Cardano Holder Loses $6 Million in 30 Seconds

Cardano wallet exchanged 14.4 million ADA for Anzens (USDA) through illiquid pool, losing $6 million.

A Cardano wallet, dormant for five years, suddenly became active and inadvertently exchanged 14.4 million ADA for the Anzens (USDA) “stablecoin” through an illiquid pool. The incident was highlighted by on-chain investigator ZachXBT.

The user executed the transaction in two steps: first, a test transfer of 4437 ADA, followed 33 seconds later by the main exchange of 14.4 million ADA valued at $6.9 million. Due to the pool’s low liquidity, the stablecoin’s price spiked sharply from $1.03 to $4.8.

At the time of writing, the USDA rate stands at $1.03.

As a result, the Cardano holder lost $6.05 million. ZachXBT dubbed him the “on-chain clown of the month.” Prior to the incident, the wallet had been inactive since September 13, 2020.

Notably, the funds originated from the network’s genesis block, created on September 23, 2017, as discovered by a user known as bobcorn.

I looked into the address that sold the 14M $ADA and it was funded by the Genesis Block, the first Cardano transaction ever on 9-23-2017

Full details below. This post is also sponsored by the Pulse Presale in quoted tweet make sure to check them out once you’re done reading.… https://t.co/UcKiMg9HkG pic.twitter.com/0FB23H9C46

— bobcorn (@bobcorn_ada) November 17, 2025

Criticism of Cardano

The community showed little sympathy for the affected user. Members criticized Cardano for lacking a developed infrastructure for stablecoins and its support from the project.

This kind of incident should never happen again, it could easily freeze up the Cardano DeFi market!

I think we need to push forward with a “Stablecoin DeFi Liquidity Budget” as soon as possible to bring in more stablecoin liquidity. https://t.co/hEv38LEpJV

— dori (@dori_coin) November 17, 2025

“Such incidents should not recur—they can paralyze the entire DeFi market in the Cardano ecosystem!” wrote a developer known as dori.

A community member under the pseudonym Cardano YODA also emphasized the importance of “stablecoins” for the decentralized finance sector. He urged the blockchain platform’s leadership “not to delay decision-making.”

“The bull market has lasted a year, yet we cannot allocate even a few tens of millions to DeFi. We urgently need to restore governance functionality: elect a new board member and approve a proposal on the blockchain. […] We are creating cutting-edge technology, but without users, liquidity, and volumes, we have no chance to stand out against competitors,” the user stated.

The team behind USDA, Anzens, shared a similar view, issuing a statement regarding the incident.

“This case demonstrates the demand for stablecoins in the Cardano ecosystem. We urge the community to participate in building liquidity for native fiat-pegged coins on Cardano,” the developers noted.

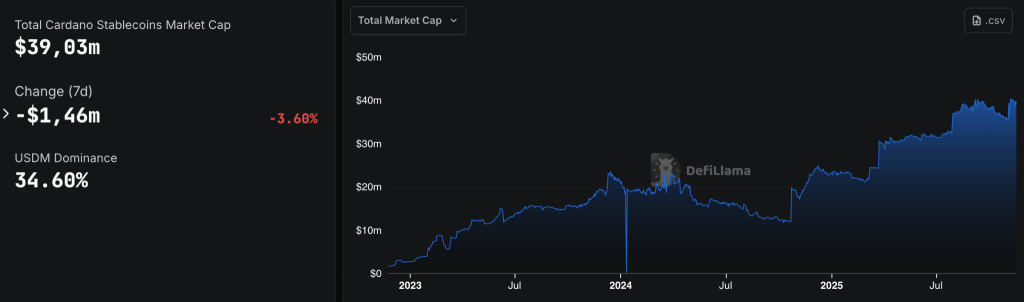

At the time of writing, 11 stablecoins operate within the Cardano ecosystem, six of which are issued on the network itself. The total capitalization of “stablecoins” amounts to $39 million.

In comparison, Ethereum’s figure exceeds $165 billion, while Solana’s is $13 billion.

Back in August, ZachXBT described Cardano’s operational model as an “insider enrichment scheme.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!