CME Introduces Bitcoin Volatility Index Similar to VIX

CME unveils new cryptocurrency benchmarks, including a Bitcoin volatility index.

The largest regulated derivatives exchange, CME, has unveiled a set of new cryptocurrency benchmarks, including a volatility index for the leading cryptocurrency.

Measure bitcoin’s expected market risk in real-time. 💥

The CME CF Volatility Benchmarks are now available, providing the first forward-looking implied volatility indices derived from our regulated options market. ➡️ https://t.co/cPVRnSbwed pic.twitter.com/nEgZDXNiLQ

— CME Group (@CMEGroup) December 2, 2025

The tool will track the implied volatility of bitcoin futures options, reflecting traders’ expectations of the asset’s price fluctuations over the next 30 days.

Like the VIX on the stock market, this indicator will serve as a key benchmark for assessing uncertainty, pricing, and risk hedging. The release notes that the index itself is not a tradable contract but serves as a “standardized reference point.”

The set also includes benchmarks for Ethereum, Solana, and XRP.

Rising Activity

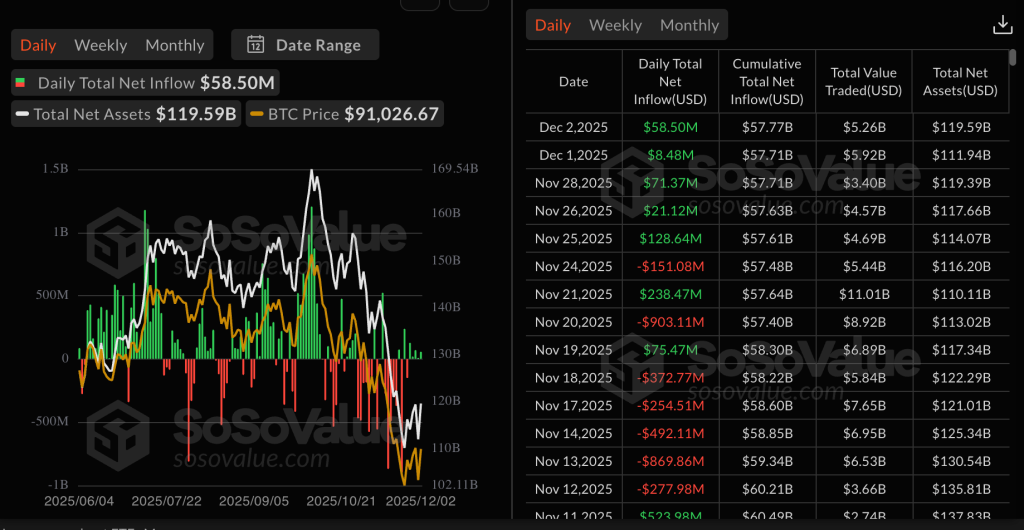

Institutional interest has been one of the drivers of the crypto market in the current cycle. This has been fueled not only by the excitement around exchange-traded funds but also by the active development of futures and options.

Crypto derivatives appeared long before ETFs, but for a long time, this segment received less attention amid large capital inflows into spot investment products based on digital assets.

The third quarter saw a surge in institutional activity on CME. The total trading volume of cryptocurrency futures and options exceeded a record $900 billion.

By the end of September, the average daily open interest reached $31.3 billion. The growth of this indicator indicates deep market liquidity and confidence among major players.

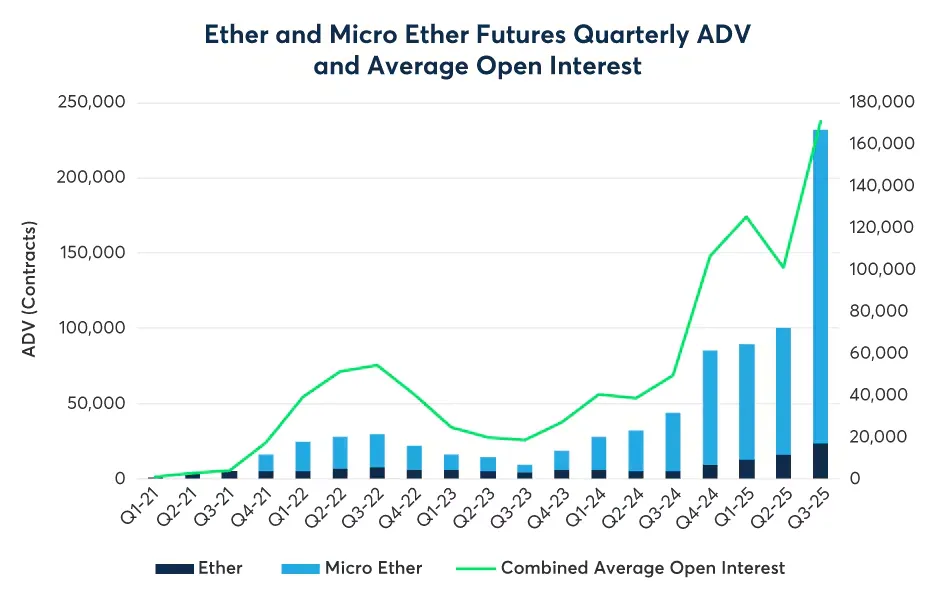

Investors paid particular attention to Ethereum-based instruments. In September, the trading volume of futures based on this asset set a daily record of 543,900 contracts worth $13.1 billion. Simultaneously, open interest soared to $10.6 billion.

“A record 118 large holders opened futures positions in August; the overall growth in activity shows how institutional investors are increasingly utilizing Ethereum,” experts added.

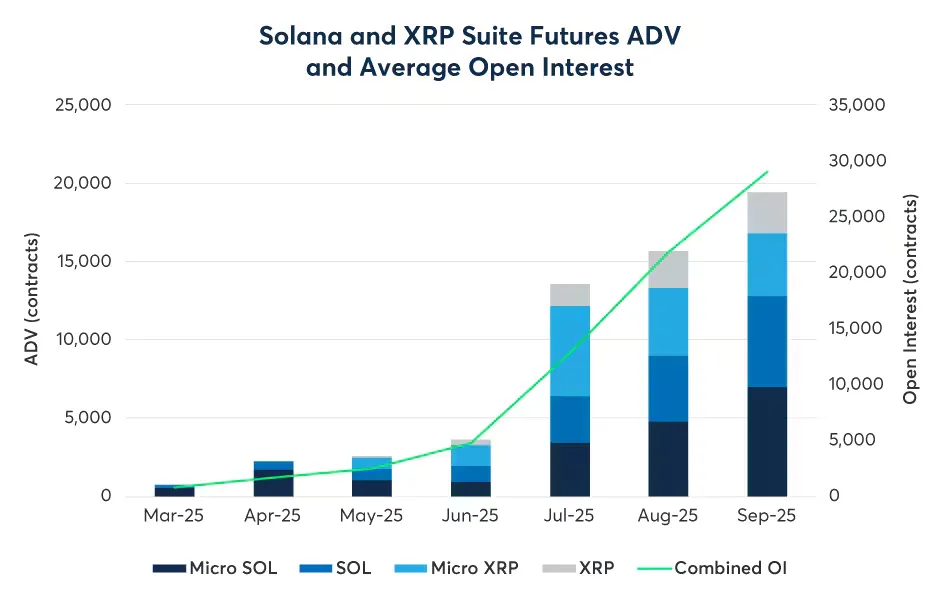

The third quarter also saw a surge in demand for Solana and XRP futures. Their volumes reached historical highs.

Since March, the number of Solana contracts exceeded 730,000, amounting to $34 billion, while XRP contracts reached 476,000, totaling $23.7 billion.

In October, CME launched around-the-clock trading of options and futures for cryptocurrency-based instruments.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!