California Public Employees’ Retirement System Increases Stake in Riot Blockchain Amid Bitcoin Rally

The California Public Employees’ Retirement System (CalPERS) nearly sevenfold increased its investments in the mining company Riot Blockchain in Q4 2020. This is evidenced by the filing submitted to the U.S. Securities and Exchange Commission.

CalPERS purchased 16,907 shares of Riot Blockchain (ticker RIOT), which trades on Nasdaq, during the previous Bitcoin rally at the end of 2017.

The fund’s stake remained unchanged for three years, and in the third quarter of 2020 it was valued at about $46,000.

By the end of 2020 CalPERS already owned 113,034 shares of the mining company worth more than $1.9 million.

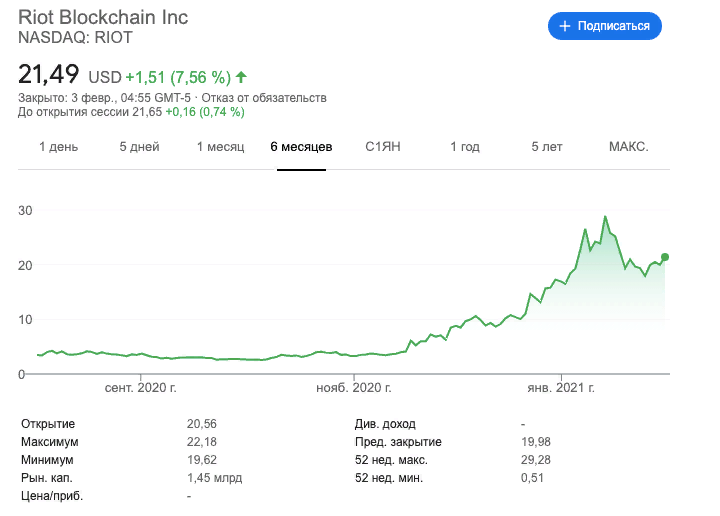

Riot Blockchain’s securities in November rose 160% to $8.45 amid the Bitcoin rally. In December the leading cryptocurrency hit several all-time highs and ended the year around $29,000.

As of December 31, RIOT had risen to $16.99. At the time of writing, the shares were trading at $21.49.

CalPERS is the largest state pension fund in the United States by assets. Its value as of December 31, 2020 exceeded $441 billion.

Earlier the American financial giant Charles Schwab bought 22,977 shares of Riot Blockchain for $52,000. Vanguard and Fidelity similarly diversified their portfolios.

Subscribe to ForkLog on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!