Bitwise Outlines Conditions for Bitcoin to Surpass $80,000 by Year-End

A Trump victory in the U.S. elections, a 50 basis point rate cut by the Fed with new stimuli from China, and a lack of major surprises in the industry are the conditions for bitcoin to rise above $80,000 by the end of the year, according to Bitwise, reports The Block.

Matt Hougan, the company’s CIO, confirmed the year-end forecast. He previously cited the approval of a BTC-ETF and the fourth halving as drivers.

In his latest note, the expert emphasized that a victory by Democratic candidate Kamala Harris could hinder the scenario.

“The party has varying views on cryptocurrencies, from Senator Elizabeth Warren’s ‘anti-crypto army’ to deep support from Representative Ritchie Torres. The problem over the past four years has been that the former controlled policy and agency appointments, creating a hostile environment for the sector,” Hougan noted.

The Bitwise CIO is convinced that bitcoin needs politicians to “get out of the way.”

“In the absence of a Democratic majority in both houses of Congress and a Harris victory, the party will adopt a more neutral approach to the industry,” the specialist predicted.

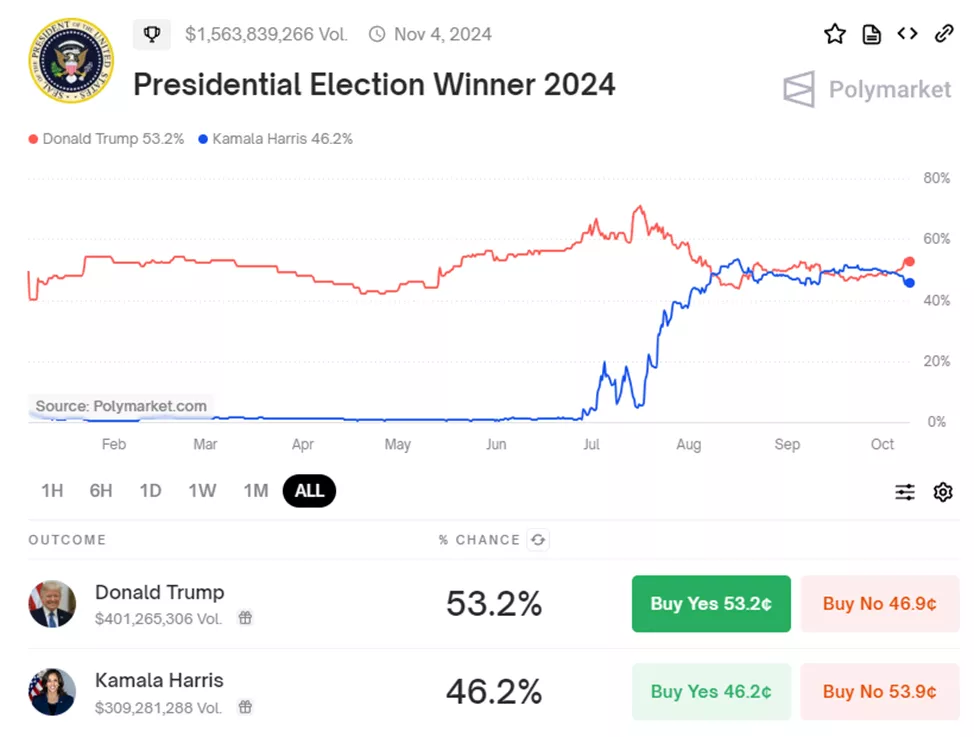

The prediction platform Polymarket indicates a 20% chance of full legislative control by the “donkeys” versus 33% for the “elephants”. The probability of a Trump victory is estimated at 53%, noted the Bitwise CIO.

Regarding industry surprises, Hougan explained that these refer to “hacks, large-scale lawsuits, and major coin unlocks.”

The expert is convinced that digital gold does not require support from Ethereum, Solana, or “new altcoins like Sui, Aptos, and Monad” for a rally.

For a “full-scale surge” to $100,000 in just a few months, the entire market would need to embrace pro-crypto sentiments, Hougan added.

In conclusion, the Bitwise CIO noted that bitcoin is already having a good year thanks to its mainstream acceptance among politicians and increased institutionalization through ETFs.

“Regardless of what happens this year, the price of digital gold will aim for $80,000 and much higher in 2025,” he explained.

Bernstein’s Position

Bernstein also indicated a rise in bitcoin to $80,000-90,000 in the event of a Republican candidate’s victory on November 5. A switch from Joe Biden to Harris would lead to a retreat to $40,000, without altering long-term positive prospects, analysts added.

Specialists confirmed their expectations amid the largest divergence in odds in favor of the former president since the Democratic representative was officially nominated as a contender.

Experts noted that bitcoin would move sideways if the odds of a Harris and Trump victory converge. However, growth will intensify if the latter maintains or strengthens his lead.

In altcoins, a sideways trend is expected until the election results are finalized. Market participants want “more clarity regarding the SEC chair,” Bernstein indicated.

Earlier, a list of candidates for the head of the agency in the event of a Trump victory appeared in the media.

As reported, Standard Chartered predicted a fivefold increase in Solana if the former U.S. president returns to the White House.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!