Buying USDT at scale: how to invest in crypto from $1 to $1m

Tether (USDT) is one of the most liquid assets in the crypto market. As of the end of the third quarter of 2024, USDT is used by 330 million crypto wallets and on-chain accounts. Buying USDT has become a popular way to enter the market: investors exchange fiat for stablecoins without worrying about volatility. However, when depositing large sums to a CEX there is always a risk of an account freeze.

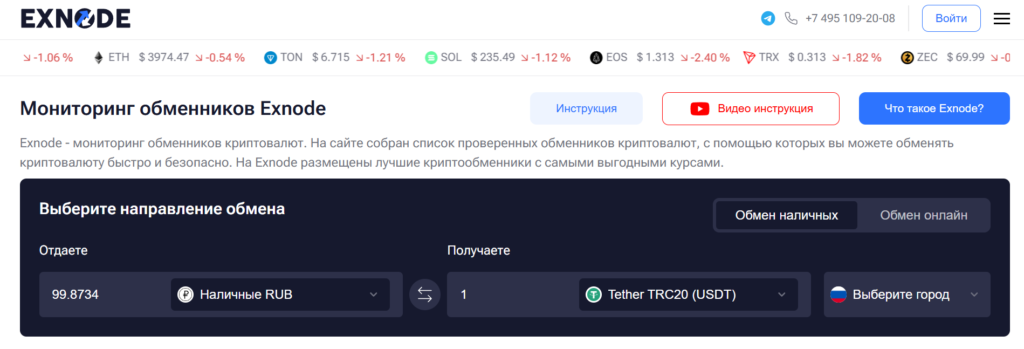

With the exchange monitor Exnode we explain how to minimise this risk using offline exchangers.

The problems of centralisation

It is important to note that USDT itself is a centralised stablecoin. This means the issuer — Tether — can freeze tokens directly at a wallet address.

For example, in September Tether helped the US Department of Justice seize assets worth more than $6m linked to crypto scammers from Southeast Asia. In total, the company has frozen roughly $1.8bn.

“As a rule, such freezes are tied to criminal or fraudulent cases. Ordinary crypto investors should not worry about funds being blocked at wallet addresses, unless, of course, they are involved in dubious operations,” — note Exnode representatives.

Even so, when dealing with certain centralised exchangers and exchanges, users may face additional KYC procedures, especially for large deposits. Moreover, in 2024 banks still do not want to work directly with crypto exchanges because of regulatory constraints.

“The main volume of fiat/crypto trading takes place via P2P markets on CEX. Mostly this is buying or selling USDT. When working with them you should first and foremost pay attention to card limits if you want to invest from $10,000,” — comment Exnode representatives.

At an exchange or a bank there is always a chance of an additional check. In a bull market this can happen at the worst possible moment, when delays threaten missed investment opportunities. To minimise such risks, there are offline exchangers that work with cash.

Cold exchange

When choosing an exchange point, it is better to use aggregators such as Exnode. According to the project team, not every service offers a favourable rate and ensures client safety.

“Obviously, a person’s physical presence in an office with a large sum carries additional risks, so reputation plays a paramount role. To avoid scammers, you should not choose an exchanger by links in a search engine. There are monitors that check their reliability and collect user reviews for this,” — they emphasise at Exnode.

To get into the list of exchangers on Exnode, a service must meet a number of requirements. Among them:

- offer clear exchange terms;

- have Russian-language support and a Russian version of the website;

- when receiving a negative review, provide a detailed response and resolve the situation within 24 hours.

Offline crypto exchange works as follows:

- Choose the exchange direction. On the monitor’s homepage select the “Cash exchange” option and create a currency pair by pressing “Give” and “Get”;

- Choose a city. Exnode lists exchange points in cities in Russia, the UAE, Turkey, Georgia, Armenia and other countries;

- Choose an exchanger. Exnode will provide a list of exchangers with the best market rate.

- Exchange. The user goes to the exchanger’s website and submits a request. A manager then gets in touch to agree a time for an office visit or cash delivery.

After completing a deal, you can leave a review on Exnode to help other users. The aggregator does not act as a guarantor of transactions; it only provides information about an exchange point and reviews about it. However, if problems arise with an exchange, Exnode specialists will help resolve them.

Conclusions

To invest a large sum in cryptocurrency, it is enough to choose an exchanger with a good reputation and a competitive USDT market rate.

Buying stablecoins helps avoid volatility-related risks. Using a non-custodial wallet to store USDT reduces the likelihood of funds being frozen and allows gradual investment in bitcoin and altcoins via CEX, DEX and online exchangers.

Aggregators such as Exnode help find a reliable service for exchanging cash for USDT.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!