Bitwise Predicts Record Inflows into Bitcoin ETFs

Spot bitcoin ETFs in the US are expected to attract record capital inflows.

Spot bitcoin ETFs in the US are expected to attract record capital inflows in the fourth quarter, suggested Bitwise CIO Matt Hougan.

He anticipates that by the end of 2025, total inflows into bitcoin-based exchange-traded funds will significantly surpass last year’s total of $36 billion.

The expert identified three key drivers of these inflows: asset managers’ approval of cryptocurrency investments, the recent rise in the price of digital gold, and “depreciation trade”.

According to Hougan, major players like Morgan Stanley have begun to flexibly integrate crypto assets into diversified portfolios. Specialists recommended zero exposure for conservative investors and 2-4% allocations for more risk-tolerant ones.

Similar decisions are being made by leading financial institutions: Wells Fargo, UBS, and Merrill Lynch. The analyst noted that this indicates a growing demand for bitcoin ETFs among professional advisors.

Gold vs Bitcoin

The top performers this year have been the first cryptocurrency and gold, which supports the relevance of the “depreciation trade” strategy, Hougan reported. The US money supply has grown by 44% since 2020, and investors are seeking protection from fiat currency devaluation in these assets.

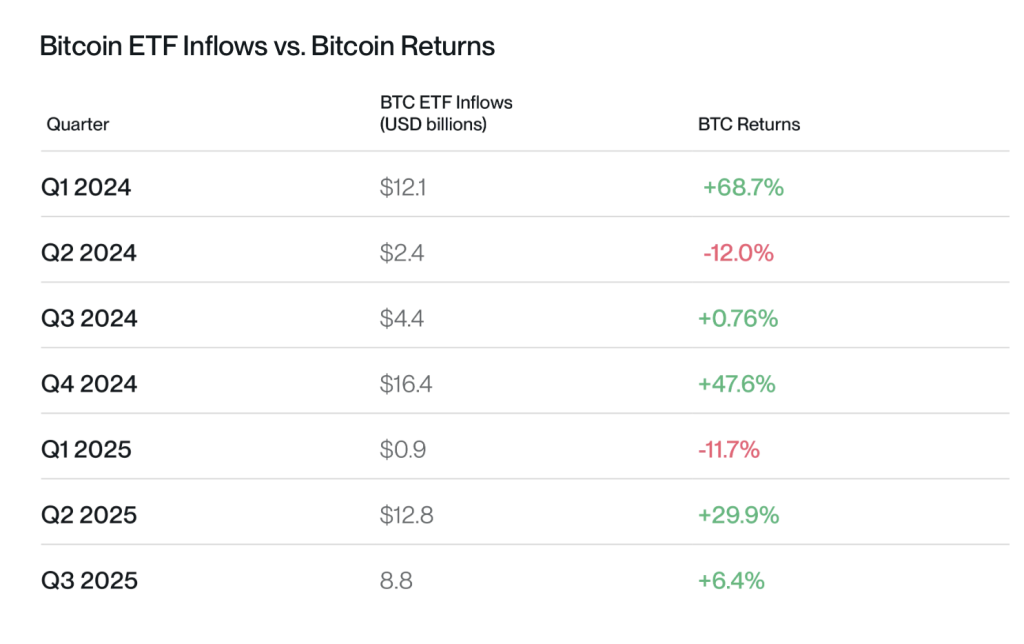

According to the Bitwise CIO, the surge in bitcoin’s price also stimulates new inflows into ETFs. Every quarter that bitcoin delivered double-digit returns, billions of dollars flowed into funds based on the asset.

The recent short-term surpassing of the $125,000 mark by digital gold caught the attention of media and investors. The analyst believes this suggests a new wave of momentum in the year’s final quarter.

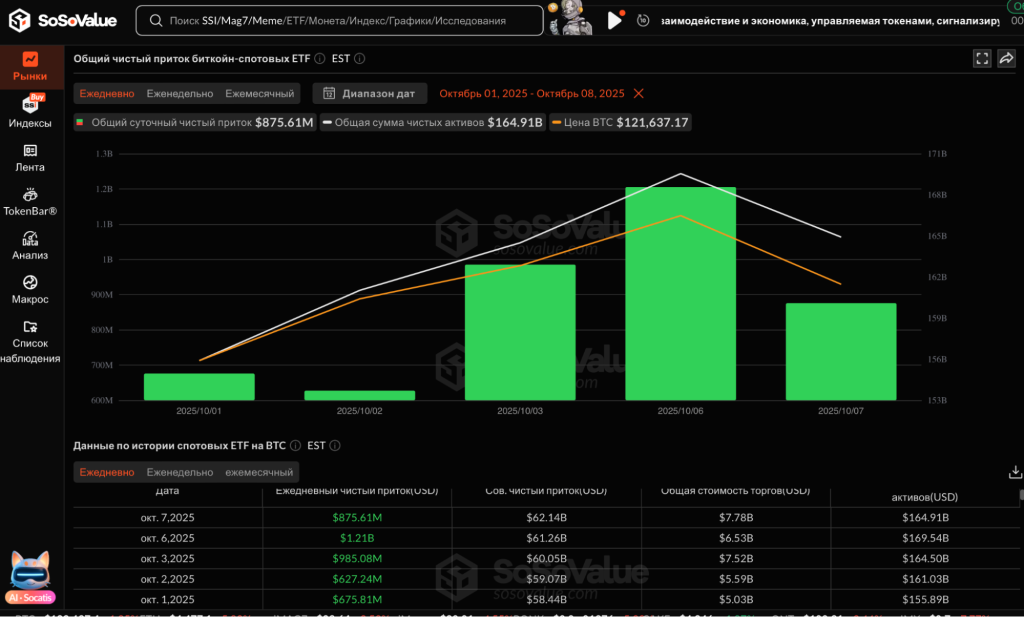

He noted that in the first four trading days of October, bitcoin ETFs already recorded a total inflow of $3.5 billion. The cumulative figure since the beginning of the year reached $25.9 billion.

“We have 64 days left to gather another $10 billion. I think we will achieve this and even more,” concluded Hougan.

Earlier, Bitwise named Solana as a future Wall Street favorite.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!