China and South Korea Impose New Restrictions on the Crypto Market

China's Banking Regulatory Commission instructs brokers to halt RWA business in Hong Kong.

China’s Banking Regulatory Commission has unofficially instructed several local brokers to halt their RWA business in Hong Kong, according to Reuters.

One source told the agency that the instructions are aimed at strengthening risk management. Authorities want to ensure that projects are backed by real business.

Beijing’s initiative contrasts with Hong Kong’s policy. Over the past year, the city’s authorities have been actively working to transform it into a hub for digital assets. Meanwhile, mainland China has banned cryptocurrency trading and mining since 2021.

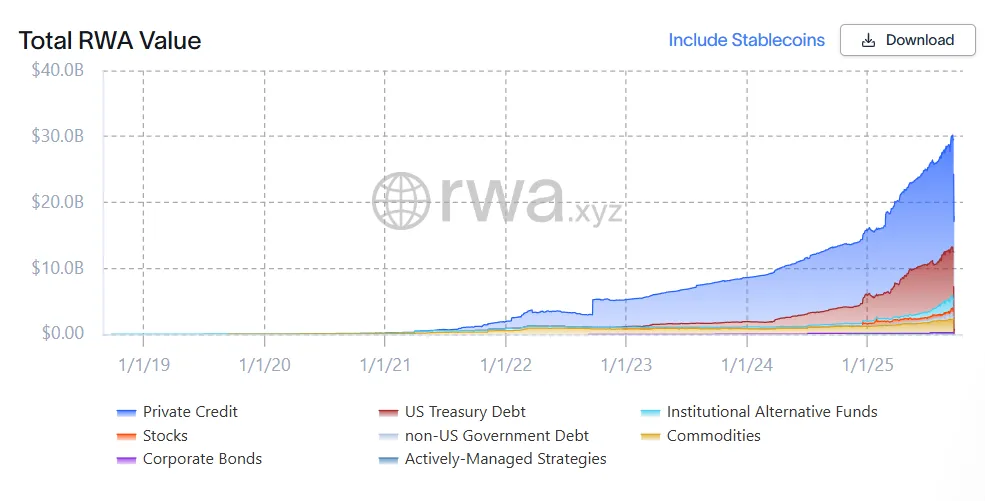

According to RWA.xyz, the global market for tokenized real-world assets is valued at $28 billion.

Suspicious Transactions in South Korea

Meanwhile, South Korea has recorded a surge in suspicious cryptocurrency transactions (STR). From January to August 2025, local virtual asset service providers filed 36,684 STR reports, exceeding the combined totals for 2023 and 2024.

Most reports are linked to “hwanchigi”—the illegal transfer of foreign currency. Criminal proceeds are converted into crypto-assets on offshore platforms, then transferred to local exchanges and cashed out in won.

From 2021 to August 2025, Korea’s Customs Service referred cryptocurrency crime cases worth $7.1 billion to prosecutors. About 90% ($6.4 billion) of these involve “hwanchigi” schemes.

Officials have called for tighter controls to track criminal funds and block disguised money transfers.

Back in August, Chinese regulators demanded that brokerage firms and think tanks cancel seminars and cease publishing research on stablecoins.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!