Bitwise Identifies the Next Major Narrative in the Crypto Market

'Mega-apps' have surpassed 'mega-protocols' in popularity.

‘Mega-apps’ could become the dominant theme in the crypto industry in the coming months, according to Bitwise’s Chief Investment Officer, Matt Hougan.

Just read through 10 research reports and crypto newsletters. My big takeaway: All the cool kids are talking about the “fat app” thesis. Feels like that could be a dominant theme in the coming months.

— Matt Hougan (@Matt_Hougan) September 10, 2025

“Just read 10 research reports on the crypto market. Main takeaway: all advanced investors are discussing the ‘mega-apps’ theory,” he noted.

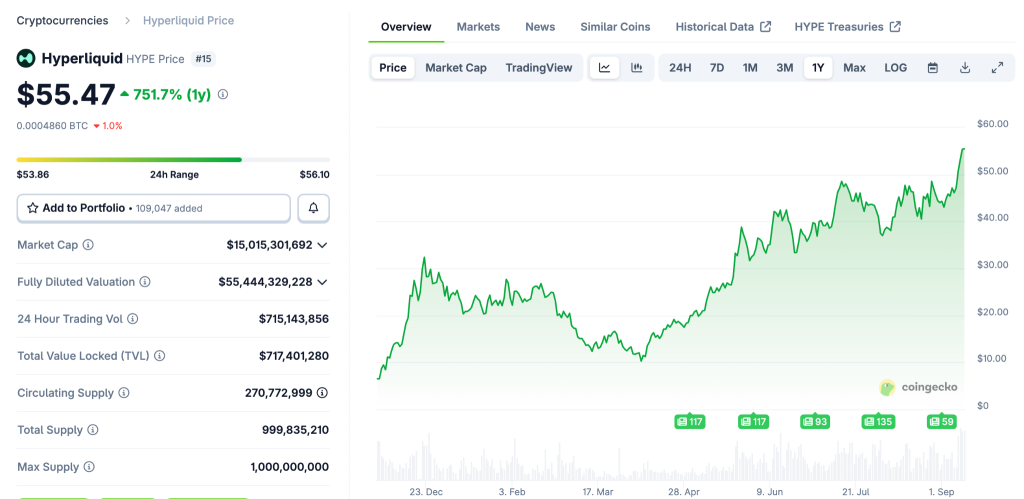

Starkiller Capital confirmed the trend’s relevance with real data: over the past year, the SOL/BTC ratio has decreased by 16.11%, while application tokens like Hyperliquid have shown significant growth.

“The most explosive growth is shown by applications, not protocols. A prime example is Hyperliquid. HYPE has become one of the highest-yielding tokens in the crypto market,” experts noted.

What’s the Essence?

The new ‘mega-apps’ theory challenges the idea of ‘mega-protocols’, which was proposed by Joel Monegro in 2016. The latter suggested that the main value would ultimately be concentrated at the base level—blockchains like Ethereum, Solana, or Avalanche, rather than in applications.

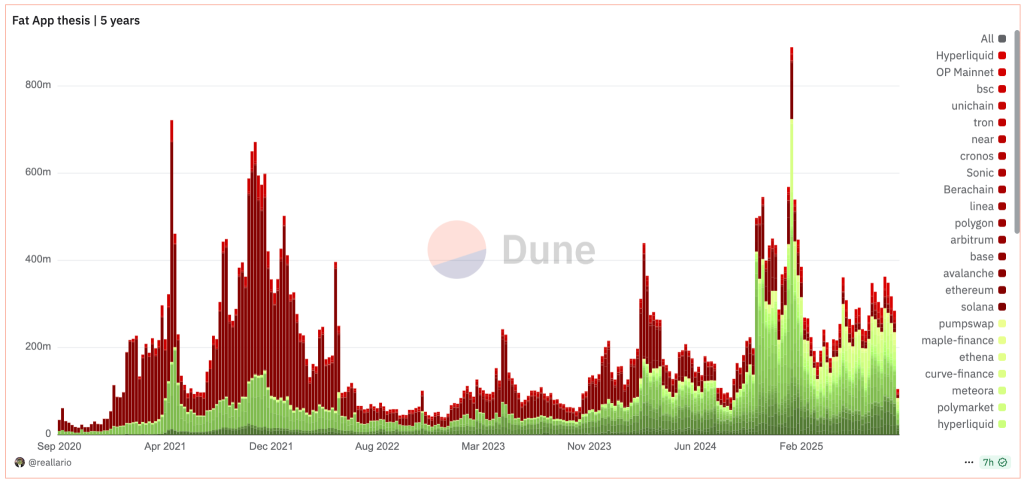

However, as seen in the Dune chart, platforms like Polymarket and PumpSwap have gained more attention in recent years.

The ‘mega-protocols’ theory has been a subject of debate. In 2021, Arca’s Chief Investment Officer Jeff Dorman wrote that it had not been confirmed. According to him, the reason lies in retail investors perceiving L1 blockchains as a simple index asset, while venture funds focus on larger market opportunities.

“Venture funds still define cryptocurrency investments at early stages. They focus on market potential rather than financial valuations, seeking what ‘could be’ rather than what ‘already is’,” he clarified.

In February this year, Dorman stated that the ‘mega-protocols’ theory had caused significant damage to the crypto industry.

5) Fat protocol thesis has done major damage to crypto. It’s nonsense, it causes every app to try to become an L1, it drives all VC dollars to L1s, & it makes dead L1s worth $1 bn+

A few L1s will win, but none will be worth more than the sum of the apps.https://t.co/yEln7hy1fD

— Jeff Dorman (@jdorman81) February 27, 2025

“It’s absurd. It causes every app to try to become a first-level blockchain, all venture funds go to L1, and non-functioning projects are valued at billions of dollars,” he wrote.

Ongoing Disagreements

According to Dorman, only a few L1 networks will remain, and their value will not exceed the combined figure of all applications, he emphasized.

However, Hougan does not share such a pessimistic view regarding first-level blockchains.

“In my view, major L1s are in a winning position for the upcoming year. But Starkiller Capital’s arguments are justified and definitely worth considering,” he noted.

Nevertheless, the expert acknowledged that the HYPE token has become a benchmark example of the new paradigm. According to him, the coin’s growth reflects demand at the application level.

Earlier in September, Hyperliquid set a new record for revenue and trading volume.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!