BlackRock’s Bitcoin ETF Sees Record Daily Inflow of $872 Million

On October 30, BlackRock’s spot bitcoin ETF, iShares Bitcoin Trust, recorded a net inflow exceeding $872 million, surpassing the March peak of $849 million.

“The surge in inflows is driven by several key factors, including the global shift of central banks towards lowering interest rates, which has increased liquidity and made capital more accessible to investors,” crypto analyst Rachel Lucas from BTCMarkets told The Block.

She added that expectations of Donald Trump’s victory in the U.S. presidential election could also be a contributing factor.

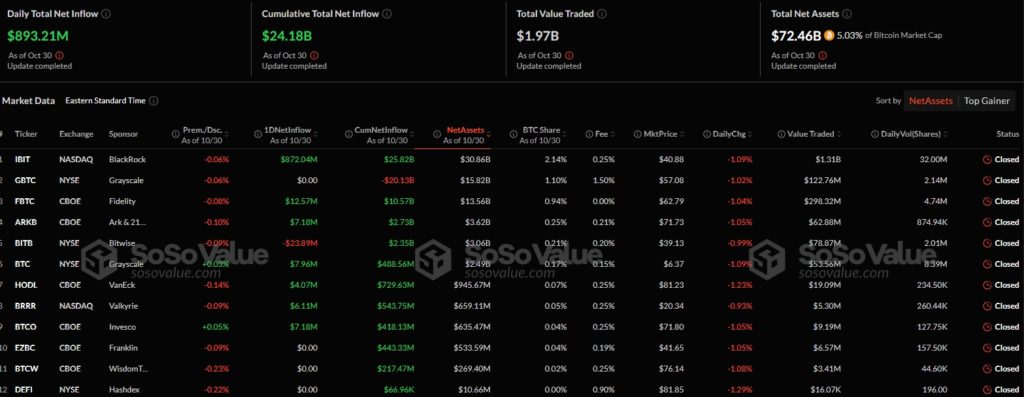

In total, U.S. spot bitcoin ETFs attracted $893.2 million on Wednesday. Fidelity’s FBTC contributed $12.57 million; other funds included:

- Grayscale’s GBTC — $7.96 million;

- ARKB from Ark and 21Shares — $7.18 million;

- Valkyrie’s BRRR — $7.18 million;

- Invesco’s BTCO — $4.9 million;

- VanEck’s HODL — $4.07 million.

Only BITB from Bitwise recorded an outflow of $23.89 million. The asset values in other structures remained unchanged.

Since approval in January, U.S. spot bitcoin ETFs have attracted $24.18 billion. Their combined AUM has reached $72.46 billion.

Bloomberg ETF analyst Eric Balchunas noted that ETF issuers have accumulated 995,663 BTC. He predicts that their reserves are likely to exceed 1.1 million BTC, attributed to cryptocurrency creator Satoshi Nakamoto, by the end of November.

Ok we gonna need to move up our predictions as yest alone the btc ETFs gobbled up over 12k coins like Pac-Man on a bender, now hold 996k btc- good chance to pass 1 million today (as the ridic volume yest likely to translate to big flows tonight). Legit shot to get to Satoshi by… https://t.co/Ua9GzhsBwE pic.twitter.com/84bBprhi6I

— Eric Balchunas (@EricBalchunas) October 30, 2024

Lucas believes that capital inflows into ETFs are likely to increase before the presidential election on November 5. She linked this to investors’ desire to “hedge against potential economic and political shifts.”

“This period may bring increased volatility as markets react to poll data, political statements, and debates about the regulatory landscape for digital assets,” she suggested.

Market participants in bitcoin options have prepared for a “bullish” scenario following the election and the Fed meeting, increasing OI on November calls with strike prices above $80,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!