Blur and Paradigm launch NFT lending protocol

The Blur platform unveiled the lending protocol Blend for non-fungible tokens (NFTs).

1/ Blur Lending, aka Blend, is NOW LIVE.

If you have a Punk, you can now borrow up to 42 ETH within seconds.

If you want an Azuki, you can now buy one with just 2 ETH up front.

Points have been updated as well. Learn more ? pic.twitter.com/jRBwE8DYEo

— Blur (@blur_io) May 1, 2023

The developer Dan Robinson from Web3-company Paradigm contributed to the creation of the new service.

According to the project’s white paper, the protocol provides for perpetual lending. This means that loans do not have a pre-set repayment date. As a result, positions can remain open indefinitely, until liquidation, with market-determined rates.

According to Dune, total lending volume since platform launch stands at 6,406 ETH across 679 loans.

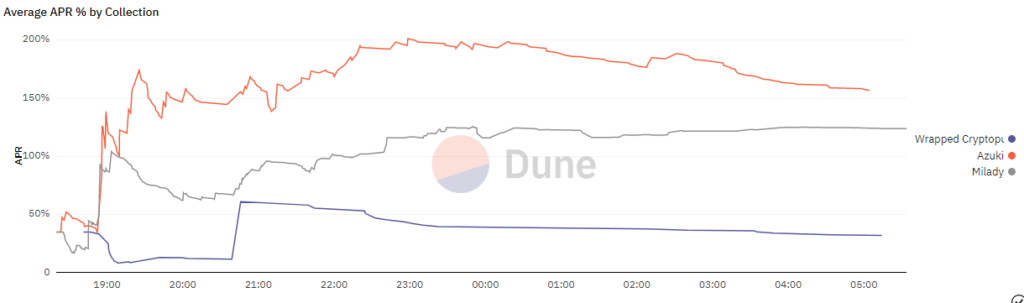

The chart below shows the interest rates for the Azuki, Cryptopunks and Milady collections.

The largest lender is matchbigbrother.eth (33 loans totaling 610.4 ETH).

«By default, Blend loans carry fixed rates, and there is no expiry date. Borrowers can repay them at any time, and lenders can exit positions by triggering a Dutch auction to find a new lender at a new rate. If the auction fails, the borrower is liquidated, and the lender takes possession of the collateral»,

— explained in the document.

As of writing, the platform supports three collections: Azuki, Cryptopunks and Milady.

2/ Blend is launching with 3 collections at 3 different price points to start:

Punks

Azukis

MiladysMore are coming soon. pic.twitter.com/6vmqDRK1DT

— Blur (@blur_io) May 1, 2023

«If you have a Punk, and you want to buy a new NFT for 10 ETH without having funds in your wallet, you would need to sell your token. This forces holders to abandon collections and drives down minimum prices. With Blend, holders can borrow ETH against their NFT collateral without having to sell them»,

— explained by the developers.

According to them, the smart-contract audit was conducted by Code4rena and Chain Light. The results will be published on the website soon.

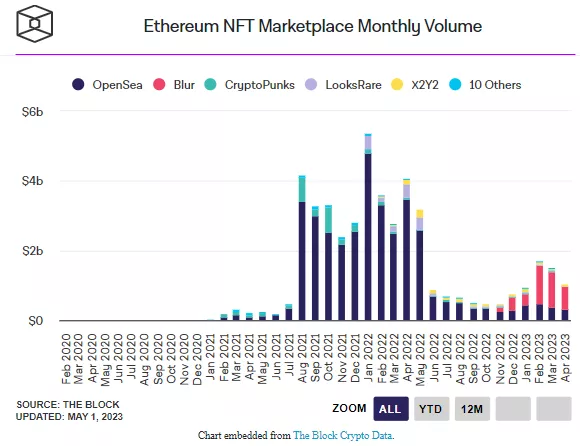

The chart below shows that, despite waning NFT popularity, Blur has fiercely competed with the once-leading OpenSea in trading volume over the past six months.

In February, the new marketplace rose to the top. The buzz around the platform may have been aided by the BLUR token airdrop.

In response, OpenSea rebranded the Gem aggregator, naming it OpenSea Pro. By April, the latter surpassed the competitor in several metrics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!