Circle to raise $546 million in follow-on stock offering to acquire Concord Acquisition Corp

Circle will conduct a follow-on stock offering worth more than $546 million for a deal with SPAC Concord Acquisition Corp, through which the cryptocurrency company would go public.

On Friday, we (@circlepay ) filed our Form S-4 with the SEC. https://t.co/XOxIodDSEn

— Jeremy Allaire (@jerallaire) August 9, 2021

Securities will be issued by Circle Acquisition Public Limited Company (Topco), registered in Ireland. The company has filed a registration statement with the U.S. Securities and Exchange Commission.

After the merger, Concord will remain as a subsidiary of Topco, which will also acquire all of Circle Internet Financial Limited’s share capital (Circle). Thus the firm will also become 100% a Topco subsidiary.

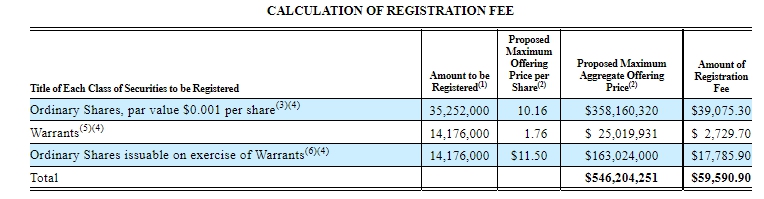

The offering consists of 35,252,000 common shares to be exchanged for Concord shares, a further 14,176,000 shares for exercise of Topco warrants and an equal number of warrants to cover the SPAC obligations.

The estimated placement price is $546,204,251.

As a reminder, Circle’s pre-merger valuation was pegged at $4.5 billion. The merger is expected to bring the firm $691 million.

In May 2021, the company raised $440 million in financing from FTX, Digital Currency Group, Fidelity Management, Valor Capital Group and other investors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!