Bitwise Introduces On-Chain Vaults with 6% Yield

Bitwise launches on-chain vaults with 6% yield in partnership with Morpho.

Bitwise, in collaboration with the DeFi protocol Morpho, has launched non-custodial on-chain vaults. The initial product targets an annual yield of 6% through overcollateralized lending pools.

Finance is moving onchain. Vaults are a key part of that, offering investors a transparent way to earn digital yield on their assets.

Today, we’re excited to announce that Bitwise is launching non-custodial vault strategies as a curator on @Morpho.

The quick details:

— Bitwise (@BitwiseInvest) January 26, 2026

Portfolio manager Jonathan Mann will oversee strategy and risk management at Bitwise. The company described the new tools as a key part of the shift to on-chain finance and a transparent way to generate income.

A key feature of the vaults is the ability to deposit and withdraw funds at any time. Assets are not locked, as they are in some staking protocols. This makes the tool similar to traditional funds, but with software replacing intermediaries.

Earlier, Bitwise predicted that such “ETF 2.0″ would double assets under management by 2026. Analysts expect billions of dollars in capital inflows and attention from major financial publications.

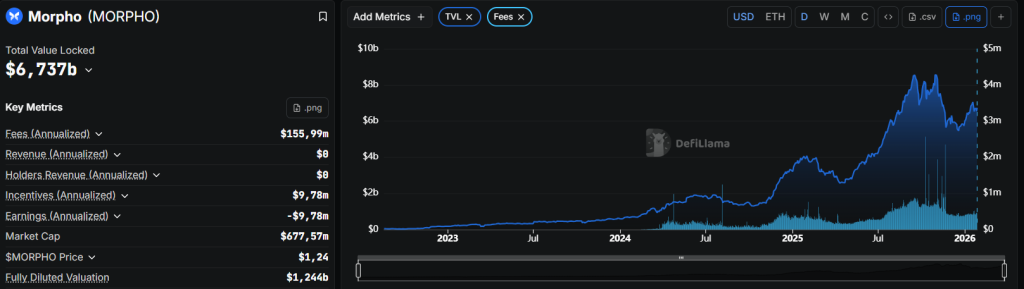

Morpho ranks seventh in terms of total value locked among DeFi protocols, with $6.7 billion.

Back in January, Bitwise analysts concluded that Bitcoin and gold significantly enhance portfolio efficiency adjusted for risk compared to traditional strategies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!