BlackRock to Launch Bitcoin ETF on European Exchanges

On March 25, BlackRock will list its iShares Bitcoin ETF on the European market. The instrument will trade under the ticker IB1T on the Xetra and Euronext Paris platforms, and in Amsterdam under the ticker BTCN, reports Bloomberg.

This marks BlackRock’s first foray of cryptocurrency funds outside the United States.

“The launch of the product reflects what can truly be considered a watershed moment in the industry — the combination of established retail investor demand with the growth of professionals,” said Manuela Sperandeo, head of iShares Product at BlackRock in Europe and the Middle East.

Coinbase will serve as the custodian, BlackRock announced. IB1T, available to institutional and experienced retail investors, will be launched by a special purpose company registered in Switzerland.

The market entry is accompanied by a temporary fee reduction to 0.15%. The promotional period will last until the end of the year, after which the fee will be 0.25% annually.

CoinShares also offers a similar product with a 0.25% fee, but the initial tariff reduction makes BlackRock’s offering more attractive.

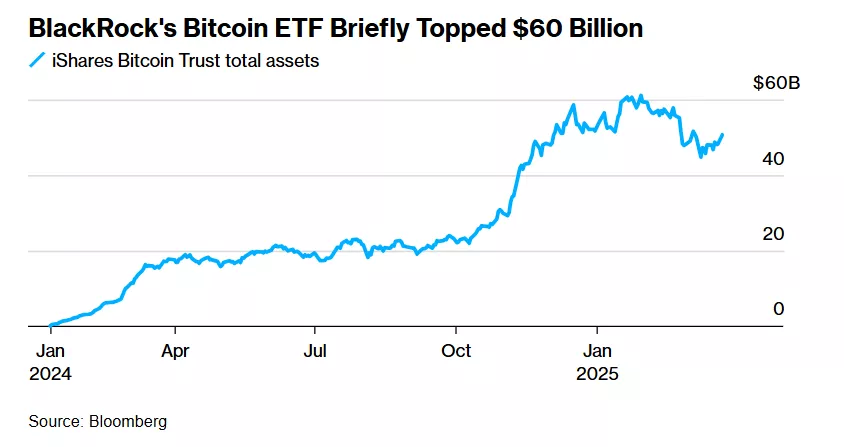

The debut of the U.S.-registered iShares occurred in January last year, quickly amassing billions of dollars in assets and becoming the best exchange-traded fund launch in market history.

Last month, the government-owned Mubadala Investment Company of Abu Dhabi disclosed investments in BlackRock’s Bitcoin ETF amounting to $436.9 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!