish episode.

While the divergence—rising metrics vs. falling… pic.twitter.com/vAHo8OOMZV

— Swissblock (@swissblock__) February 2, 2026

Those numbers are now starting to rise, which “looks like the final signal before a potential push,” the specialists stressed.

“So far we get a strange picture: on-chain metrics are improving while price is falling. That means investors are returning, but only to sell. The main question now is whether they will stay long enough this time for the market to build strength,” they wrote.

Further improvement in these metrics could give bitcoin the nudge it needs to reverse.

Earlier, Galaxy Digital’s head of research Alex Thorn suggested that digital gold could fall to $56,000.

An analyst going by Brett outlined an even gloomier scenario: he predicted a slump to $40,000 if the 2022 trend repeats.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!