Bitwise Declares Bitcoin’s ‘Silent IPO’ Has Begun

Bitcoin's sideways movement signals a 'silent IPO' phase, says Bitwise CIO.

The current sideways movement of the leading cryptocurrency signals the onset of a ‘silent IPO‘ moment for the asset, according to Matt Hougan, Chief Investment Officer at Bitwise.

He referenced research by macroeconomist Jordy Visser, who examined the reasons behind Bitcoin’s sluggish performance despite significant inflows into ETFs, ‘stunning progress’ in regulation, increasing institutional demand, and more.

According to Visser’s interpretation, a ‘silent IPO’ denotes a quiet period in stock prices lasting 8-16 months, after which the price begins to rise.

‘Sideways movement doesn’t necessarily indicate something is wrong with the company. Often, it occurs when founders and early employees cash out their holdings. Those who took a wild gamble on the startup when it was extremely risky have seen it pay off and are now enjoying 100-fold returns,’ Hougan drew a parallel with Bitcoin.

Hougan believes that only after achieving a certain balance of sales and purchases will the asset resume its growth. However, some market participants misinterpret the situation, panic-selling their positions.

‘Early selling by investors doesn’t mean the end of the asset’s story. It’s just a new phase,’ emphasized the Bitwise CIO.

Unlike traditional companies, which need to maintain stable revenue post-IPO for healthy dynamics, Bitcoin ‘doesn’t need to prove anything,’ noted Hougan.

In his view, after the sell-off by early investors, the sole condition for the first cryptocurrency’s market capitalization to grow from $2.5 trillion to gold’s $25 trillion will be widespread adoption.

‘In the long term, Bitcoin’s decline is a stroke of luck. I see it as an opportunity to buy more coins before they start appreciating again,’ the expert added.

Maturation

As digital gold transitions from early adopters to institutional investors and evolves as a technology, its price is no longer subject to the same existential risks it faced a decade ago, Hougan pointed out.

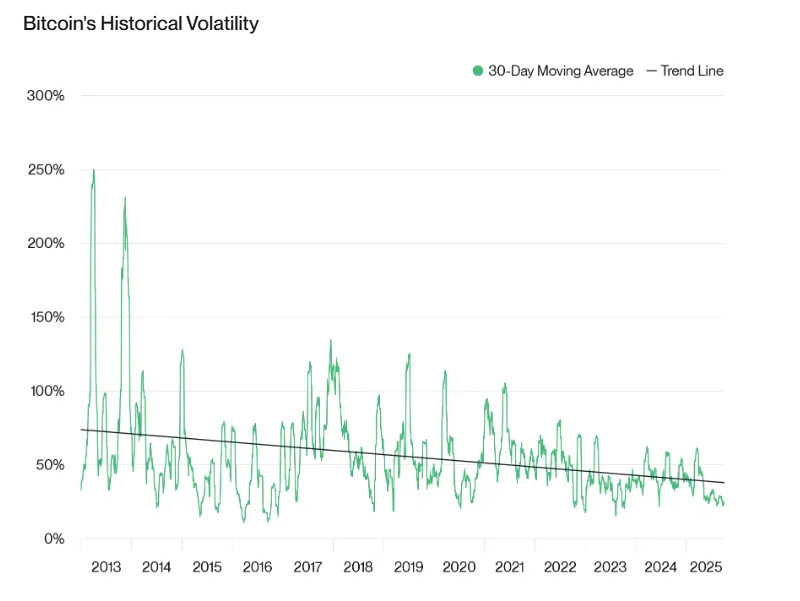

Since the start of trading in spot Bitcoin-ETFs in January 2014, the asset’s volatility has sharply decreased. However, this has also led to a drop in returns.

Nonetheless, lower volatility means increased security as a long-term investment.

‘The days of 1% Bitcoin allocations [in portfolios] are over. Investors should increasingly consider 5% as a starting point,’ he concluded.

Experts have considered the correction of the first cryptocurrency below $100,000 to be quite moderate in the context of the current cycle. The price drop aligns well with historical patterns.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!