Circle to Launch IPO on NYSE

Circle, the issuer of the stablecoin USDC, has submitted an application for an initial public offering (IPO) to the U.S. Securities and Exchange Commission (SEC).

This move is the realization of previously announced plans to go public.

Class A shares will be issued under the ticker CRCL on the NYSE. Details regarding the number of shares and the expected offering price have not been disclosed.

“For Circle, becoming a public company on the New York Stock Exchange is a continuation of our commitment to operate with maximum transparency and accountability,” said Circle CEO Jeremy Allaire.

According to documents filed with the SEC, the issuer has experienced “ups and downs” in recent years: from a net loss of $768.8 million in 2022 to a profit of $267.6 million in 2023. At the end of last year, Circle had $1.05 billion in liquid assets, including $751 million in cash.

The underwriters for Circle’s IPO include several major investment banks, such as JPMorgan and Citigroup.

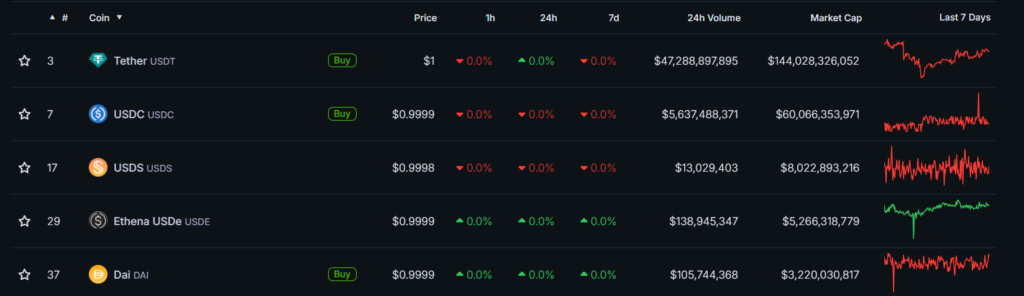

USDC remains the second most popular stablecoin with a market capitalization of $60 billion, according to CoinGecko. Its main competitor, Tether’s USDT, continues to lead the stablecoin segment with a corresponding figure of $144 billion.

Allaire described USDC as “the foundation of Circle’s stablecoin network,” which has been used for over $25 trillion in transactions as of March 28, 2025.

Millions of end users employ the “stablecoin” for payments, settlements, and as a digital store of value, added the company’s CEO.

Back in November 2023, Bloomberg journalists reported Circle’s intention to go public. In January 2024, the firm confidentially filed for an IPO in the U.S.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!