CME: Nasdaq dynamics affect Ethereum more than Bitcoin

Movements of the Nasdaq 100, a high-tech index, typically affect Ethereum prices more than Bitcoin prices. To this conclusion пришли analysts CME.

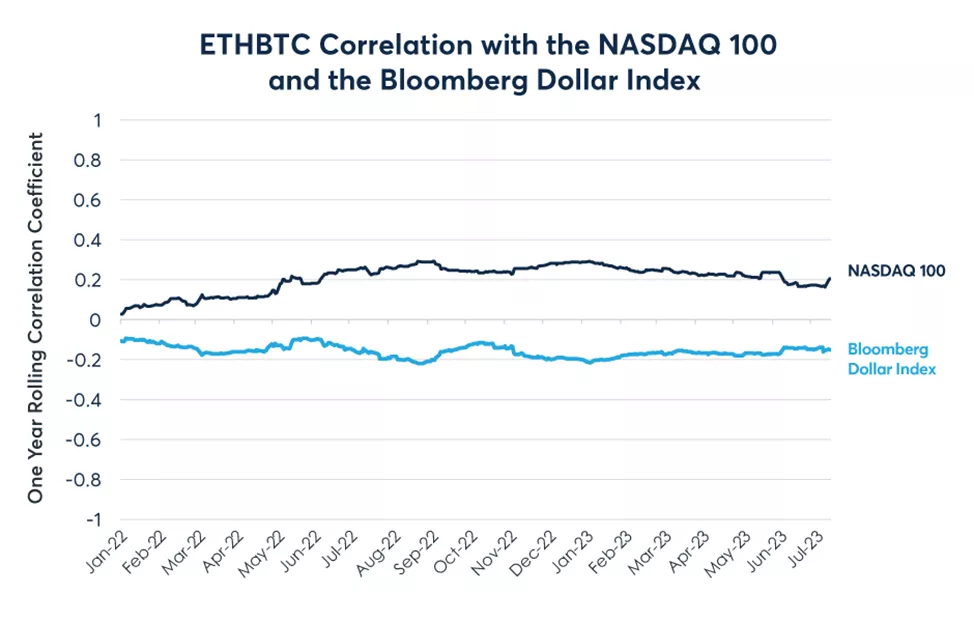

Since May 2022, the annualized ETHBTC correlation with the Nasdaq 100 has stood at around +0.2, with occasional climbs to +0.3. This points to a modest but persistent positive price relationship between tech stocks’ movements and Ethereum’s price relative to Bitcoin, the researchers noted.

“In days when tech stocks rise, ETHBTC tends to rise, as the first yields greater returns than the second,” — the report states.

Experts attribute the divergence to the Ethereum network’s practical applications (the second-largest cryptocurrency by market capitalization) and Bitcoin’s status as digital gold—a highly volatile store of value and hedge against fiat devaluation. Differences in market capitalization and tokenomics may also play a role.

Analysts say the US dollar has the opposite effect. On days when its index against a basket of the 10 major currencies rises, ETHBTC trends downward. This trend is not extremely strong, with an annualized moving correlation of about -0.2.

Meanwhile, the price relationship between ETHBTC and moves in interest rates, gold futures, and crude oil is almost zero.

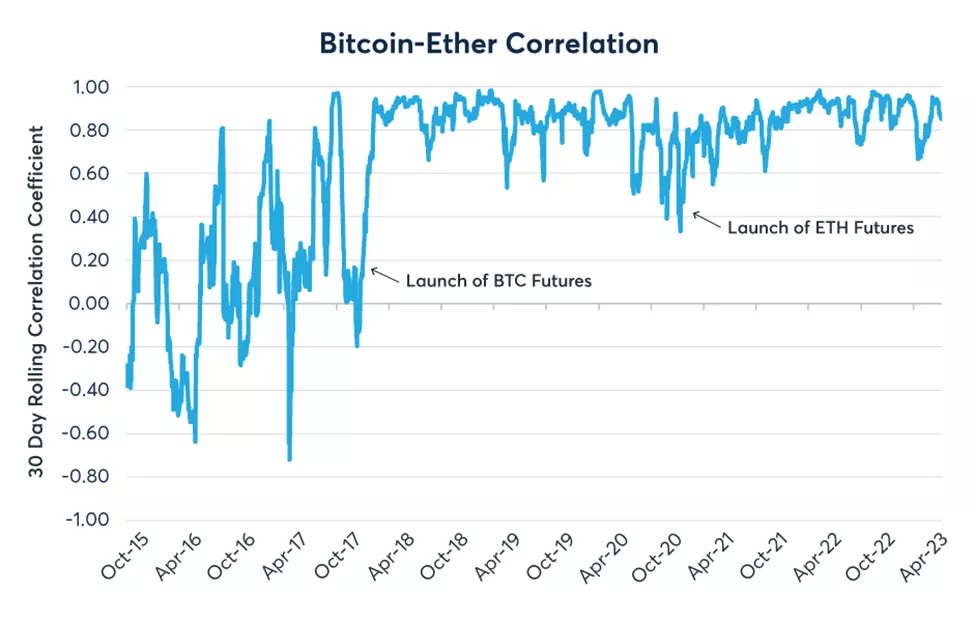

The price correlation (30D-MA) between the two main digital assets over the last year was estimated at 0.85, indicating a close relationship.

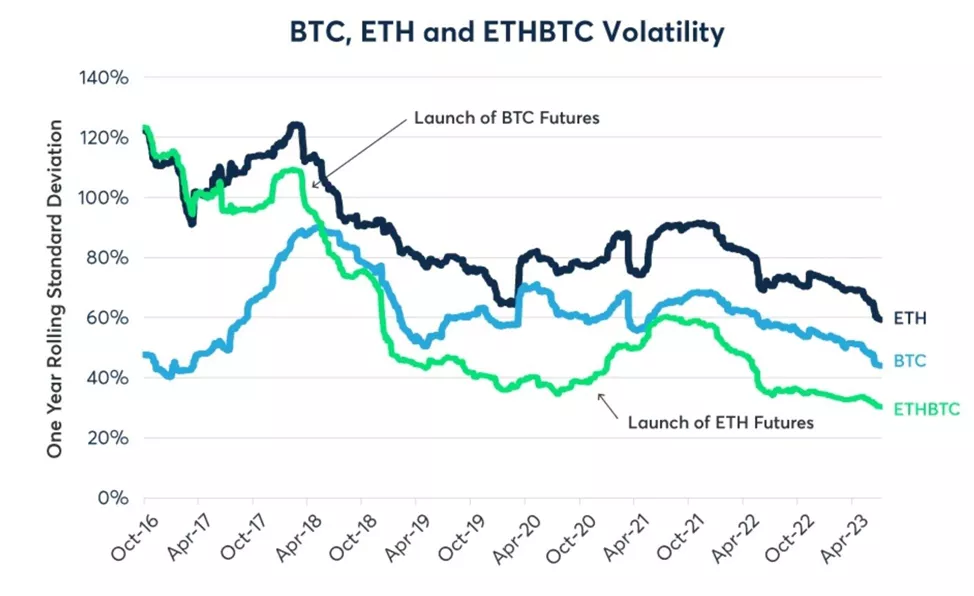

Over the past year, the volatility of daily Bitcoin price moves annualized stood at 42%, with Ethereum at 59%.

“In days when digital gold appreciates, the second-largest cryptocurrency tends to rise at faster rates, and vice versa,” — the report states.

The high degree of correlation implies that ETHBTC should have lower volatility than BTC or ETH alone. The latter has been observed since Bitcoin futures were launched in late 2017.

Over the past year, ETHBTC volatility fell to 30%, about a quarter lower than BTCUSD and roughly half that of ETHUSD.

Trading of the Ethereum-to-Bitcoin contract on CME futures will begin on July 31.

Earlier the platform reported a record open interest in futures on digital gold and the second-largest cryptocurrency by market capitalization.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!