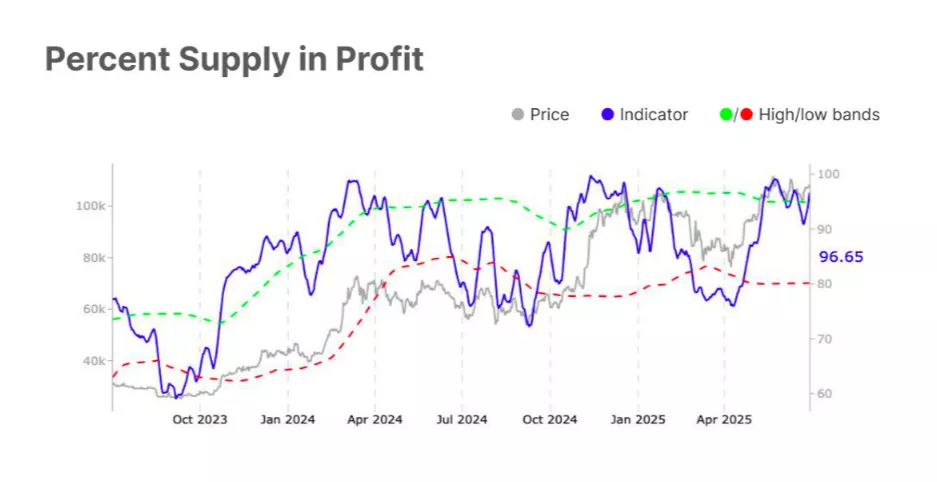

Cautious Optimism: 96.7% of Bitcoin Supply in Profit

As of late June, 96.7% of the supply of the leading cryptocurrency was in profit, indicating a high risk of volatility, according to a report by Glassnode.

Historically, such high levels lead to selling pressure as the potential for profit-taking increases, researchers noted. The current situation reflects “bullish investor sentiment, but with caution regarding price corrections.”

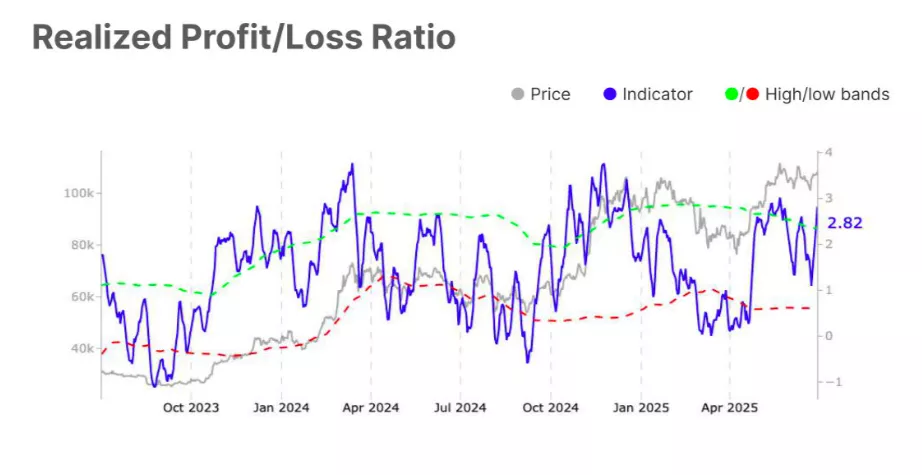

From June 22 to June 30, the realized profit and loss ratio for Bitcoin jumped from 1.1 to 2.8 points.

“It seems the market has entered a mode of cautious optimism with stronger positions from institutional players and a resumption of accumulation,” added Glassnode.

Experts believe that sustained demand and broader market confidence are necessary to support the rally.

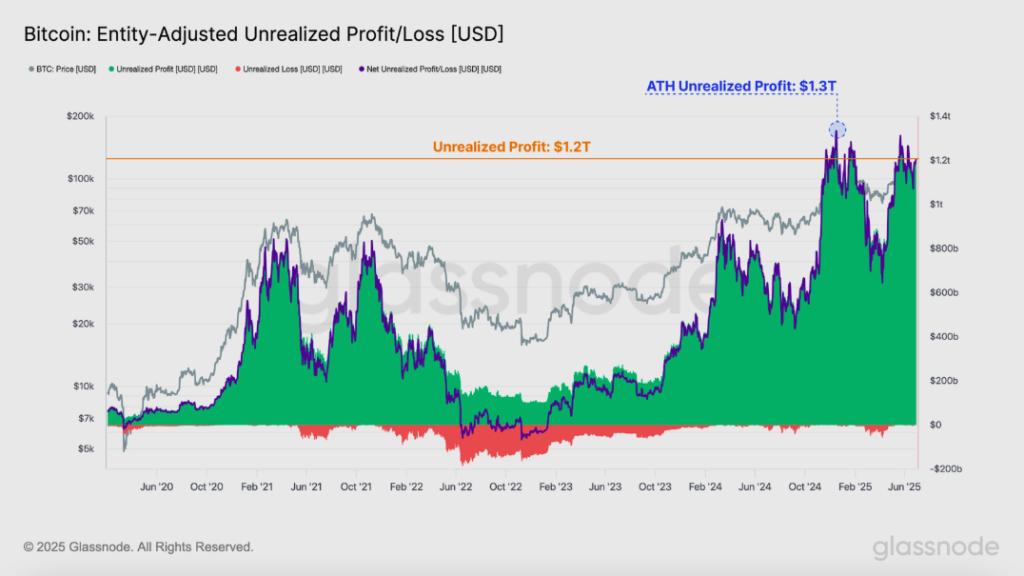

In the company’s weekly report, it was stated that the total “paper profit” of Bitcoin investors reached $1.2 trillion, nearing the historical peak of late 2024 at $1.3 trillion.

The average unrealized profit of digital gold holders stands at 125%. Before the peak, the figure was 180%.

“Hodling appears to be the dominant market mechanic across multiple spending metrics,” analysts concluded.

This trend leads to a decrease in realized Bitcoin profits and an increase in the volume of coins held by long-term holders. The metric is nearing a record.

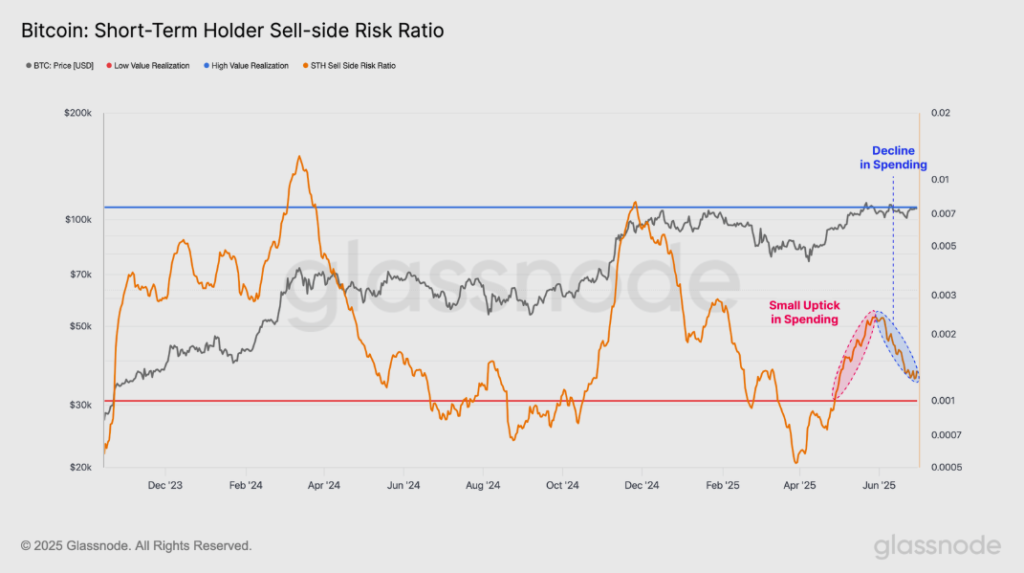

Glassnode also noted a sharp decline in sales from short-term holders after Bitcoin rose to levels near its historical high in May 2025.

“This further indicates that the current price range is not attractive enough for investors to continue selling, suggesting the market may need to rise (or fall) to unlock additional supply,” researchers emphasized.

Earlier, analysts at Standard Chartered Bank stated that halving will no longer affect the cycle of the first cryptocurrency and predicted its rise to $200,000 by the end of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!