CME margin traders bet on Bitcoin correction from $20,000

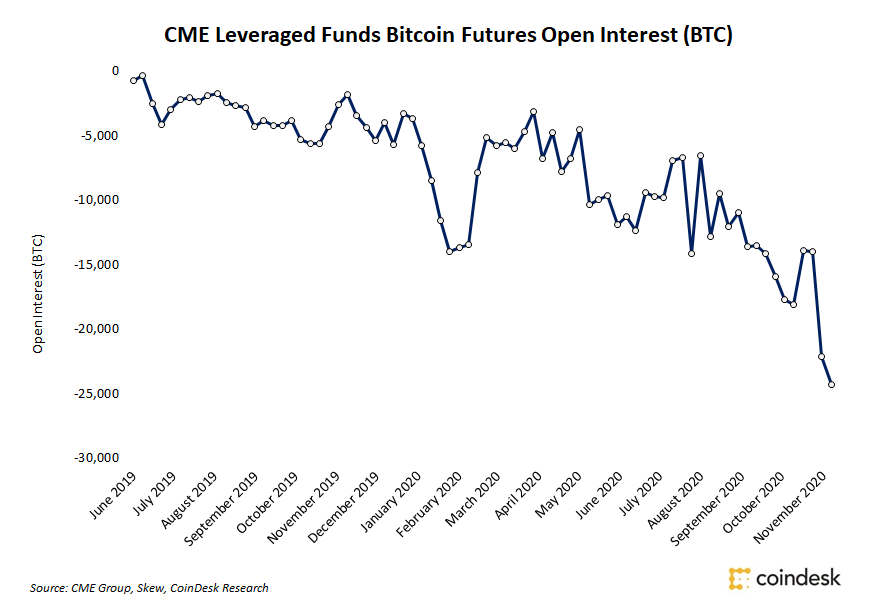

The aggregate short position of leveraged participants trading Bitcoin futures on the CME has reached record levels. Its value continues to rise as the price of the leading cryptocurrency consolidates near an all-time high.

By the end of November the figure reached 25,000 BTC (~$482.5 million), according to CoinDesk. Borrowed funds account for 62% of the total open interest (OI) in Bitcoin futures on the Chicago Mercantile Exchange.

Data: CME, skew, CoinDesk Research.

Tend to form short positions has been evident since September. Since then Bitcoin has risen about 60%. Techemy Capital trader Josh Olshievich observed in this move that market participants hedge long positions on other trading venues. He noted that many CME participants engage in arbitrage between the spot and futures price of Bitcoin.

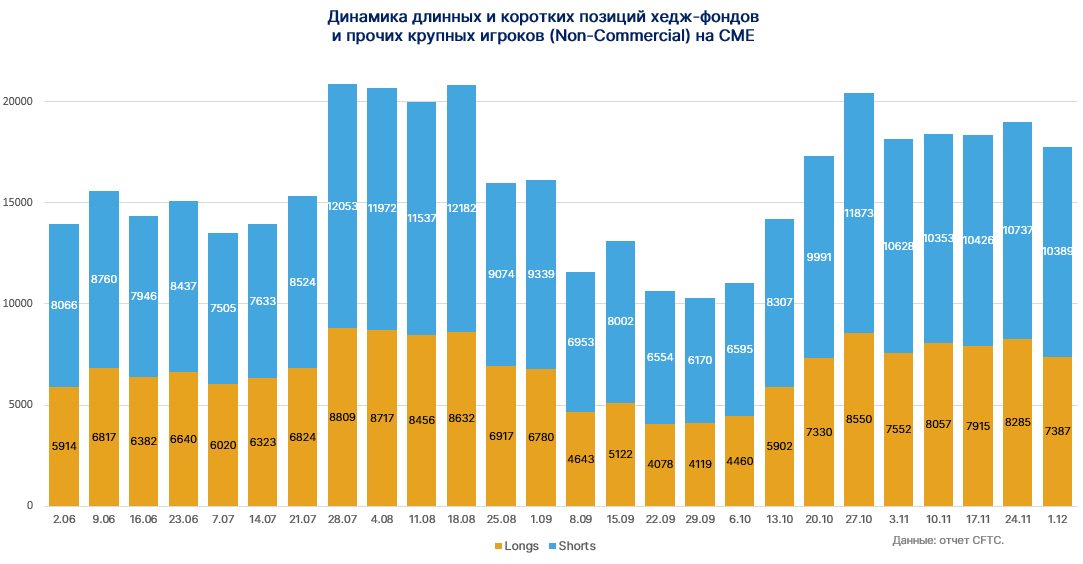

The tilt toward short positions has strengthened among hedge funds and other large players — 58%, as of December 1.

Data: CFTC, ForkLog.

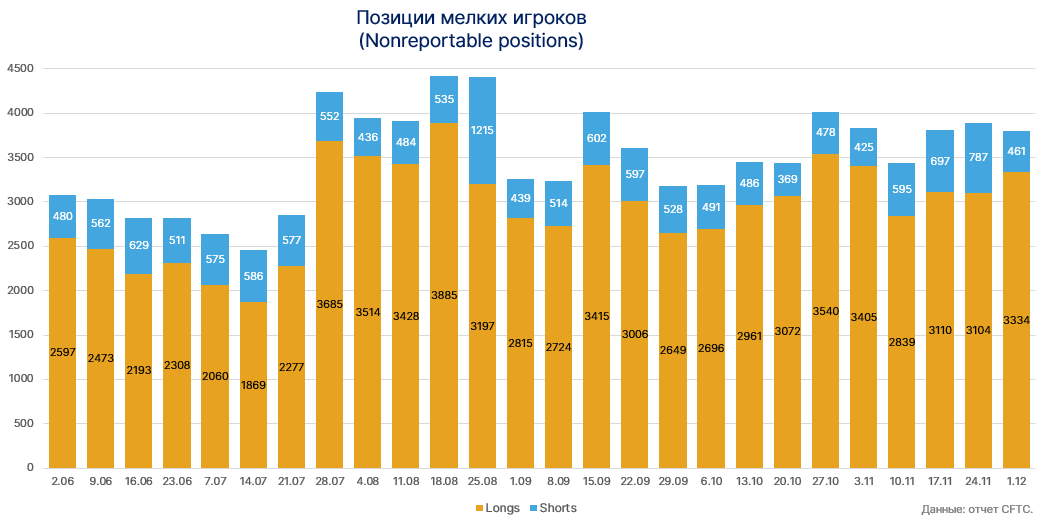

Traders categorized as Nonreportable, forming 17% of total open interest, have, on the contrary, built long positions to historic highs. 87% of the open interest of retail traders is in longs.

Data: CFTC, ForkLog.

The number of traders holding five or more contracts (>25 BTC) reached record highs.

Data: CFTC, ForkLog.

The number of traders holding five or more contracts (>25 BTC) reached record highs.

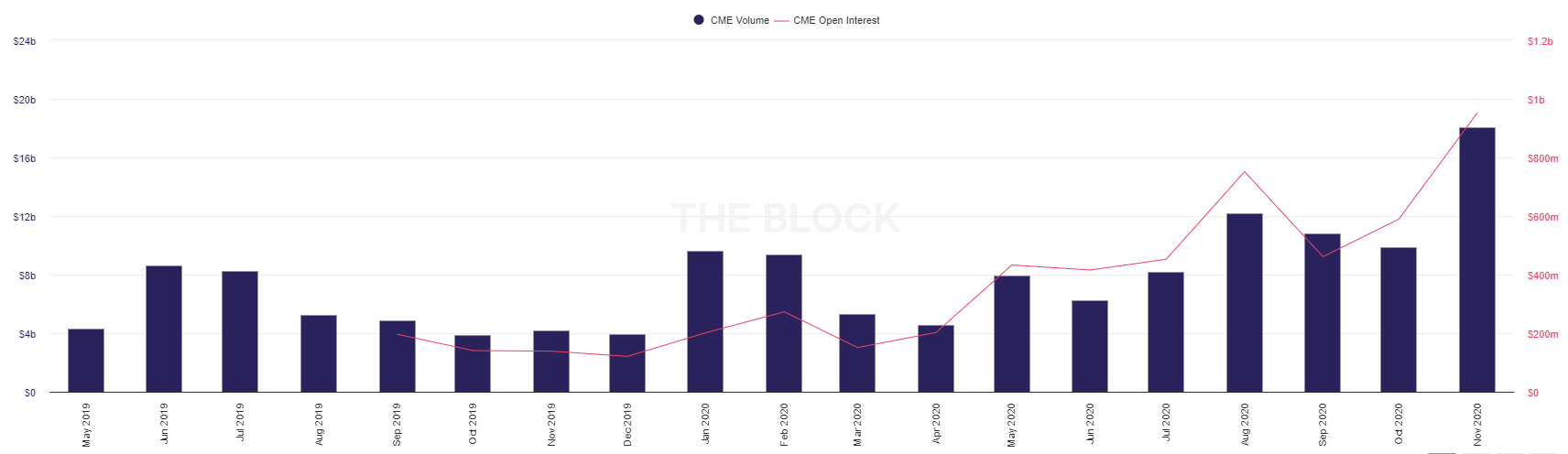

Data: The Block.

During November OI hit a new all-time high, surpassing August’s figures.

New records in November were also characteristic for the Bitcoin futures sector as a whole. Open interest across all platforms reached a level of $7.1 billion. The total daily trading volume of Bitcoin futures rose to $30 billion.

More information on futures and other derivatives in the analytical ForkLog’s November report.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!