CME overtook Binance in the Bitcoin futures ranking

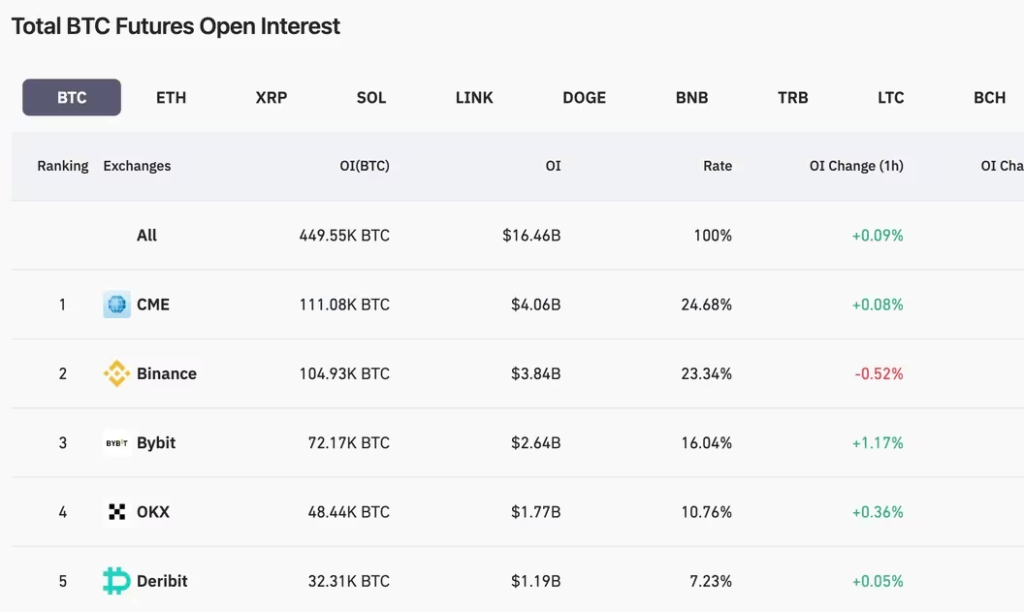

CME overtook Binance for the top spot in the list of the largest platforms by open interest (OI) in Bitcoin futures, according to Coinglass.

Over the past 24 hours, open interest on the Chicago Mercantile Exchange rose 4%, to $4.06 billion, lifting the platform’s share to 24.7% of the market. Binance’s figure fell by 7.8%, to $3.8 billion.

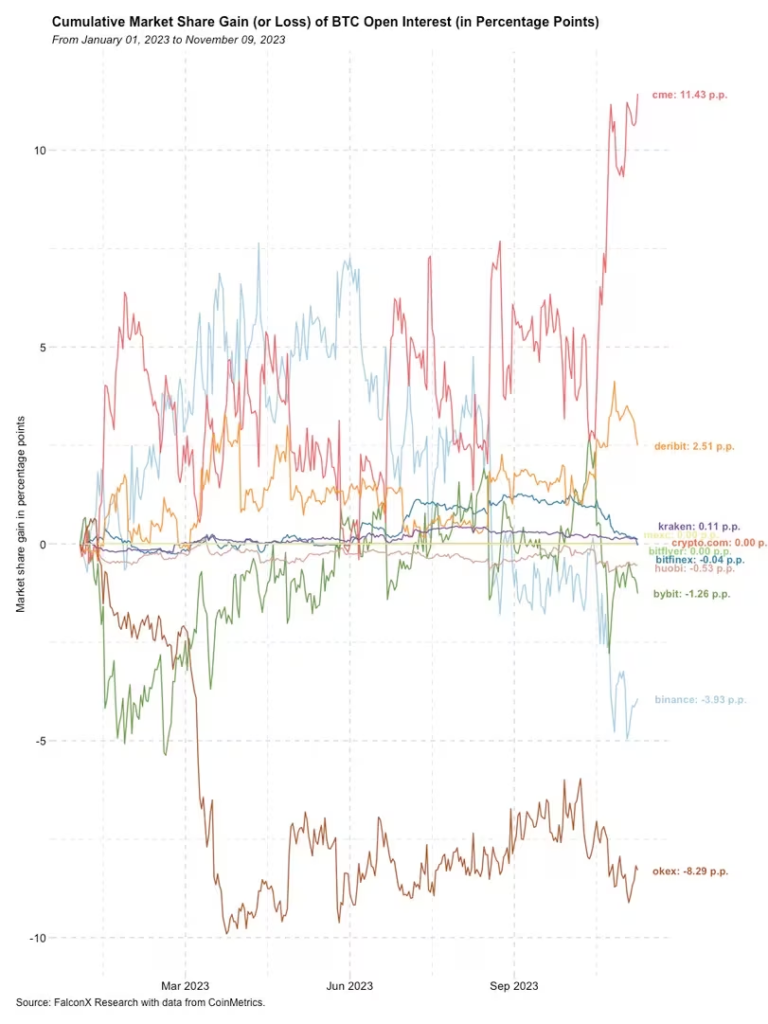

Below is FalconX Research’s trajectory of Bitcoin futures open-interest market share.

CoinDesk attributed the swap to rising demand from institutions. The latter favour the regulated products listed on the Chicago Mercantile Exchange.

Binance lost leadership for the first time in two years, according to crypto media.

“CME had captured market share for almost all of 2023. The growth accelerated in recent weeks, as hype around spot ETF filings surged,” — commented FalconX’s head of research, David Louant.

The changes may have been aided by waves of liquidations contracts.

Earlier, ForkLog reported that Binance clients held short positions. The scale of forced liquidations due to risk-management requirements at the platform could have been relatively higher than at peers, journalists explained.

As reported, the CME’s cryptocurrency division head Gio Vichioso said there was record interest in Bitcoin and Ethereum derivatives in Q3.

In October, the open-interest in futures based on digital gold on the exchange exceeded 100 000 BTC for the first time.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!