BlackRock’s Spot Bitcoin ETF Sees 70 Consecutive Days of Inflows

Inflows into BlackRock’s IBIT have reached 70 consecutive days, placing the product among the top ten exchange-traded funds with the longest streaks of daily inflows. Bloomberg analyst Eric Balchunas highlighted this achievement.

$IBIT inflow streak currently at 69 DAYS. one more day and it moves into Top 10 and ties $JETS (a streak I was equally as fascinated by) altho streak ending today would be pretty hilarious, show financial gods have sense of humor via @thetrinianalyst pic.twitter.com/niDzfaKqgp

— Eric Balchunas (@EricBalchunas) April 22, 2024

“The inflow trend in IBIT stands at 69 days. One more day — and it will enter the top 10, tying with JETS,” he wrote.

The latter, which includes stocks of companies in the airline industry, also achieved 70 consecutive days of inflows. Until April 22, JETS was in 10th place, as noted by The Block.

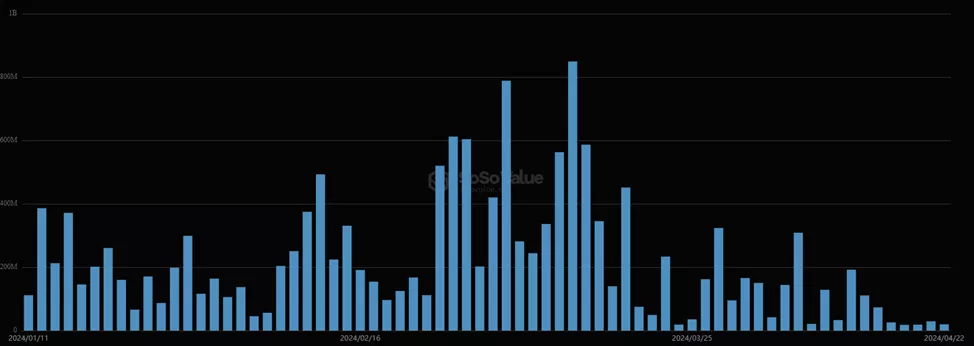

The leader of the ranking is the JPMorgan Equity Premium Income ETF (JEPI) with a record of 160 days. According to SoSoValue, inflows into IBIT on April 22 amounted to $19.5 million.

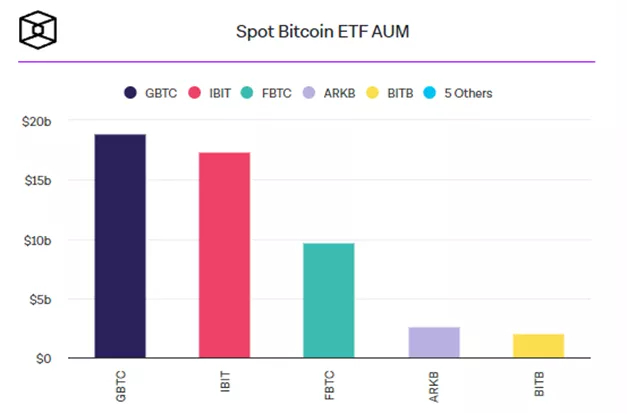

AUM for IBIT increased to $18.18 billion. In comparison, the leader GBTC from Grayscale reached $20.23 billion.

Overall, the net inflow into products on April 22 was $62.1 million and $12.38 billion since their approval.

According to SoSoValue, the total net inflow of Bitcoin spot ETF yesterday, April 22, was $62.0899 million. Grayscale GBTC had a single-day net outflow of $34.993 million. The single-day net inflow of Fidelity ETF FBTC was US$34.8334 million, and the historical cumulative net… pic.twitter.com/yt2vTMA5bm

— Wu Blockchain (@WuBlockchain) April 23, 2024

Earlier, crypto assets in GBTC halved approximately three months after conversion to a spot ETF.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!